ETH struggles to bypass resistance range but open interest suggests…

- Sell pressure is building up following a retest of a key resistance level.

- Profit-taking in the futures market was observed but whales are holding on to their bags.

Ethereum’s native cryptocurrency ETH achieved a new YTD high during Thursday’s (16 February) bull run. However, it has since pulled back, confirming that the bulls are battling strong resistance.

A key observation just occurred in the derivatives market that may offer insights into the next move.

Is your portfolio green? Check out the Ethereum Profit Calculator

The state of the derivatives market often provides a rough view of liquidity flows, hence its importance in determining a trend.

According to the latest Glassnode alerts, ETH’s open interest in perpetual futures just reached a new 4-week high. The last time that the same metric soared to its current highs was in November last year.

? #Ethereum $ETH Open Interest in Perpetual Futures Contracts just reached a 3-month high of $323,334,502 on #Deribit

Previous 3-month high of $321,159,869 was observed on 16 February 2023

View metric:https://t.co/5MhXAkWLAZ pic.twitter.com/Si4yZrQOGd

— glassnode alerts (@glassnodealerts) February 17, 2023

Is this a bullish or bearish sign for ETH?

Perpetual futures can be executed on a short or long basis. Further investigation is necessary to determine what is going on.

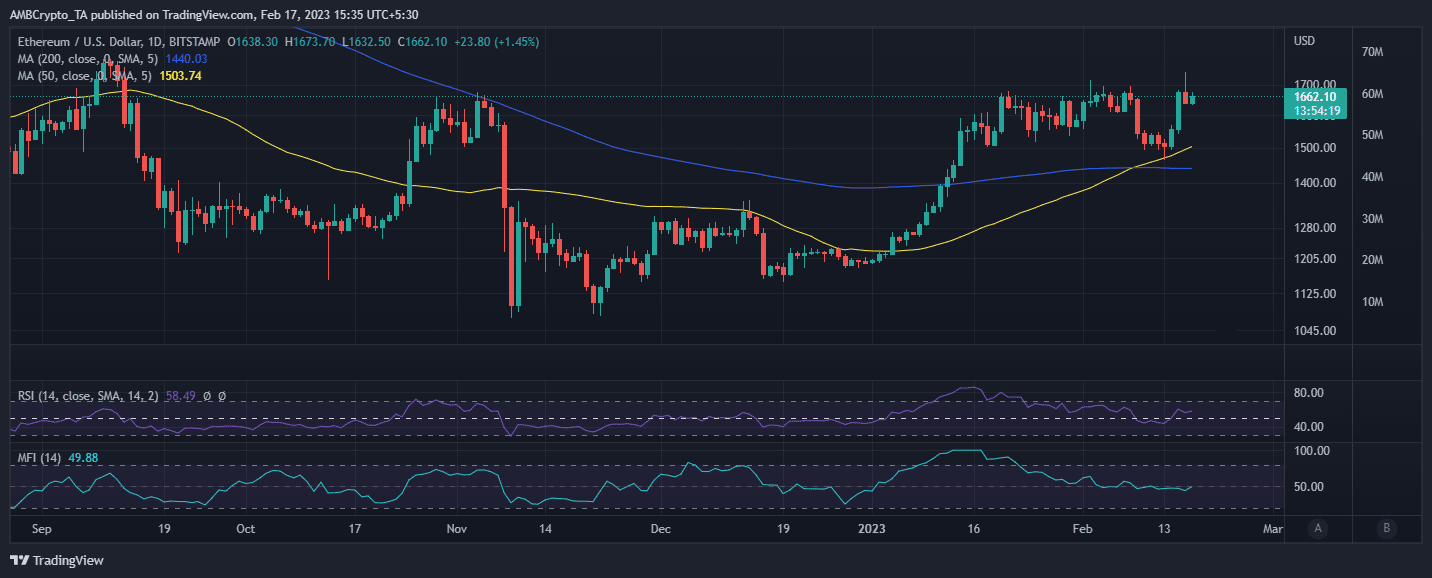

A look at ETH’s price action reveals that the price is currently within a resistance zone that has prevailed since November. Unsurprisingly, there was a return of significant sell pressure at this range during Thursday’s trading session.

