Bitcoin: This section of BTC holders has a reason to rejoice

- Bitcoin holders’ profits reach a new all-time high.

- Selling pressure remains relatively low, however, volume declines.

Due to all the fear, uncertainty, and doubt (FUD) that surrounded the crypto space over the last year, many addresses were compelled to sell their Bitcoin holdings.

However, there was a section of addresses that continued to show faith in the king coin BTC and HODLed their way through the woods.

Interestingly, these long-term holders are now seeing all-time highs in terms of their profitability.

Read Bitcoin’s Price Prediction 2023-2024

Not sure which #Bitcoin holder is more impressive as they all continue to make all-time highs.

1+ year = Have held the entirety of 2022

2 + years = Bought the top of the 2021 bull

3+ years = Expect this to start trending upwards ( 1 week away from covid)

5+ years = Bought… https://t.co/IzUbZeZRX8 pic.twitter.com/6B2g3vV1QU— James V. Straten (@jimmyvs24) March 4, 2023

Reportedly, HODLers who have held their BTC for anywhere between 1-5 years, have been seeing a profit-making opportunity.

However, as the profitability of these holders rises, the overall incentive to sell these holdings increases.

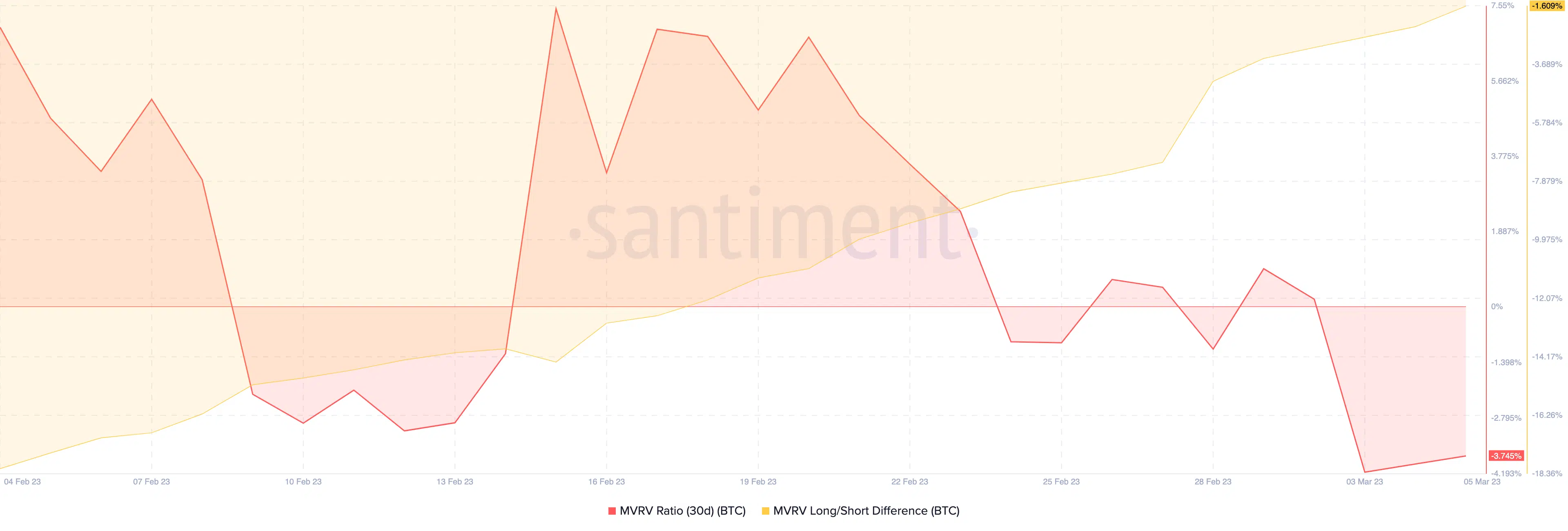

An interesting metric to look at at this point would be the MVRV ratio.

Well, the MVRV ratio for the king coin was negative, at the time of writing. This implied that the majority of BTC holders would end up taking a loss if they sold their coin at the current price.

This also suggested that the profitable holders were a minority on the Bitcoin network. And, hence there was no major selling pressure that could be anticipated.

Addresses get active

In fact, whales also showed massive interest in the coin of late. Hence, general activity on the Bitcoin network began to rise.

According to data provided by glassnode, the number of BTC transactions reached a 2-year high on 5 March.

