Solana tries to improve network appeal, but gets pulled back by these indicators

- Solana’s development activity went on a downward spiral.

- Accompanied by high volatility, SOL dropped by 5% at press time.

In the hope of enticing more developers to come and build on the platform, the Solana [SOL] ecosystem announced a slew of new features.

The Solana developer ecosystem is about to BOOM

what we're releasing in the coming days:

– NFT compression support (already out in devnet)

– DAS indexer

– A brand-new RPC archival system

– GeyserVM

– Account change webhooks

– Transaction webhooks replaybrace yourselves

— Helius (?, ⚡) (@heliuslabs) February 16, 2023

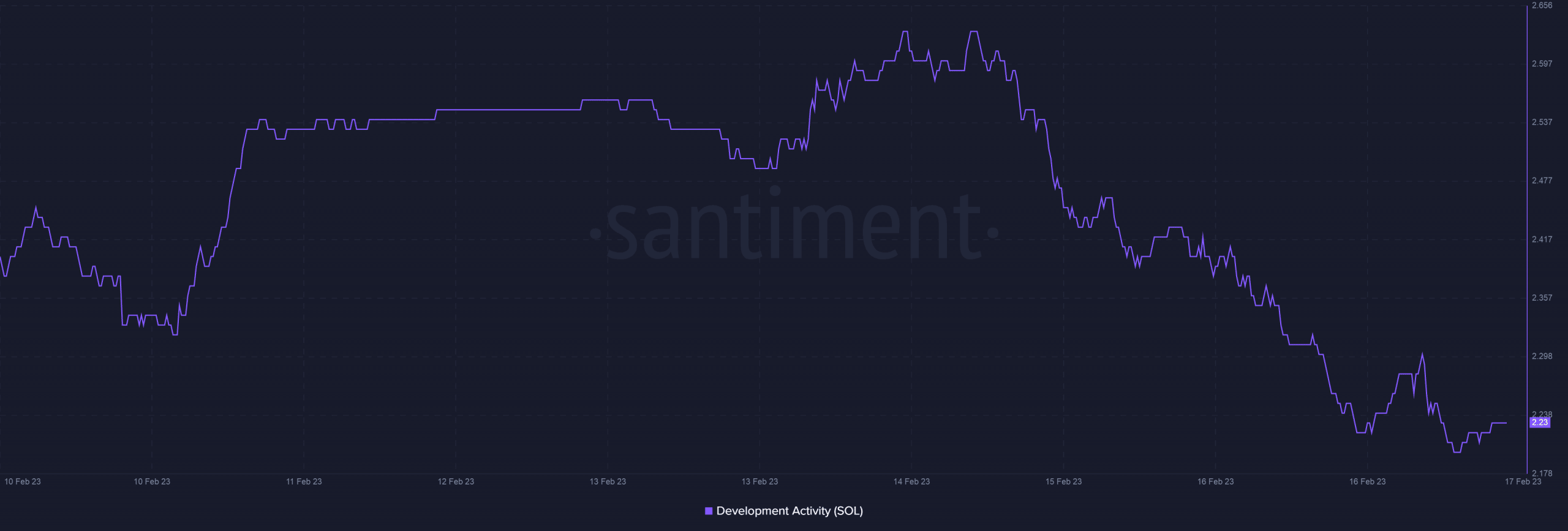

However, the development activity presented an antithetical story. Since 14 February, this metric has been in a free fall, according to data provided by Santiment. It remains to be seen whether there will be a considerable rebound going ahead.

Is your portfolio green? Check out the Solana Profit Calculator

Solana’s struggle continues

SOL has struggled to carry forward the BONK-powered bullish momentum in February. Since the start of the month. the coin has shed more than 11% of its value, per data from CoinMarketCap.

With a fall in the value of its dog-themed coin which was launched with much optimism, Solana’s decentralized finance (DeFi) also took a beating.

The total value locked (TVL) on the platform recorded a 9% decline over the last 30 days, as per DeFiLlama, and was down 1.41% over the last 24 hours at press time.

