Assessing the impact of Silvergate episode on the crypto market

- Global crypto market capitalization declined by over 4% in the last 24 hours.

- Though BTC and ETH were affected, a few metrics predicted a trend reversal.

Coinbase on 2 March announced that it had frozen accepting or initiating payments to or from Silvergate. This episode happened as Silvergate, one of the most influential banks in the digital asset industry, revealed that it would delay the filing of its annual report, igniting panic in the crypto space.

At Coinbase all client funds continue to be safe, accessible & available.

In light of recent developments & out of an abundance of caution, Coinbase is no longer accepting or initiating payments to or from Silvergate.

— Coinbase (@coinbase) March 2, 2023

Not only Coinbase, but several other crypto entities such as Circle, and Crypto.com also announced the suspension of Automated Clearing House (ACH) transfers with Silvergate.

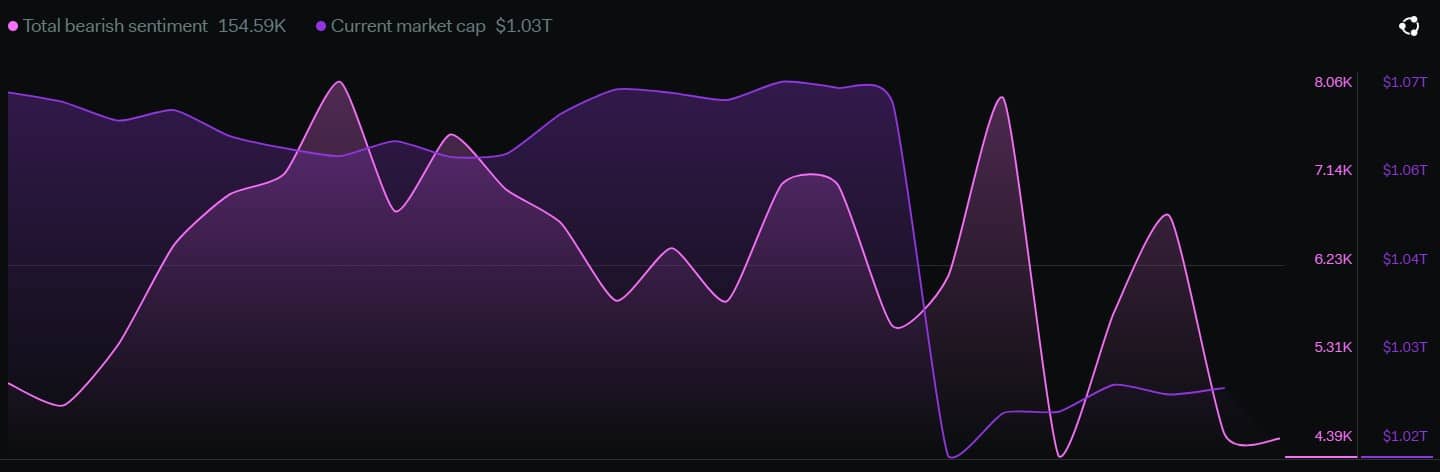

As the news caught fire, the global crypto industry’s market capitalization registered a decline of 4% in the last 24 hours, and as per LunarCrush, bearish sentiments shot up unexpectedly.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Is the crypto market under pressure?

In fact, the largest cryptocurrencies such as Bitcoin [BTC] and Ethereum [ETH] were also affected. Lookonchain’s data suggested that the news initiated a sell-off. As per the tweet, a whale transferred 15,400 ETH worth over $25 million to Binance.

A whale transferred 15,400 $ETH ($25.4M) to #Binance 30 mins ago.

The whale bought 8,599 $ETH with 11.48M $USDC and received 7,150 $ETH ($9.01M) from #Binance in December 2022.

The average buying cost is $1,305, and selling $ETH at today's price could make a profit of $4M! pic.twitter.com/5No1CDqDDc

— Lookonchain (@lookonchain) March 3, 2023

The sell-off further pushed ETH’s price down, and at press time it was trading at $1,569.34 with a market capitalization of over $192 billion.

Moreover, CryptoQuant’s data revealed that BTC’s exchange reserve was increasing, suggesting increased selling pressure, which was a negative signal.

Will the market change its direction?

However, the current bearish trend might be a short-term event, as several of the other metrics suggested the probability of a trend reversal.

For instance, BTC’s open interest in perpetual futures contracts reached a 1-month low of $1,302,371,571.24 on OkEx.

? #Bitcoin $BTC Open Interest in Perpetual Futures Contracts just reached a 1-month low of $1,302,371,571.24 on #Okex

Previous 1-month low of $1,332,260,012.64 was observed on 10 February 2023

View metric:https://t.co/DAYRIFJKGQ pic.twitter.com/t24eGtzsmN

— glassnode alerts (@glassnodealerts) March 3, 2023

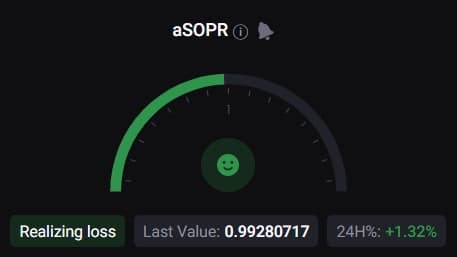

Not only this, but BTC’s aSOPR was also green, which suggested that more investors were selling at a loss amid a bear market. Therefore, a possible market bottom can be expected.

Is your portfolio green? Check the Bitcoin Profit Calculator

Ethereum buckled up

Meanwhile, Ethereum also showed signs of revival from the bear market lately, as its state in the futures market looked promising.

As per CryptoQuant, ETH’s taker buy/sell ratio suggested that buying sentiment was dominant in the derivatives market. In addition to that, DeFiLlama’s data revealed that ETH’s total value locked (TVL) registered a steady uptick for several weeks, which looked promising for the network.

Owing to these developments, it appeared fairly possible that the market would undergo a trend reversal.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)