Has Arbitrum gained the top spot in the L2 space? According to these factors…

- Arbitrum reached new highs in terms of transaction volume.

- Low development activity and stablecoin usage raised concerns.

According to a 20 February tweet by Wu Blockchain, Arbitrum’s transaction volume had reached new heights, as the scaling solution’s transaction volume reached $2.62 billion and witnessed a 34% spike. If the trend continued, Arbitrum could go toe-to-toe with Ethereum [ETH] soon.

According to DeFiLlama, in the past week, the DEX transaction volume on the Arbitrum reached $2.62 billion, a YOY increase of 34%, setting a new weekly high, second only to Ethereum. Most of Arbitrum’s native application tokens have increased in the past 7 days.… https://t.co/WwWg0twWYA

— Wu Blockchain (@WuBlockchain) February 20, 2023

Read GMX’s Price Prediction 2023-2024

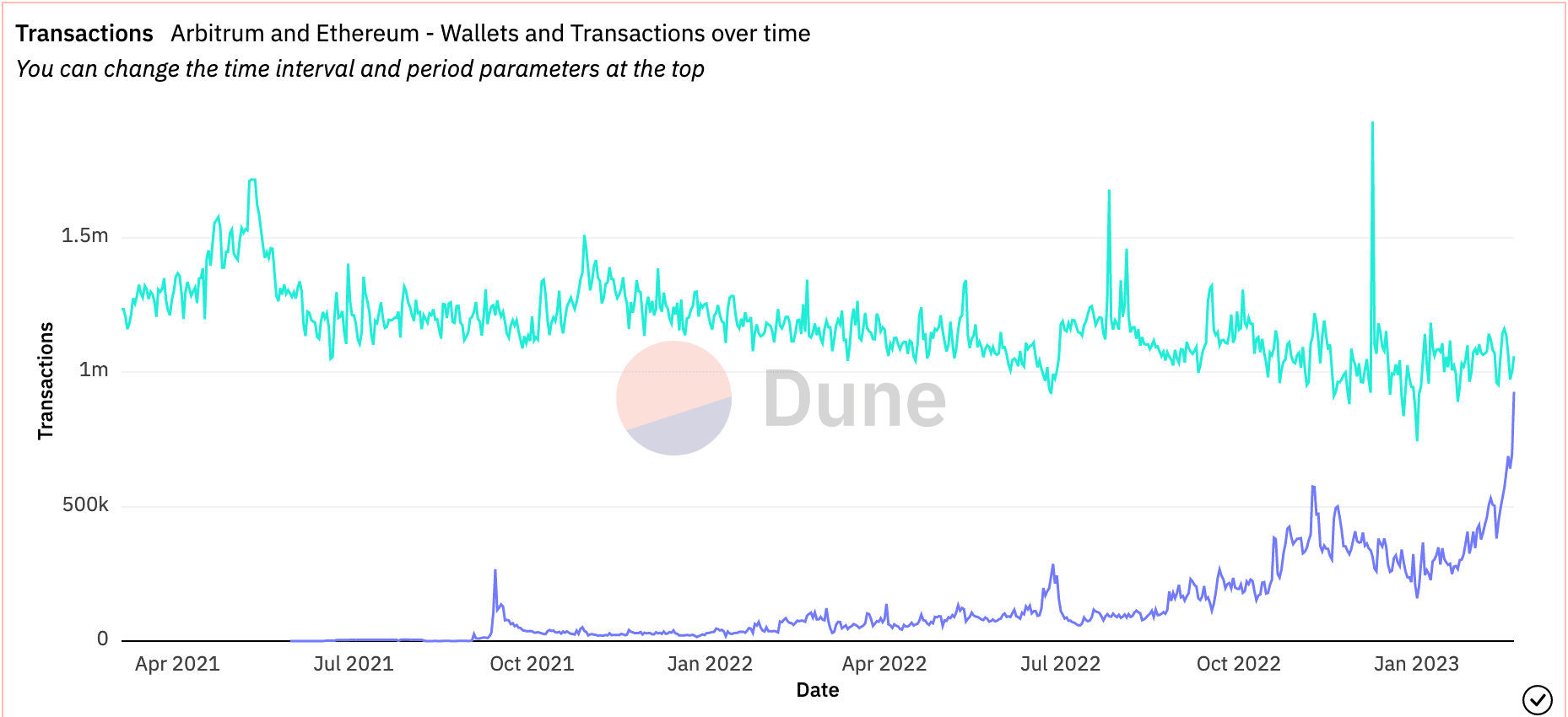

As can be observed from Dune Analytics’ data, the number of transactions on Arbitrum was on its way to match Ethereum’s transaction frequency.

One reason for the growing number of transactions would be the declining transaction fees on the protocol. As the transaction fees of Arbitrum continued to decline, it would make it easier for users to make transactions on the protocol.

