Axie Infinity [AXS] is close to a patterned breakout – Can shorting yield gains?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- AXS’s market structure has been strongly bearish

- Development activity increased, but active addresses declined

Axie Infinity’s [AXS] price action has weakened over the past few weeks. Since January 23, the gaming token has depreciated by 40%, with the crypto trading below $10. At the time of writing, AXS’s value was $8.3 and it could retest key support levels if macroeconomic headwinds persist.

Read Axie Infinity’s [AXS] Price Prediction 2023-24

Is a patterned breakout likely?

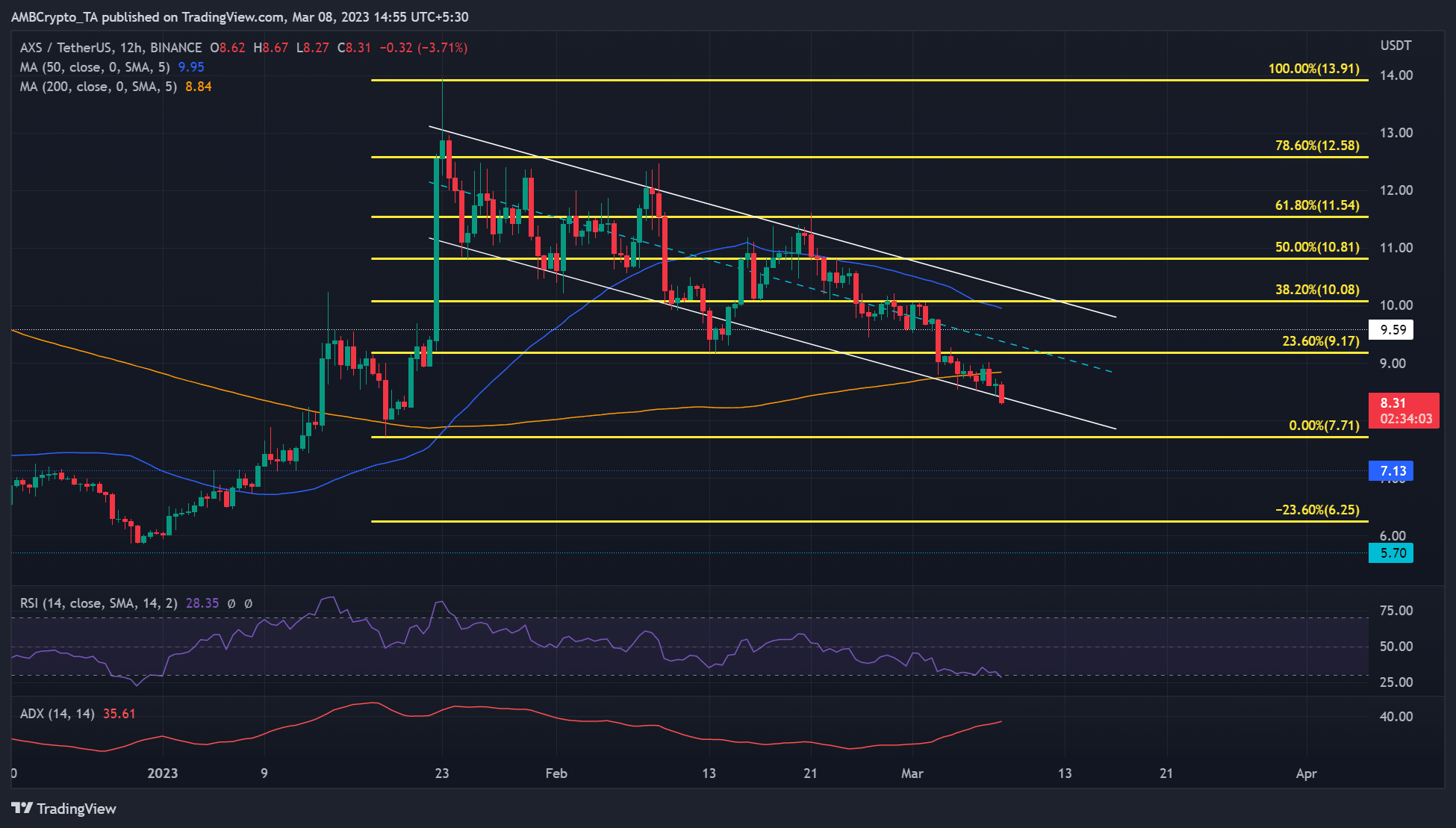

AXS has dropped from $12 to $8 as bears dominate the market. The prevailing inflation could further exert selling pressure and offer bears more leverage in the next few days/weeks. As a result, bears could sink AXS below the descending channel’s boundary of $8.40 and retest the $7.71 support. An extremely bearish scenario could see AXS drop to $6.65 or $5.70.

