MATIC falls to key support: Are short sellers running out of opportunities?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC retested 50% Fib support at $1.3531.

- Countering metric signals urged caution.

Polygon [MATIC] has reached a key support level at $1.3531, which could give bulls hope for a rebound. However, there were conflicting metric signals, and investors could get clarity on Bitcoin’s [BTC] price action soon.

Read Polygon’s [MATIC] Price Prediction 2023-24

Can the 50% Fib level hold?

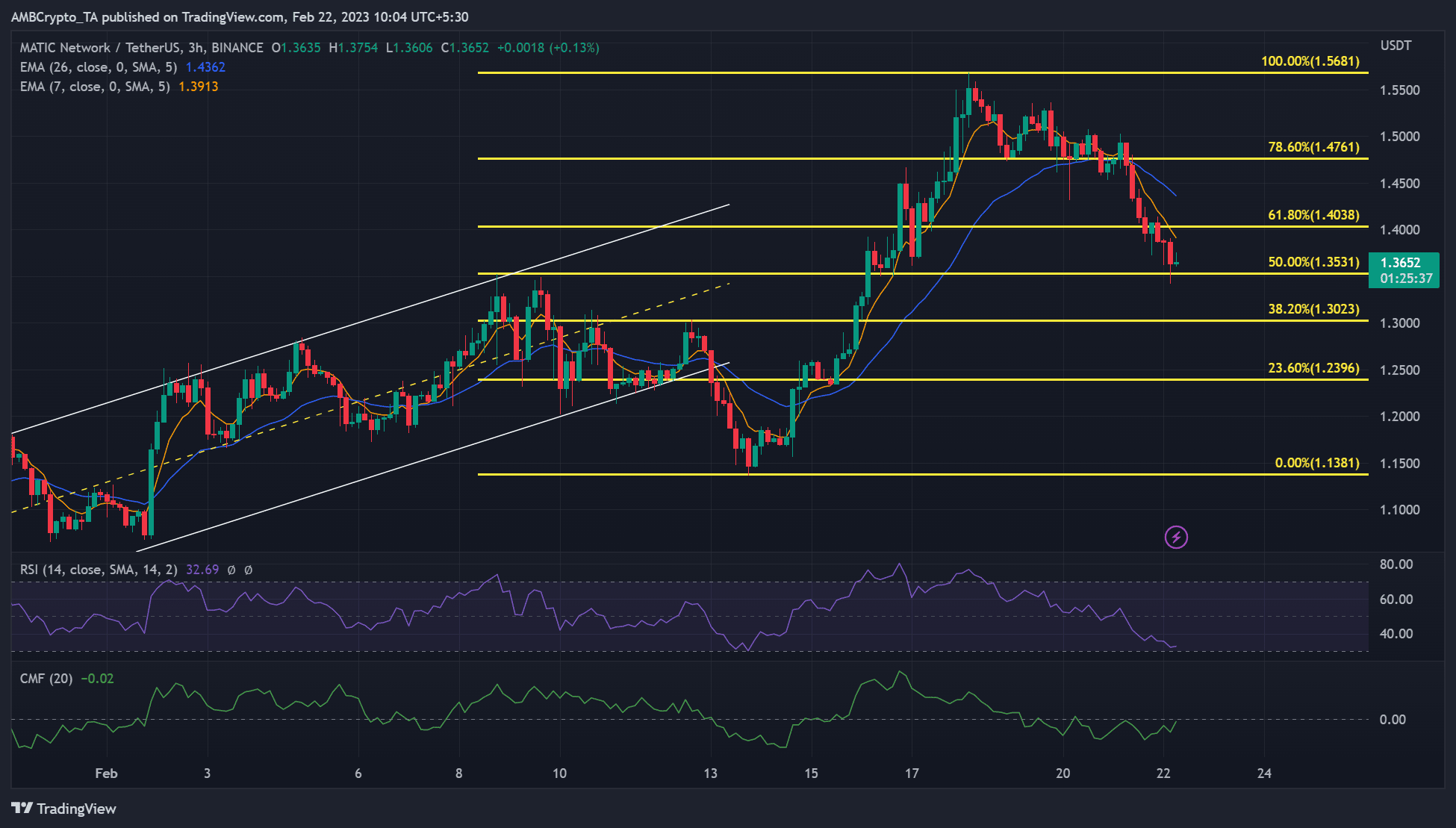

MATIC’s momentum slowed down after breaking below the ascending channel (white). However, it found solid support at $1.1381 and recovered. Last week, it gained 38% but was rejected at $1.5681. After that, a price correction eroded almost half of last week’s gain.

However, bears could get more opportunities if BTC falls below $23.86k. They could short MATIC and buy back at the 38.20% or 23.60% Fib level. But bears should only make moves if MATIC closes below the 50% Fib level.

Alternatively, bulls could target the 78.60% Fib level of $1.4761 if the 50% Fib support level holds. However, near-term bulls must overcome the obstacle at the 61.80% Fib level to advance upward.

