Analyzing why Axie Infinity [AXS] fell back despite gaming sector surge

- Axie Infinity fell short as other dApps attracted more users.

- The token might be undervalued, but whales seemed uninterested.

Gaming projects in the crypto ecosystem experienced a revival recently, but Axie Infinity [AXS] seemed to have been left behind. According to DappRadar, the blockchain-gaming ecosystem was finding it hard to attract users to its decentralized applications (dApps).

Realistic or not, here’s AXS’ market cap in BTC’s terms

However, the traction was impressive at some point in the first week of February 2023, leading the 30-day performance to a 233% volume hike.

Edging towards the end for AXS?

However, the last seven days have been rocky for the AXS ecosystem. At press time, transactions were down 11.32%. On the other hand, the volume decreased to $18.94 million—a 30% decrease within the said time frame.

However, AXS showed a glimpse of recovery on 13 February. But it was still far from the heights of 7 February, especially as Unique Active Wallets (UAW) fell to 44,370. This key metric revealed the dApp with the most user interaction.

Despite being often mentioned as one of the most popular demands, the decline meant that Axie Infinity had fallen off the rankings. The likes of PancakeSwap [CAKE], Alien Worlds, and Uniswap [UNI] sat above AXS as it lingered in the 22nd position.

However, Axie Infinity dApp traction was one of its many aspects facing a challenge. The monthly new accounts created on the ecosystem were a blot sight. According to Dune Analytics, the new monthly accounts number could not recover significantly since it began a Month-on-Month (MoM) downward trend in October 2021.

This decline aligned with the earlier notion that monthly usage and transacting addresses fell short of expectations. But is there anything positive happening with AXS? Perhaps an assessment of its on-chain condition could shed more light.

Underrated may not lead to attraction

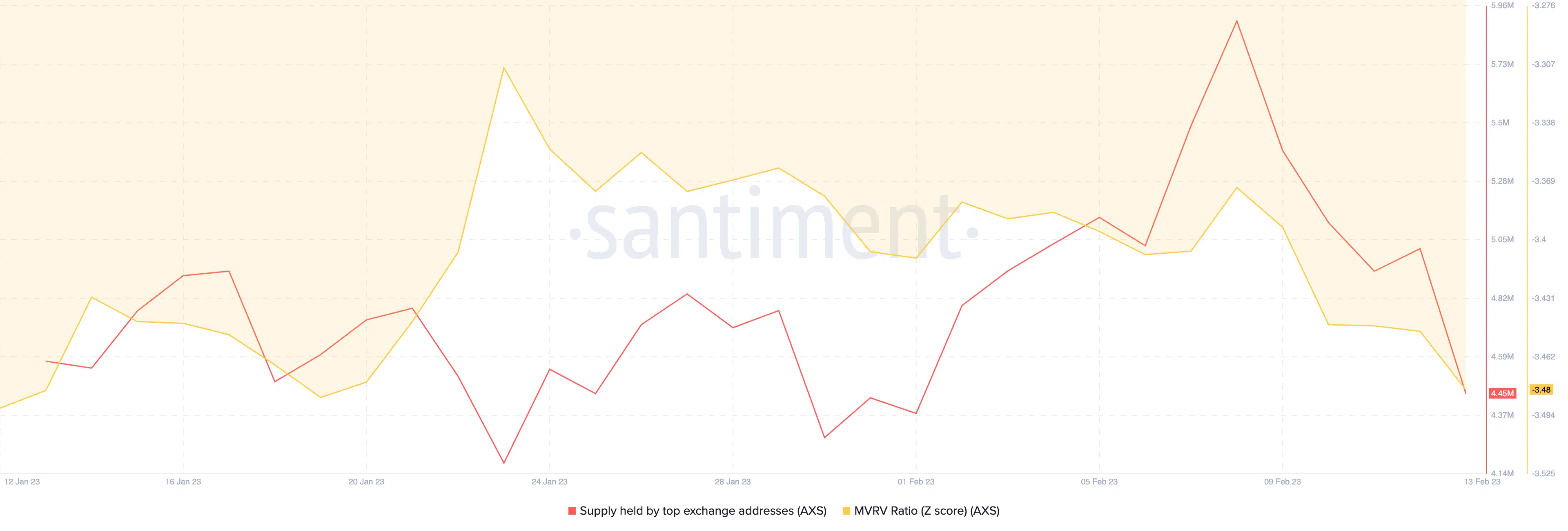

On a somewhat positive note, Santiment noted that the AXS Market Value to Realized Value (MVRV) z-score was down to -3.48. The metric gauges the state of the market capitalization and realized capitalization to evaluate an asset’s undervalued or overvalued state.

How many are 1,10,100 AXSs worth today?

Since the MVRV z-score trended lower than its position of 8 February, it implied that AXS was likely undervalued at its current price. However, whale interest in the token had also reached extreme ground level.

At press time, the AXS supply held by the top addresses on several exchanges was 4.45 million. This was far from the spikes of the period when the MVRV z-score was also at a high value.

![Axie Infinity [AXS] new monthly users](https://ambcrypto.com/wp-content/uploads/2023/02/Screenshot-2023-02-14-at-10.53.22.png.webp)