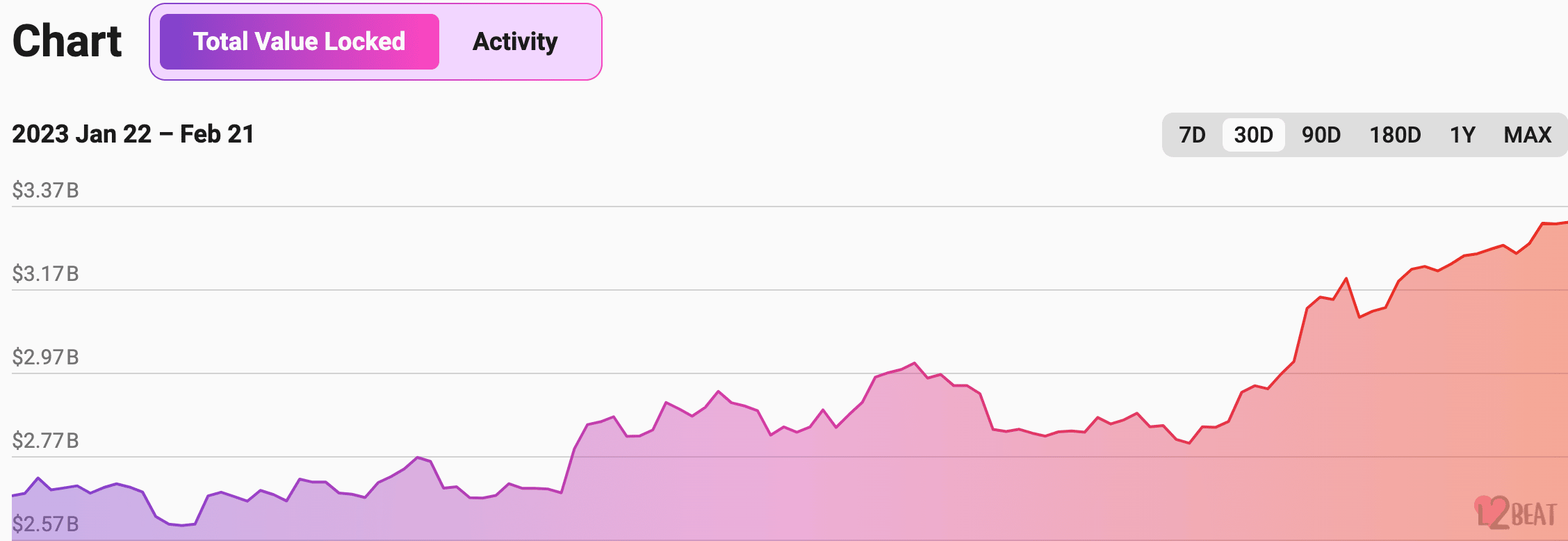

The high transaction volume also impacted the overall TVL collected by Arbitrum, which increased materially over the last few weeks. In terms of TVL, Arbitrum outperformed other L2 solutions, such as Polygon [MATIC] and Optimism [OP] as well.

