HBAR investors’ sentiment shifts, thanks to these factors at play

- HBAR bulls demonstrate readiness to take over as the bears grow weak.

- The coin’s latest report coupled with short-term support retest is likely the reason behind the sentiment shift.

The Hedera network is still one of the layer-1 blockchains that have been rapidly gaining popularity. While this was a big factor in HBAR’s bullish bounce since the start of the year, it has not been enough to prevent the loss of a third of its YTD gains.

Is your portfolio green? Check out the Hedera Profit Calculator

HBAR has so far declined by roughly 36% from its YTD peak in February. However, it is now clear that the bears are losing their momentum after dominating for over three weeks now.

Bullish signs are already starting to pile up, suggesting that a potential pivot might be in the works.

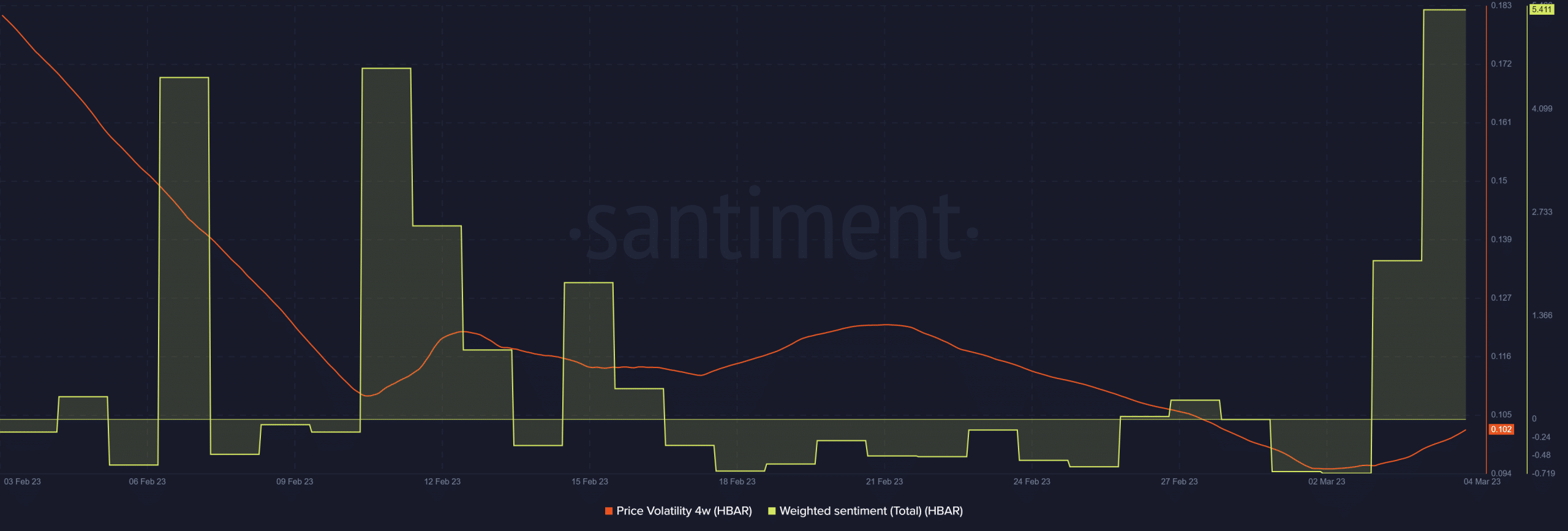

Investors have been keen on the slowdown in HBAR’s momentum. The recent spike in the weighted sentiment metric is a clear indication that investors have shifted to bullish expectations.

In fact, the weighted sentiment just concluded last week with a surge to its highest level in the past four weeks.