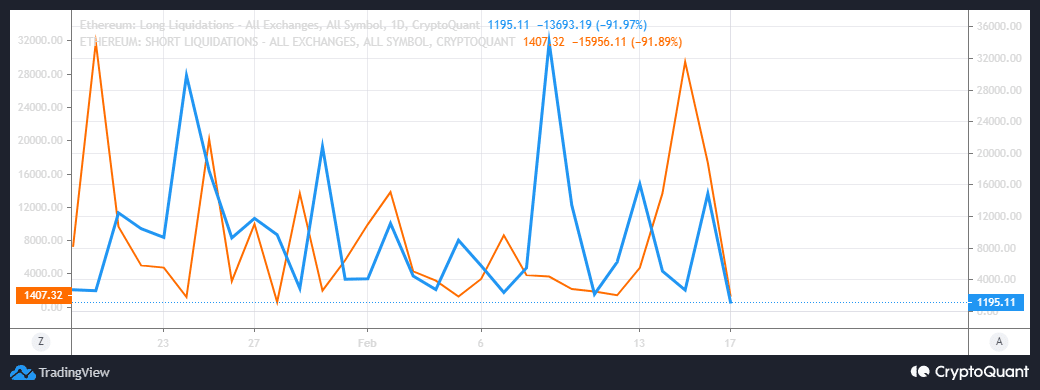

Could it be that perpetual futures anticipate a similar outcome to what happened in November? The level of leverage liquidations reveals low appeal for leveraged long positions at the current price level.

This is evident by the drop in long liquidations despite the slight pullback during the last 24 hours. This may suggest that investors anticipate more uncertainty and perhaps another pullback at the current price range, hence the shift from leveraged long positions.

The level of short liquidations has also dropped despite the price demonstrating some resilience against the downside in the last 24 hours.

Is ETH experiencing a build-up of sell pressure?