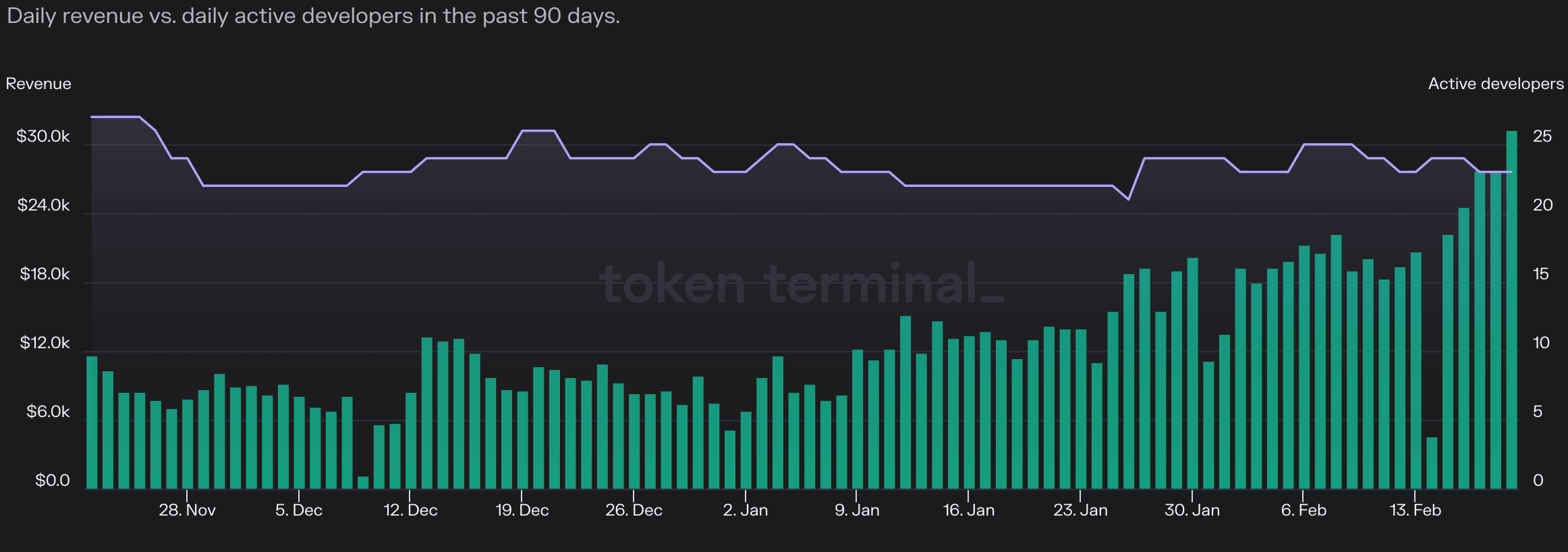

This surge in TVL also impacted the overall revenue generated by Arbitrum. According to Token Terminal’s data, the overall revenue generated by Arbitrum had increased by 80% over the last 30 days. This revenue can be used to improve the network and bring in new capabilities.

Some areas of concern for Arbitrum

However, despite the growing revenue, the revenue wasn’t being used for the betterment of the protocol. This was signified by the declining number of active developers on the network. Over the past week, the number of active developers decreased by 4.1%. This suggested that the frequency with which contributions were being made to Arbitrum’s GitHub declined.

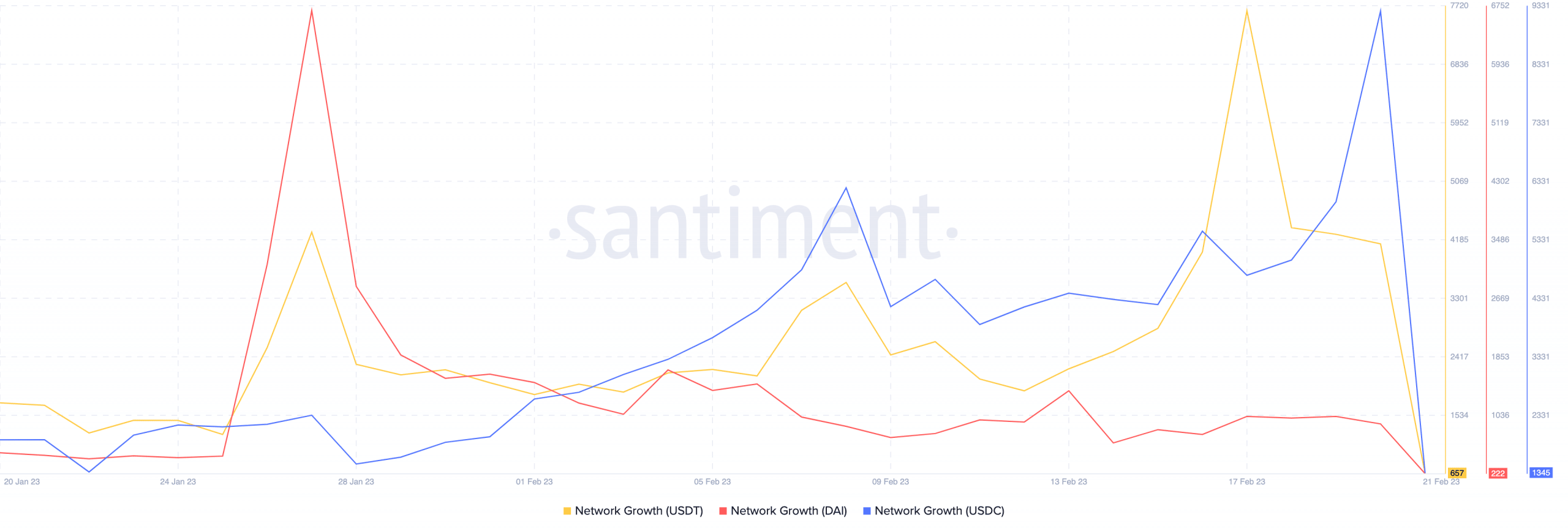

Another alarming indicator was the declining use of stablecoins on the network. According to Santiment’s data, the network growth of stablecoins such as MakerDAO [DAI], USD Coin [USDC], and Tether [USDT] decreased materially over the past month. This implied that new addresses were not using stablecoins on the Arbitrum network.

How much are 1,10,100 GMX worth today?

Even though the overall transaction volume on Arbitrum was high, the decline in stablecoin growth could create problems for the network in the future.

It remains to be seen whether Arbitrum will overcome these challenges in the future and retain its position in the L2 space.