Aave bulls defend this crucial support level and further gains are expected

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The indicators showed strong bearishness.

- Despite that, buying the asset offered a good risk-to-reward opportunity.

The past week has been a steady onslaught from the Aave sellers. The price fell from $92 to $77 within a week, but a bullish reversal could occur soon. There was some disagreement with this anticipation and from the indicators.

How much are 1, 10, 100 AAVE worth today?

Is it a good idea to buy AAVE, just because it sat atop near-term support? Will the bounce from $77 see a follow-through, or will the prices continue to plunge lower over the next week?

A lot depended on Bitcoin. As long as BTC did not see sharp selling pressure, the outlook for AAVE remains bullish in the near term.

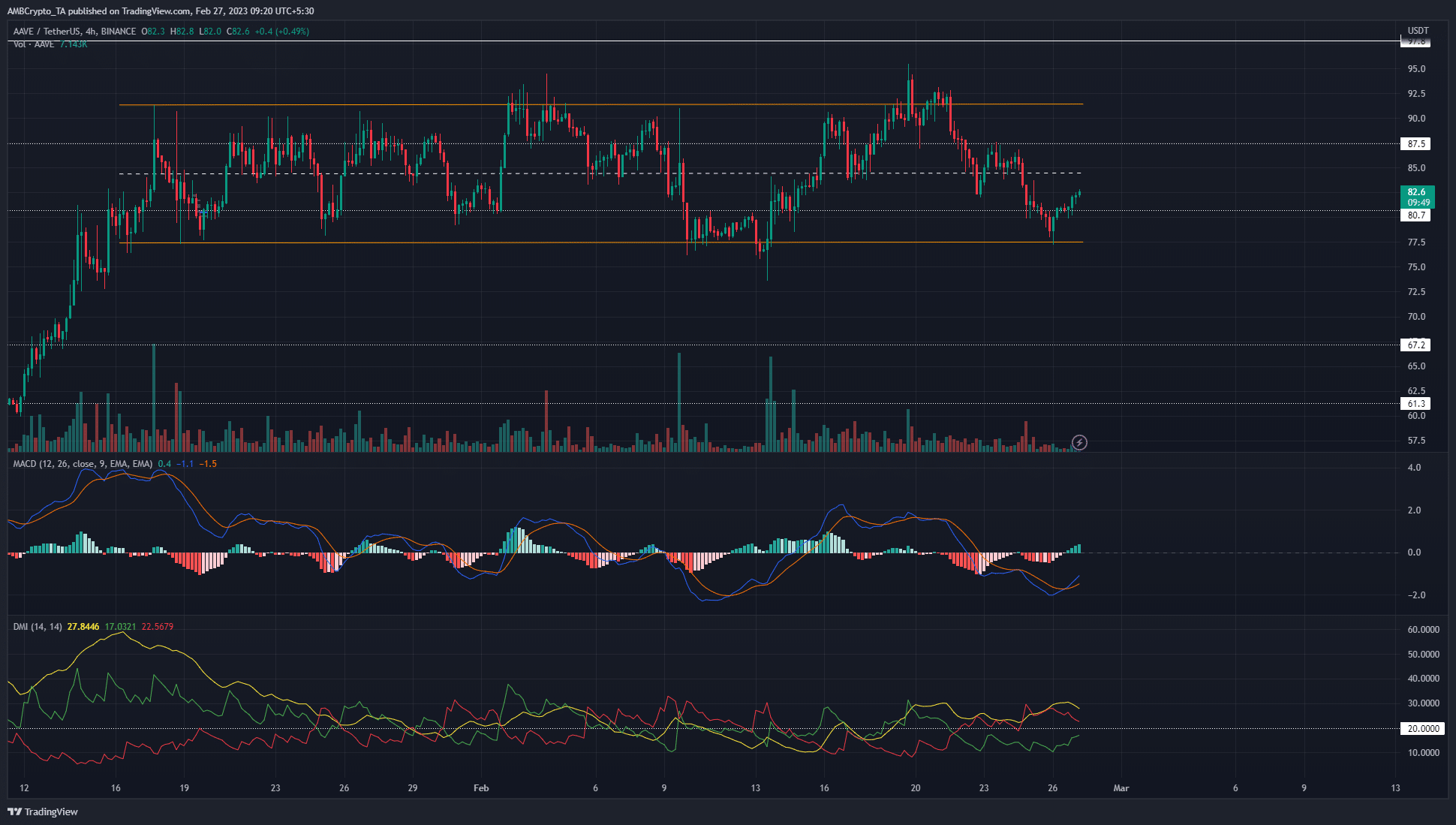

The six-week range continues to be respected

The rejection from $91.3 on 17 January established a range that AAVE continued to trade within today (27 February). The highs and lows of this range lie at $91.3 and $77.5 respectively, with the mid-range at $84.5.

Aave tested the low of the range on 26 February, reaching $77.2 before bouncing. At the time of writing, it traded at $82.5. From analyzing the price action alone, the inference is a bullish week for AAVE.

