Cardano [ADA] moves sideways, investors can look for gains at these levels

![Cardano [ADA] moves sideways, investors can look for gains at these levels](https://ambcrypto.com/wp-content/uploads/2023/02/kanchanara-999WKOMULPQ-unsplash-scaled-e1677321216549.jpg)

- ADA traded in range into the weekend.

- Demand in the derivative markets improved, but sentiment remained negative.

Cardano [ADA] consolidated into the weekend and oscillated between $0.3630 and $0.3676. Similarly, Bitcoin [BTC] traded between $23.23K and $29.96K as it struggled to maintain the $23K level.

Read Cardano [ADA] Price Prediction 2023-24

Is a breach of the consolidation range likely?

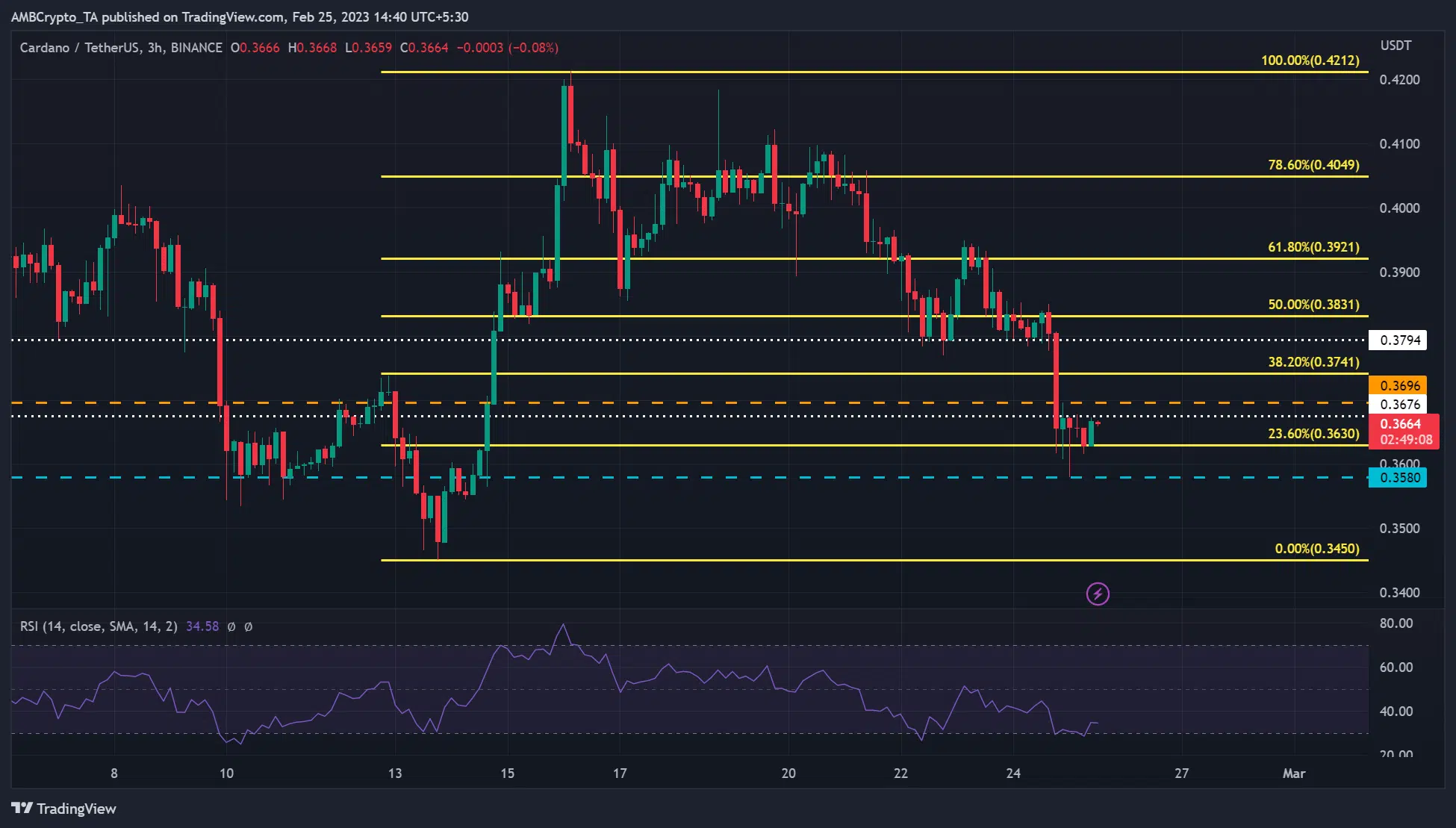

ADA fell 5% after the U.S. PCE data confirmed inflation rose in January. The Ethereum rival dropped from the 50% Fib level of $0.3831 but found steady support at the 23.60% Fib level of $0.3630.

