Arbitrum’s performance on this front could help it to edge out competition

- Big DeFi protocols powered Arbitrum’s network activity.

- Arbitrum’s DEX volume surpassed that of competitors like Optimism and Polygon.

Arbitrum’s performance in the DeFi space has been a revelation of late. The sentiment was echoed by data from DeFiLlama, which highlighted the chain’s increasing share of the daily trading volume recorded by Sushiswap [SUSHI], one of the largest decentralized exchanges [DEX] in the market.

65% of the $175.47 million in daily trading volume on SushiSwap took place on @arbitrum pic.twitter.com/Pf0T9v0fyw

— DefiLlama.com (@DefiLlama) February 10, 2023

And that’s not all. GMX, the largest decentralized exchange for perpetuals, shifted most of its activity from Avalanche [AVAX] to Arbitrum. At press time, GMX formed the lion’s share of the total value locked (TVL) on Arbitrum.

Arbitrum’s DEX volume throws a challenge to competitors

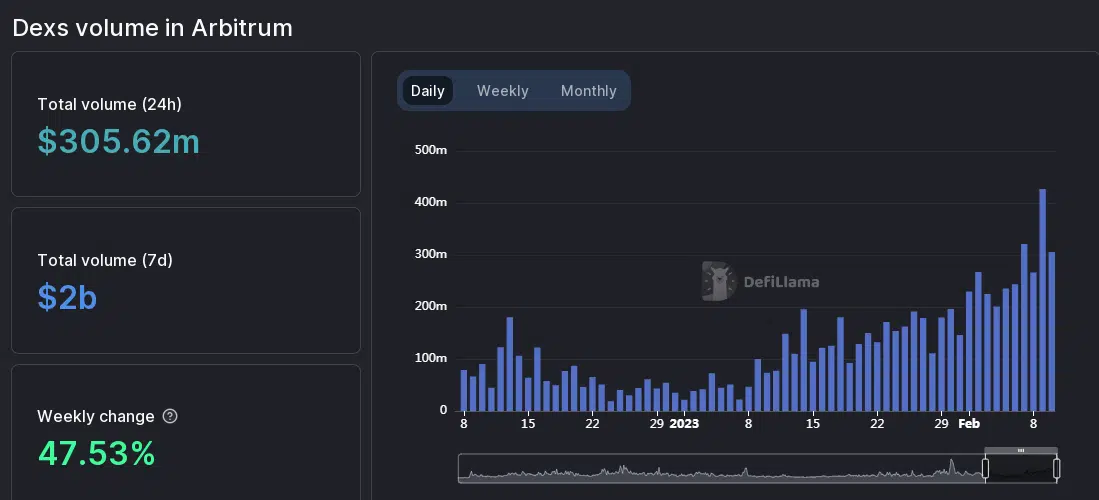

The growth of DeFi protocols on Arbitrum could also be gauged by looking at the trading volume of DEXes on the chain. The total volume in the last seven days was $2 billion which amounted to almost a 50% week-on-week (WoW) growth.

The daily trading volume hit its three-month high since the FTX collapse.

At the same time, Optimism’s volume grew by only 11% WoW and the total volume registered over the last seven days was just over $600 million, less than half of Arbitrum’s value in the same time period.

Arbitrum even managed to surpass Ethereum’s sidechain Polygon [MATIC] in volume recorded not only in the last seven days but in the last 24 hours as well.

Read Optimism’s [OP] Price Prediction 2023-2024

Key metrics suggest Arbitrum is in good shape

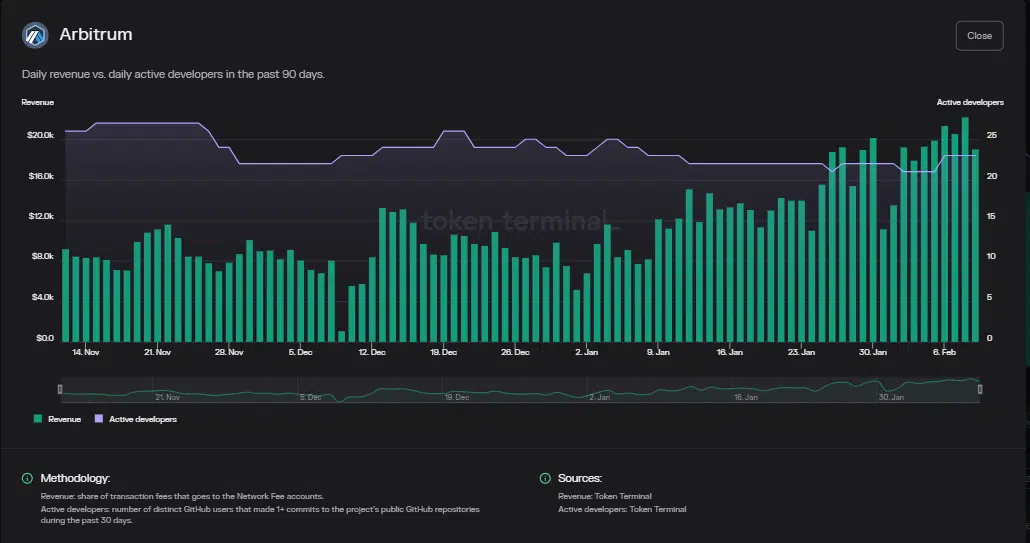

A look at Arbitrum’s key performance indicators (KPIs) could elucidate why DeFi protocols are finding it lucrative. As per data from Token Terminal, the daily active users on the layer-2 solution showed good recovery and hit a 2-month high earlier in the week.

The spike in the number of users had a domino effect on the total fees paid on the network. The transaction fees, which are generally a major incentive for validators to jump onto a chain, reached its six-month high of almost $100k

Additionally, the revenue which goes to Arbitrum and its investors grew steadily as well in the last few days. The revenue coupled with the growth in TVL could attract more investors toward the Arbitrum fold.

However, the lull in development activity remained an area of concern. The number of active developers on the chain didn’t show a noticeable increase and remained flat for most of January.