LDO rallies 2.5% in 24 hours, but a reversal may be near

- Lido’s TVL registered a decline, but daily active depositors increased over the last week.

- LDO registered gains in the last 24 hours, but things might change soon.

The week did not start on a good note for Lido Finance [LDO] as it registered a decline of over 6% in its Total Value Locked (TVL). The decline happened after Ethereum’s [ETH] price plummeted by over 7% over the last week.

? Lido Analytics: Feb 06 – 13, 2023

TLDR:

– Lido TVL is down -6.66%, following a -7.22% fall in the price of ETH.

– Lido led in new stake on Ethereum, with a 27% share in weekly deposits.

– New @AaveAave V3 wstETH: 34,726 (+34.87%).

– Lido on Polygon reaches 2% market share. pic.twitter.com/iWA9YccM6e— Lido (@LidoFinance) February 13, 2023

Read Lido DAO’s [LDO] Price Prediction 2023-24

However, not everything was against Lido, as a few metrics were in its favor. For instance, Lido’s unique depositors hit 122,905 this week. The number of daily active depositors increased over the last week as well, peaking at 431 new depositors on 12 February.

⚡️ Lido on Ethereum

Lido unique depositors hit 122,905 this week (7d: +0.86%).

The number of daily active depositors increased over the last week, with a peak of 431 new depositors on Feb 12. pic.twitter.com/vMSy7zbBOS

— Lido (@LidoFinance) February 13, 2023

Not only in terms of metrics, but Lido has been quite active recently in terms of pushing new upgrades, the most recent being the mainnet update of its MEV Boost.

Everything in Lido’s favor

Interestingly, Lido’s daily price action looked bullish as it registered gains. According to CoinMarketCap, LDO’s price soared by 2.5% in the last 24 hours, and at the time of writing, it was trading at $2.36 with a market capitalization of over $1.99 billion.

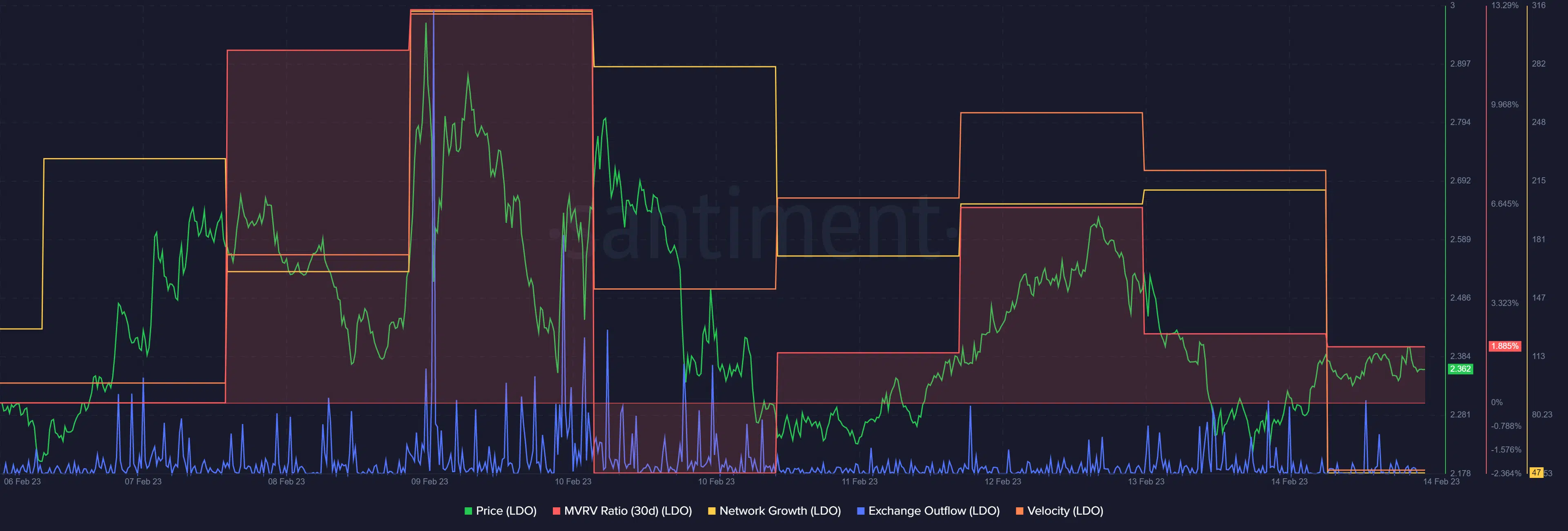

A look at LDO’s on-chain performance gave a better idea of what might have fueled the pump. The token’s exchange outflow spiked quite a few times over the last week, which is a bullish signal. After a sharp decline, LDO’s MVRV Ratio also seemed to recover as it increased in the last few days. Both LDO’s network growth and velocity remained relatively high last week, which might have played a role in LDO’s latest uptrend.

How much are 1,10,100 LDOs worth today?

However, the bears have arrived

Though the metrics were slightly bullish, LDO’s daily chart gave a bearish notion. The Relative Strength Index (RSI) was hovering near the neutral position. LDO’s Money Flow Index (MFI) also registered a decline, which was a development in the bears’ favor.

Moreover, the Chaikin Money Flow was heading further below the neutral zone, increasing the chances of a price plummet in the coming days. Nonetheless, according to the Exponential Moving Average (EMA) Ribbon, the bulls were still ahead in the market.