It is likely to test the $84.5 mark soon, breach it, and head toward $91.3-$92 if Bitcoin does not see huge selling pressure.

However, the indicators disagreed with this notion. The MACD formed a bullish crossover beneath the zero line, which indicated bearish momentum was weakening, although the bears still ran the show.

The DMI also showed a strong downtrend in progress, with both the ADX and the -DI (red) above 20.

Realistic or not, here’s AAVE’s market cap in BTC terms

The market structure was also bearish on the 4-hour chart, but until the range is broken, the structure wouldn’t dictate where reversals occurred. The range extremes remain of paramount importance for traders on lower timeframes.

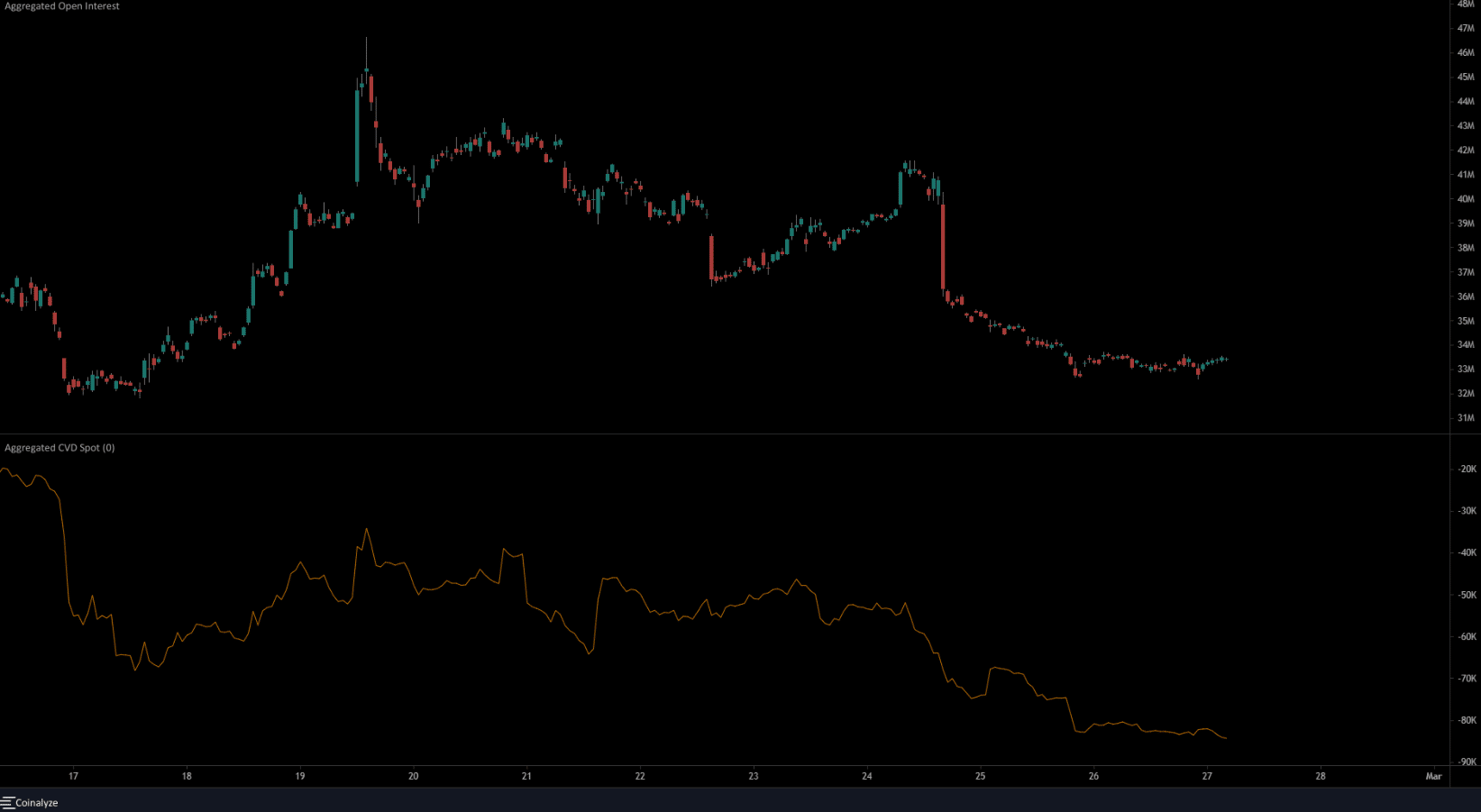

Open Interest struggles to get a move upward

Source: Coinalyze

Alongside the indicators, the futures market also noted bearish sentiment. While Aave prices bounced higher from $77 over the past couple of days, the OI has slumped, as shown on the 1-hour chart above.

This showed that market participants did not expect strong gains from the asset, which meant the rally from the range lows might not last long.

The spot CVD was also in a downtrend to suggest strong selling pressure. Therefore, AAVE buyers must be cautious and extremely vigilant about risk over the next day or two.