It has since oscillated within the $0.3630 – $0.3676 range, which investors could use for targets.

Is your portfolio green? Check out the ADA Profit Calculator

Short-term sellers could target the 23.60% Fib level of $0.3630 for gains. On the other hand, near-term bulls could benefit by targeting the upper range boundary of $0.3676. A breach of the consolidation range would invalidate the neutral or sideways market structure described above.

In the event of an upside breakout, bulls could watch out for $0.3696, 38.2%, and 50% Fib levels which are significant resistance levels. Similarly, a bearish breakout calls for short-sellers attention at $.3580 and $0.3450.

The Relative Strength Index on the three-hour chart hovered in the lower ranges, reinforcing the bearish sentiment at the time of writing.

ADA saw a demand spike in the derivatives market, but sentiment remained negative

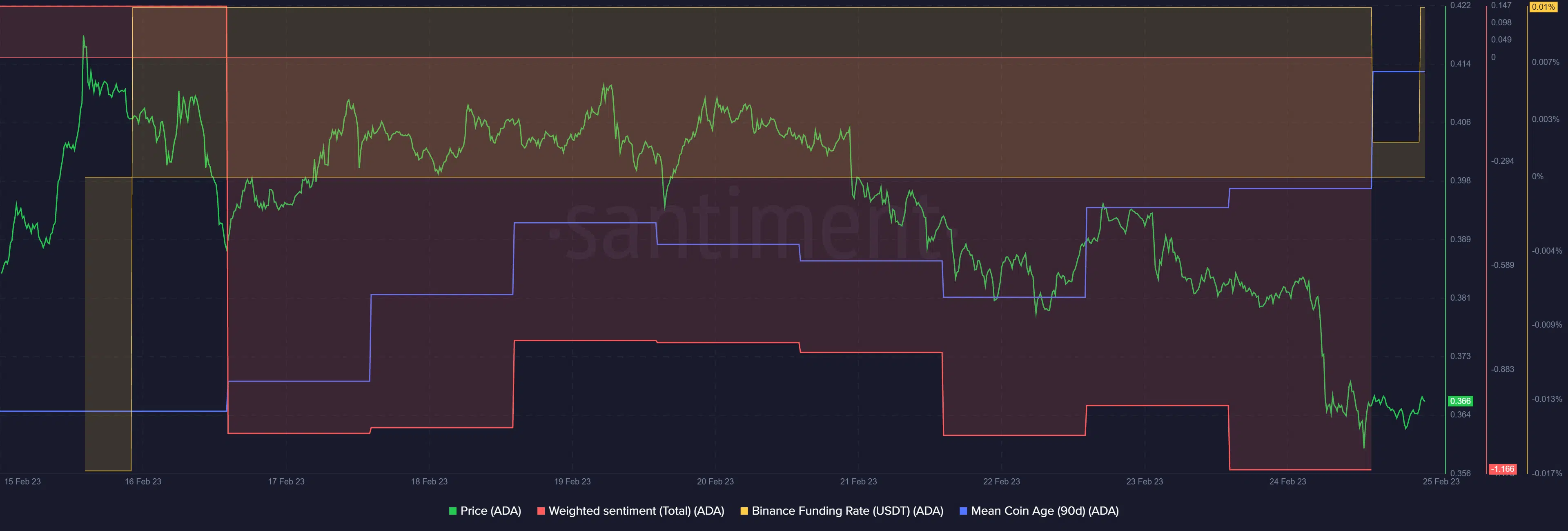

According to Santiment, Funding Rate recovered after a sharp decline on Friday (24 February). It shows demand for the ADA significantly improved after Friday’s decline.

Moreover, the Mean Coin Age (90) showed a rising slope, hence a wide-network accumulation of the token, which points to a potential bullish trend. As such, the demand could bolster bulls to inflict a recovery.

However, the weighted sentiment was negative at the time of writing. In fact, it slid deeper into the negative territory, indicating countering metrics that could suggest a continuation of the sideway structure described above.