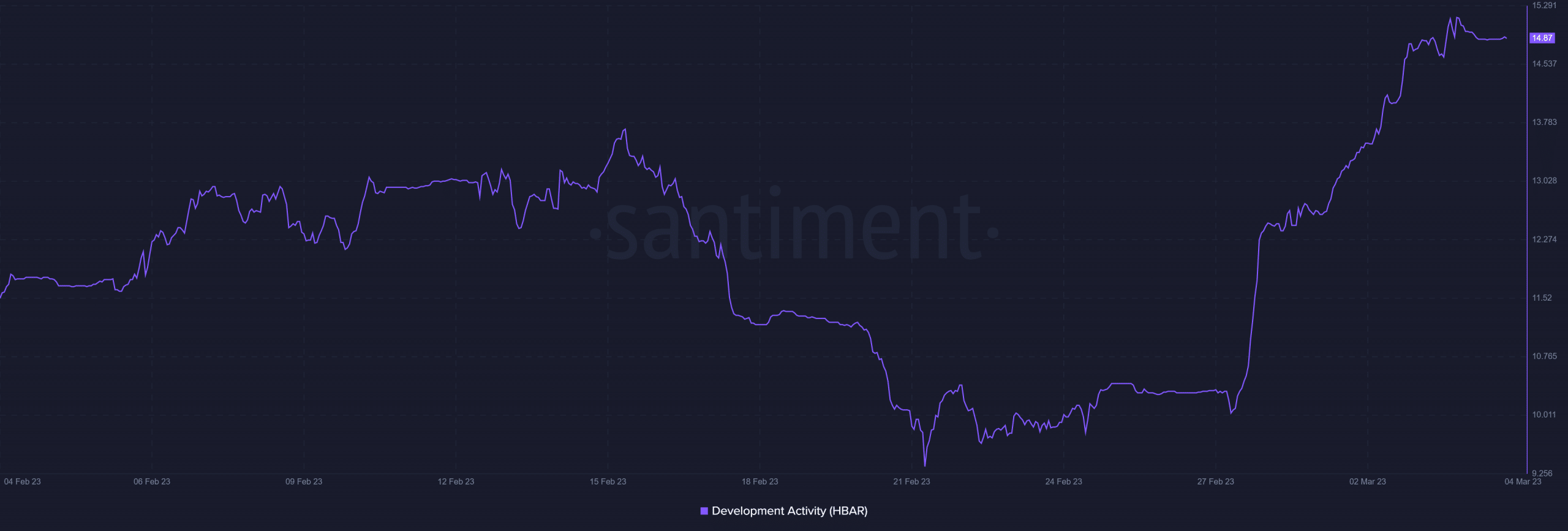

Also, the price volatility metric ended February at its lowest monthly level but it is now showing a return to higher volatility. In addition, these changes are taking place at a time when the network’s developers are in full swing.

HBAR retests short-term support

HBAR’s price action recently bottomed out at the $0.062 price level which previously acted as a short-term support level. So far the price was up for the second consecutive day. The last time such an observation was made was before 20 February.

The coin’s slight upside in the last two days indicates that some bullish activity has been taking place after the support retest.

However, this does not necessarily mean it is immune from more downsides. The price is yet to enter into oversold territory despite hovering above this zone.

Meanwhile, the MFI was bearish, suggesting that the buying pressure is still low.

How many are 1,10,100 HBAR’s worth today?

The timing of this support retest is also noteworthy. The end of the bearish momentum occurred the same day that Hedera reported that it has so far processed more than 4 billion transactions.

It also reported radical growth so far this year, courtesy of healthy enterprise adoption of its Hedera Consensus Service (HCS).

(1/3) This year, the #Hedera network has seen a sustained and massive uptick in its transaction volume, the bulk of it being the result of increased #enterprise utilization of the Hedera Consensus Service (HCS) as a decentralized public notary and system of immutable record. ?

— Hedera (@hedera) March 3, 2023

The transaction count milestone reportedly represents Hedera’s mainnet transactions with a 400 TPS average.

The report is likely the reason for the return of investors’ confidence observed in the weighted sentiment. The subsequent demand remains relatively subdued despite pivot expectations.

A potential reason for this is the surge in the overall crypto market’s bearish expectations for March.

![Sui [SUI]](https://ambcrypto.com/wp-content/uploads/2025/05/Evans-77-1-400x240.png)