Therefore, cautious bears could wait for a pullback to retest the lower channel’s boundary to confirm a further downtrend before making moves.

A candlestick close above the channel’s lower boundary ($8.4) will invalidate the aforementioned bearish thesis. Such a move could offer bulls a recovery chance, especially if Bitcoin [BTC] defends the $22K psychological level. The target for bulls would be the channel’s upper boundary or the 38.2% Fib level ($10.2). However, bulls must clear the hurdles at 23.6% Fib level ($9.17) and 50-period MA ($9.95).

The RSI (Relative Strength Index) declined to the oversold territory, reinforcing bears’ leverage. In addition, the Average Directional Index (ADX) was above 25 and the slope turned north, confirming a strong downtrend. However, the increasing divergence between the ADX and price could also indicate a slowing downtrend.

AXS’s Funding Rate was negative and active addresses declined

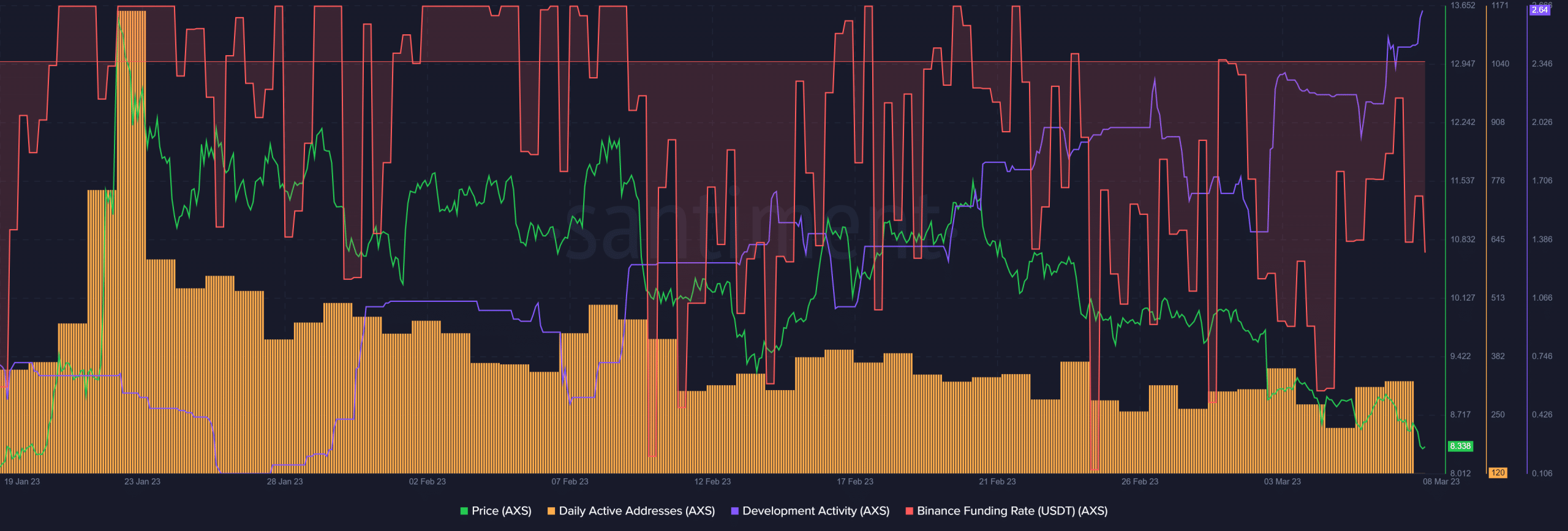

The Funding Rate for AXS/USDT pair remained disturbingly negative over the past few weeks, indicating limited demand and largely bearish sentiment in the derivatives market. Similarly, the amount of daily active addresses declined significantly over the same period, showing that fewer addresses traded the token, limiting trading volumes.

Is your portfolio green? Check the AXS Profit Calculator

However, the network kept building, as shown by the uptick in development activity. Such a massive hike could boost the token’s value in the long run. However, prevailing macroeconomic headwinds could undermine a strong rebound, especially if BTC breaks below $22K.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)