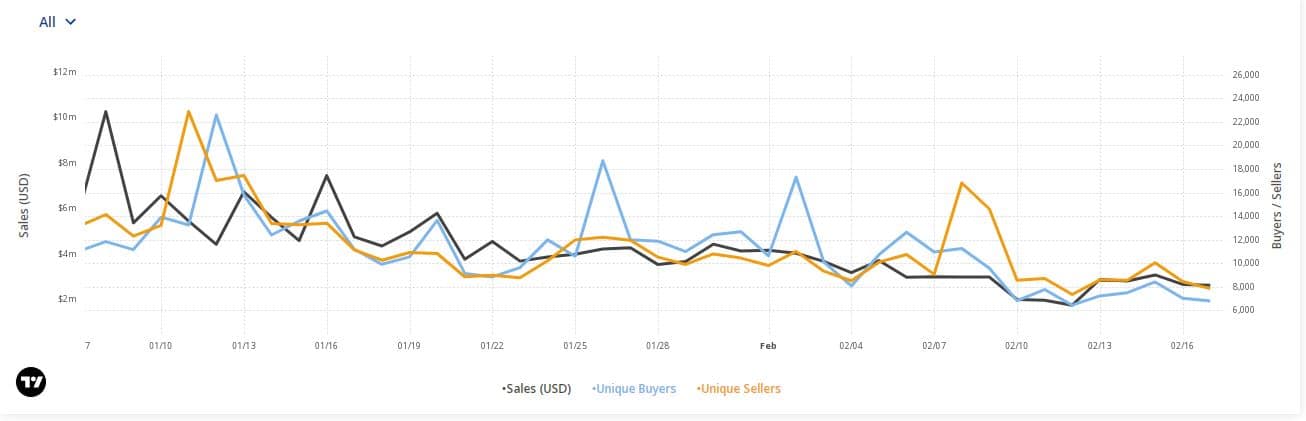

SOL’s performance on the NFT front didn’t evoke much enthusiasm either. According to data from Cryptoslam, the number of transactions on the chain dipped by almost 30% in the last seven days while the sales volume declined by more than 30%

As highlighted earlier, NFT compression support was one of the key features which Solana developers have planned to release in the coming days.

Well, it remains to be seen whether this would attract more players to come and build NFTs on Solana.

High volatility keeps investors on their toes

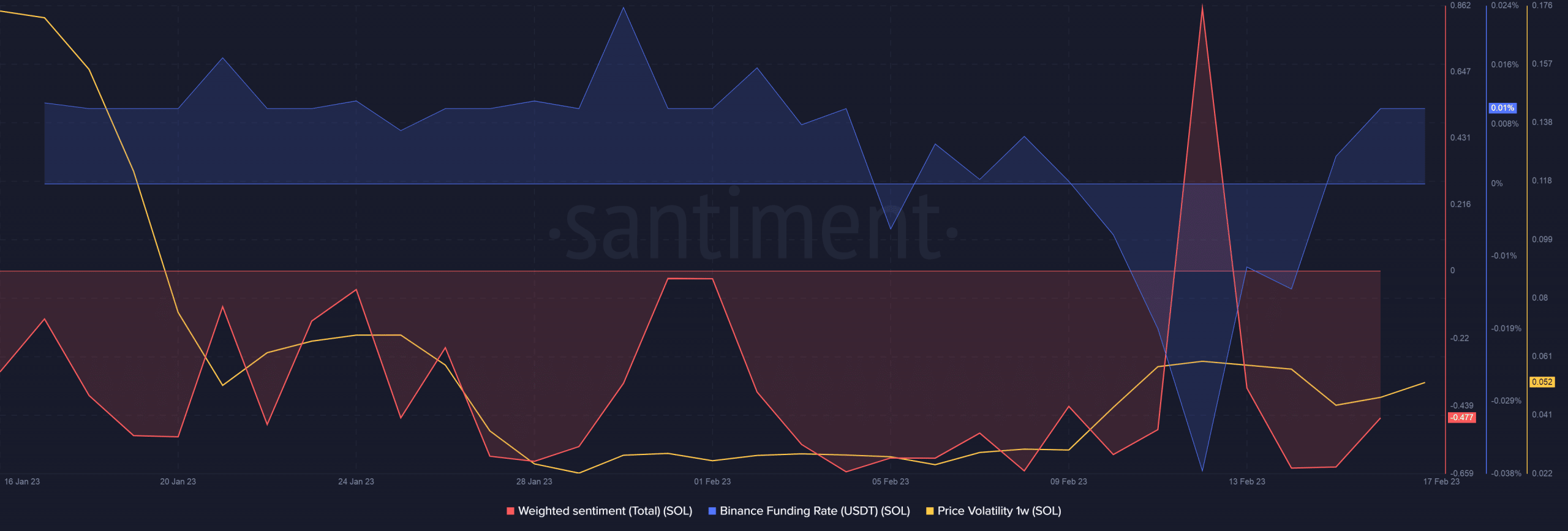

On the other hand, Solana’s weighted sentiment went into negative territory after reaching its monthly peak on 12 February, implying that investors were still jittery over its prospects.

This could have been due to the price volatility which jumped over the last two days, discouraging conservative traders to place their bets on SOL.

The Binance Funding rate was positive at the time of writing, which could be a short-term bullish signal. However, with the negative sentiment accompanying it, investors should tread cautiously.

Read Solana’s Price Prediction 2023-2024

At press time, SOL was down 5% over the previous day trading at $22.64. With drop-in key indicators, SOL’s price is likely to be volatile over the next weekdays.