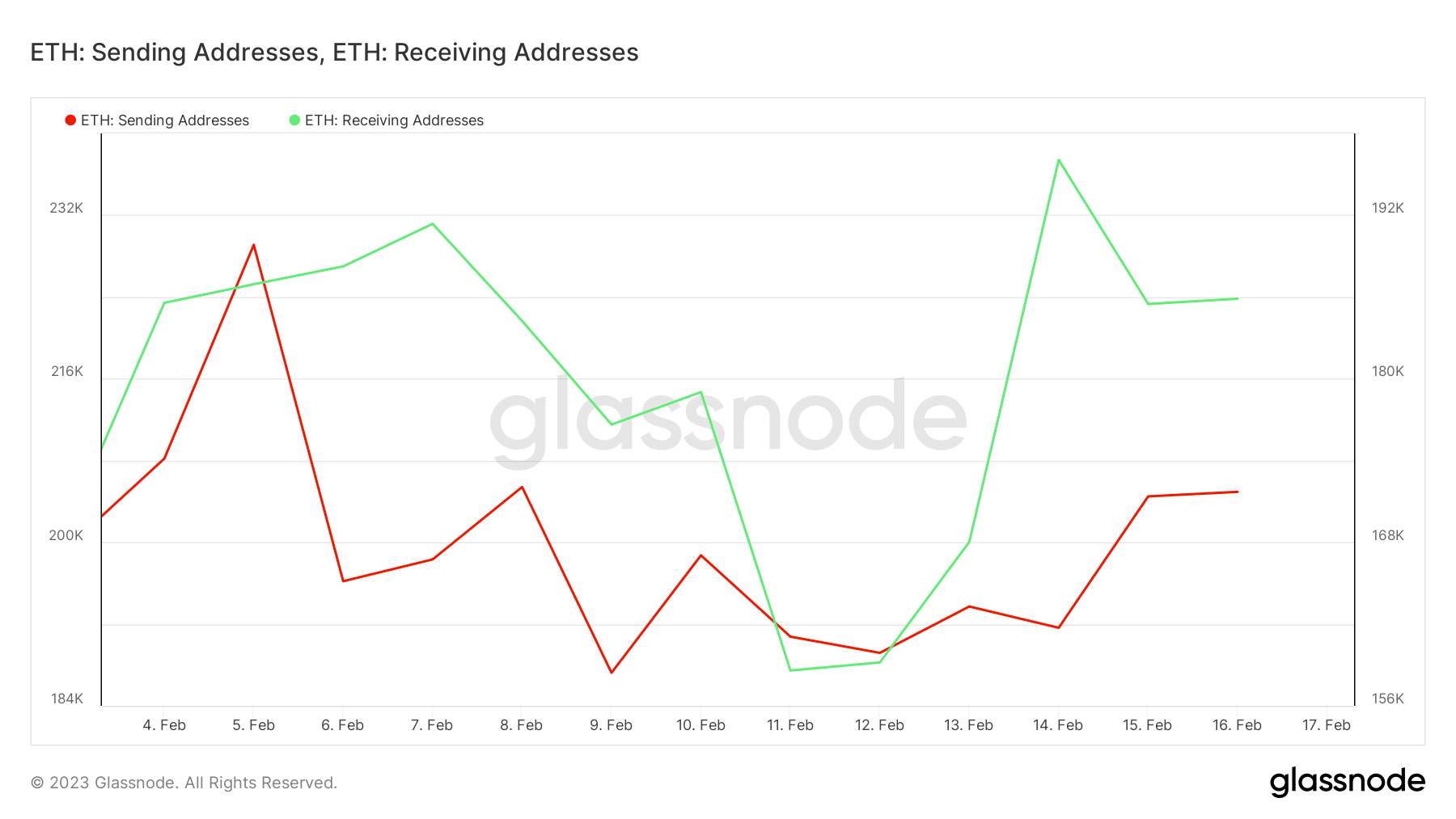

A comparison between ETH sending and receiving addresses offers some perspective. Sending addresses have increased notably since 14 February. Meanwhile, receiving addresses have slowed down and dropped during the same time.

How much are 1,10,100 ETHs worth today?

The last 24 hours alone, however, demonstrate relative inactivity. This suggests that investors are waiting to see which direction the market will likely lean into.

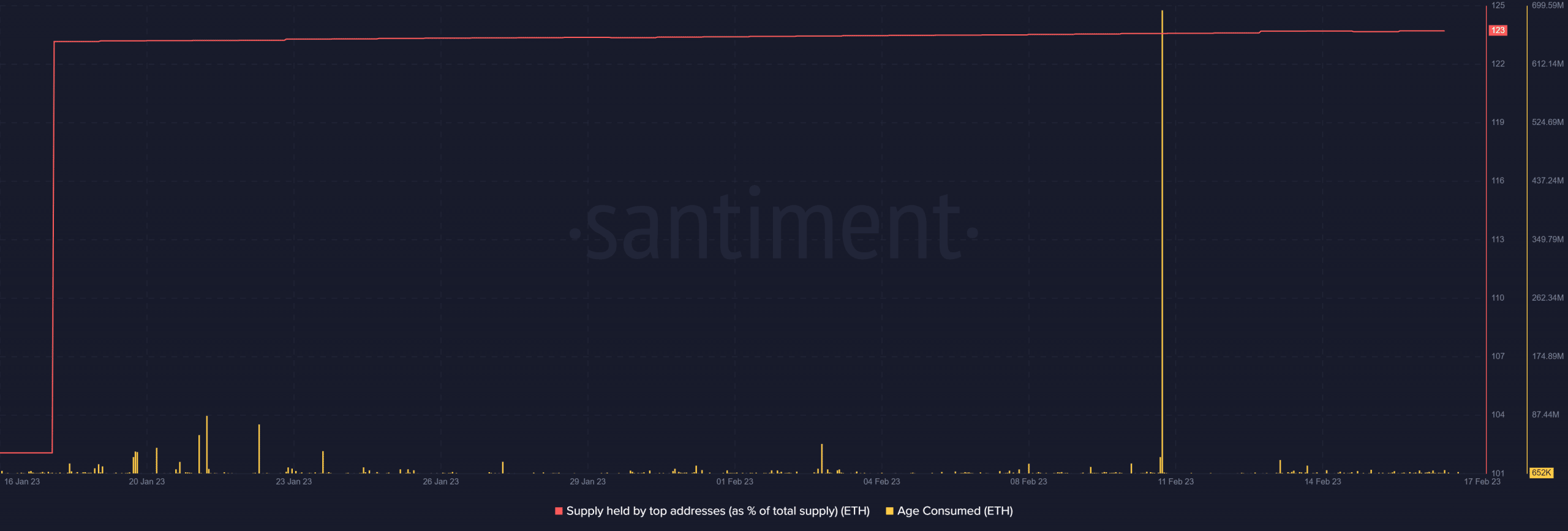

Meanwhile, whales are not yet selling despite the latest upside. This was evident by the lack of downside in the supply held by top addresses.

This was also confirmed by the lack of a spike in the age consumed metric which would otherwise confirm some selling pressure. In other words, whales are not selling and this underlines the fact that whales are targeting long-term gains.