The Relative Strength Index (RSI) was 32, showing an extremely bearish structure and momentum. Moreover, the Chaikin Money Flow (CMF) was below the zero line, reinforcing the leverage of the bears. Although the CMF has been rejected three times, a break above the zero line would underline the bulls’ hopes for a recovery.

MATIC’s open interest rate declined, but weighted sentiment remained positive

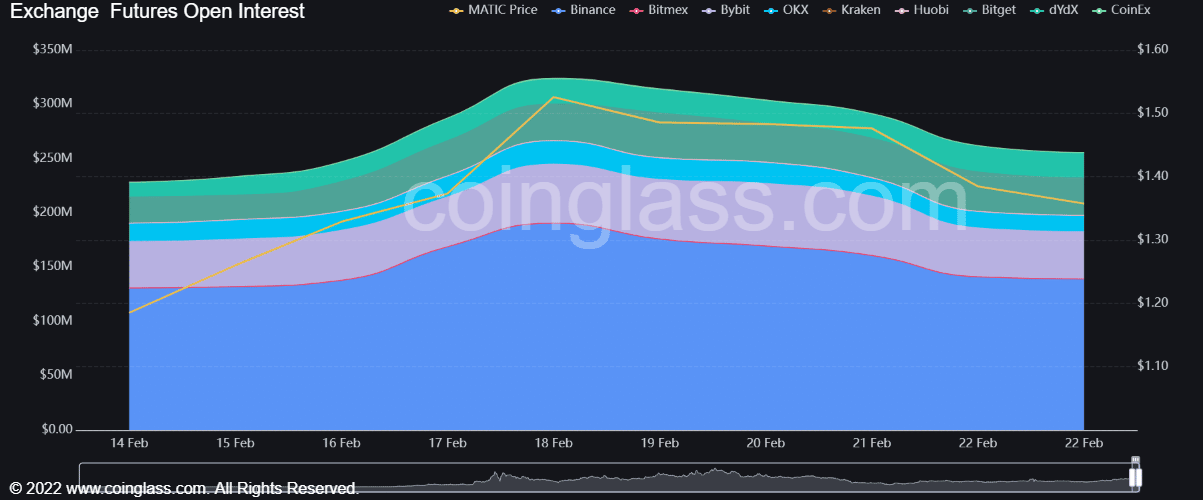

According to Coinglass, MATIC saw a significant drop in open interest (OI). OI fell from over $300 million on Saturday to just over $250 million at the time of writing. That’s about $50 million in outflows in the futures market, a bearish signal.

Is your portfolio green? Check out the MATIC Profit Calculator

In contrast, Santiment shows MATIC shows positive weighted sentiment with no change in demand since Saturday. Although this could give bulls hope for recovery if demand for MATIC increases at discounted prices, the falling OI could undermine strong recovery momentum. Therefore, caution should be observed.

In particular, investors should monitor the performance of BTC. If BTC regains the $25,000 level, MATIC could recover strongly. However, a break below $23.86k could provide further opportunities for the bears.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)