Litecoin [LTC] miners turn profits, but is there trouble brewing?

![Litecoin [LTC] miners turn profits, but is there trouble brewing?](https://ambcrypto.com/wp-content/uploads/2023/02/michael-fortsch-fYSVVQqiqPs-unsplash-e1677320798410.jpg)

- Litecoin’s hash rate and mining difficulty increased significantly over the last month.

- The network on a whole was at a loss, as indicated by the negative MVRV Ratio.

Litecoin [LTC] has been among the top-performing cryptos in 2023, jumping by as much as 33% since the start of the year, data from CoinMarketCap revealed.

Read Litecoin’s [LTC] Price Prediction 2023-24

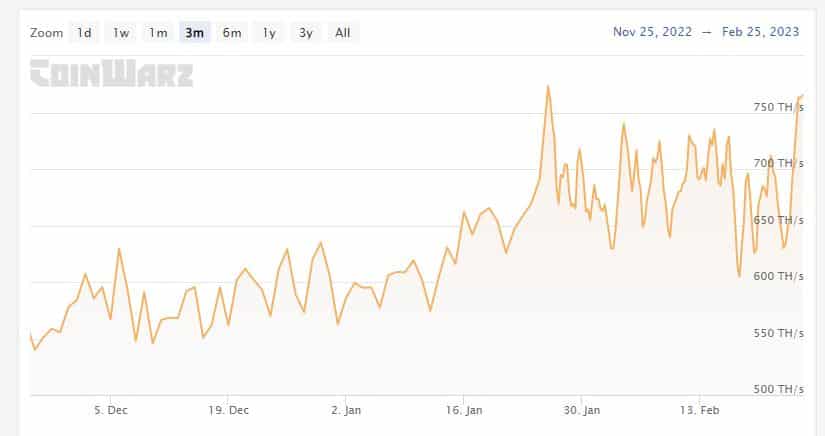

Because of the price surge, mining activity has picked up decisively on the network. As per Coinwarz, LTC’s hash rate was 765.12 TH/s at the time of writing, an increase of over 30% over the previous month. The network’s overall mining difficulty also rose in the same period.

A higher hashrate is a positive signal as it means that there are more miners on the network, thus making it more secure.

Litecoin wants to be eco-friendly

On 24 February, the Litecoin Foundation entered into a partnership with Metalpha to develop sustainable mining solutions. Litecoin stated that the partnership’s key areas of research will facilitate renewable energy use and lowering carbon emissions from mining on the network.

BREAKING: @LTCFoundation and @MetalphaPro form a partnership to develop hedging and sustainable mining solutions for the Litecoin ecosystem. Aiming to expand renewable energy use and lower carbon emissions on the Litecoin network.https://t.co/nlNXHAmphO

— Litecoin Foundation ⚡️ (@LTCFoundation) February 24, 2023

As mentioned earlier, higher hash rates are desirable. However, they can have negative impacts on the environment because of the increase in the amount of energy required for mining. This factor acts as a major scaling constraint for blockchains, due to which a lot of them shift to the proof-of-stake (PoS) algorithms.

Bears to take over?

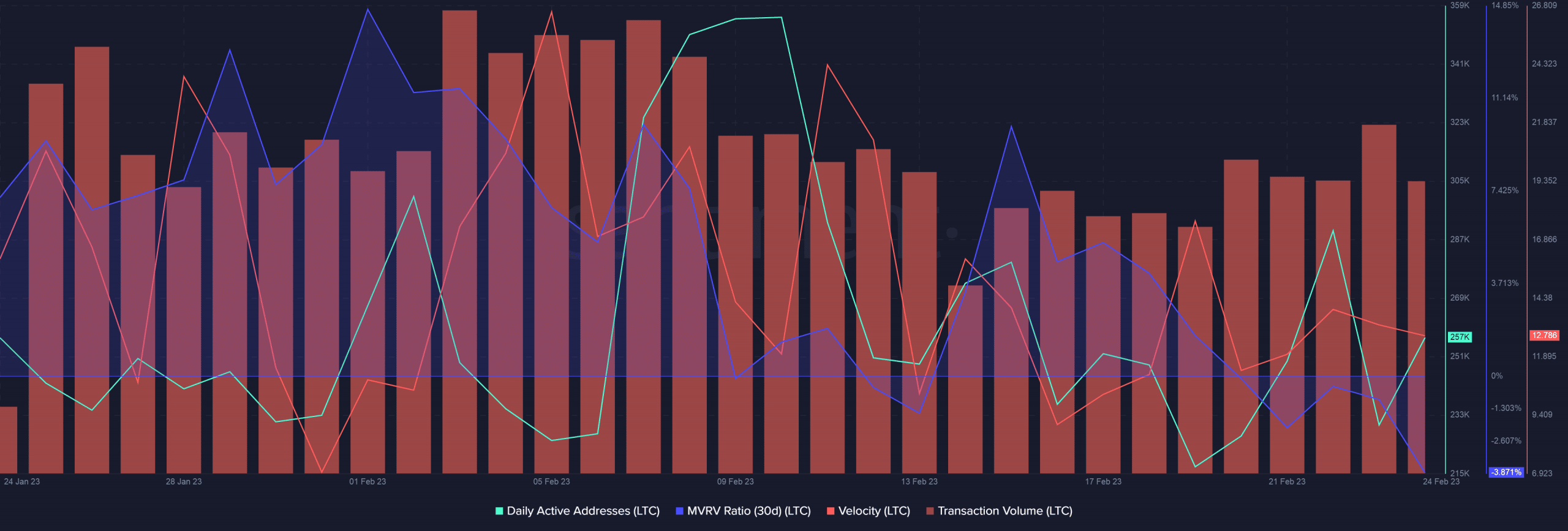

Litecoin’s on-chain activity evoked little enthusiasm as the transaction volume declined by 31% over the previous month, though there were signs of uptick in the recent days.

The daily active addresses fell considerably since hitting a monthly high on 9 February. The velocity dipped as well, implying that new addresses stayed away from LTC.

The 30-day MVRV Ratio fell deeper into negative territory. This meant that most of the LTC holders would entail losses if they sold their tokens at press time.

Is your portfolio green? Check out the LTC Profit Calculator

As per CoinMarketCap, LTC was down 2.27% from the previous day to trade at $91.99 at the time of writing. As indicated, LTC moved within a range in February. The price broke part of the resistance on 16 February but retraced to test the range lows as support.

The Relative Strength Index (RSI) dipped below the neutral 50 level, suggesting that selling pressure had increased in the market. The Moving Average Convergence Divergence (MACD) revealed strong bearish signals as well.