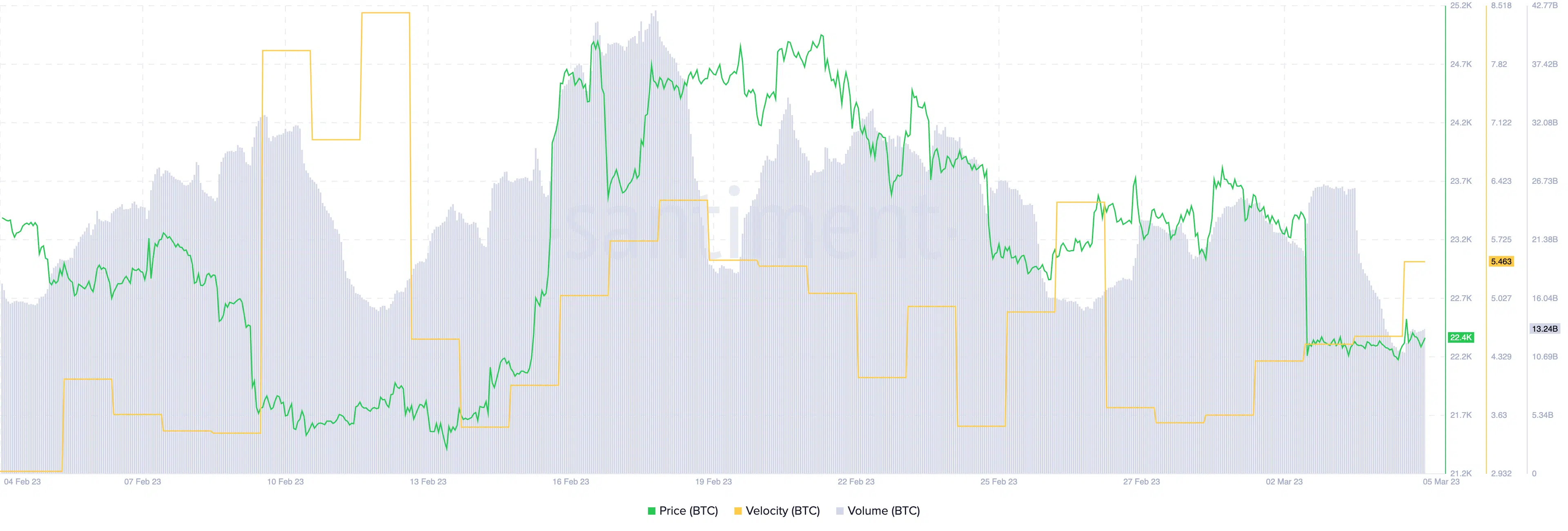

Furthermore, the high velocity of Bitcoin implied that the number of times BTC was being transferred among addresses, had increased. Sadly, that wasn’t the case with the volume metric.

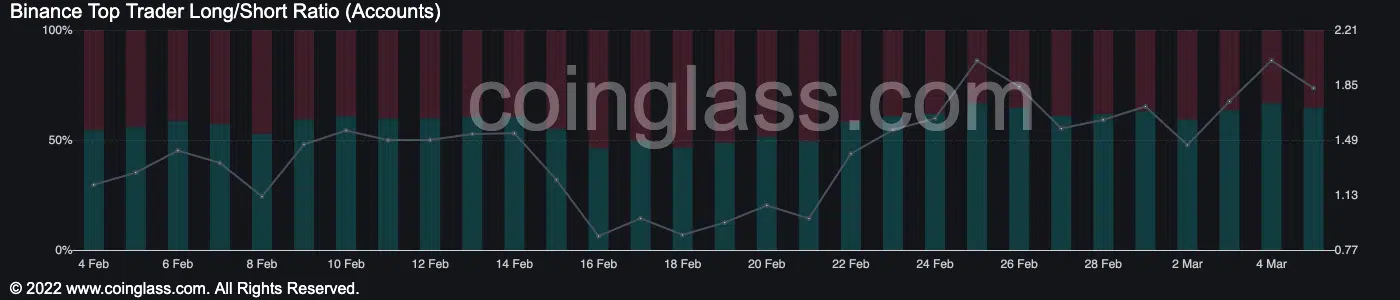

However, the declining volume did not deter traders from going long on Bitcoin. According to coinglass’ data, the percentage of long positions taken for Bitcoin on the Binance exchange increased from 50.5% to 64.66% in the past few weeks.

Is your portfolio green? Check out the Bitcoin Profit Calculator

That being said, it remains to be seen how these long positions on BTC play out for traders in the long term.