Has DOJ’s Bitcoin [BTC] movement caused panic among holders?

![Has DOJ's Bitcoin [BTC] movement caused panic among holders?](https://ambcrypto.com/wp-content/uploads/2023/03/bitcoin-2007769_1920-1-e1678372025968.jpg)

- The transfer of some BTCs by the DOJ seemed to have caused the price of BTC to drop.

- Despite the mass movement from the DOJ, the Netflow has not reflected irregular activities.

Bitcoin [BTC] has been struggling to get past the barrier it has hit lately. Recent action taken by a United States government department has only served to add to this FUD in the most unexpected way. But the question is- To what extent, though, has this had an effect?

Read Bitcoin [BTC] Price Prediction 2023-24

DOJ’s BTC move stirs the crypto space

There was a report that on Wednesday, the U.S. Department of Justice (DOJ) moved over $1 billion worth of Bitcoin [BTC] to different wallet addresses, including one owned by Coinbase.

The authorities reportedly made three separate Bitcoin transactions. About $10,000 was transferred to Coinbase-managed wallets, while about $41,000 was transferred to government-managed accounts. The DOJ’s action exacerbated fears among investors that heavy selling pressures could crash the token’s price.

Santiment reported that the Department of Justice made a series of deals totaling $666 million in 2023, substantially double the previous record.

Bitcoin continues a downward trend

By the close of trading on 8 March, the BTC price, when viewed on a daily timeframe, had dropped by a total of 2.21%. It was selling at about $21,600 as of this writing, down about 0.40% in the same timeframe.

With the most recent decline, it has been trending downward for four days in a row.

The Relative Strength Index was the indicator that best captured the present BTC emotion.

A bear trend would be indicated by the RSI falling below the neutral line and even below 36. But, it is still being determined whether it will breach the support level of $20,000 and drop below. The coin’s resistance was the long Moving Average, advancing above it.

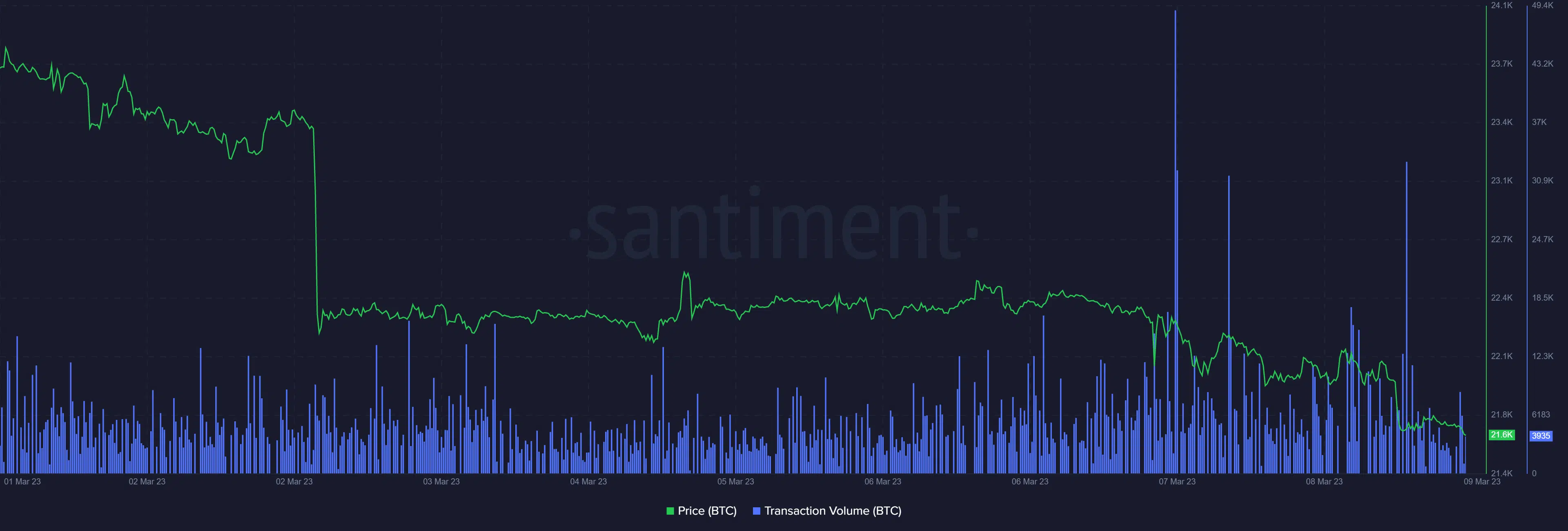

Spike in Bitcoin volume recorded

A look at Santiment’s volume indicator revealed that there had been recent increases in BTC’s transaction volume. Up to the time of this writing, Bitcoin had surpassed a total transaction volume of over 40,000. That was one of the busiest days for Bitcoin in recent months.

How much are 1,10,100 BTCs worth today?

Panic?

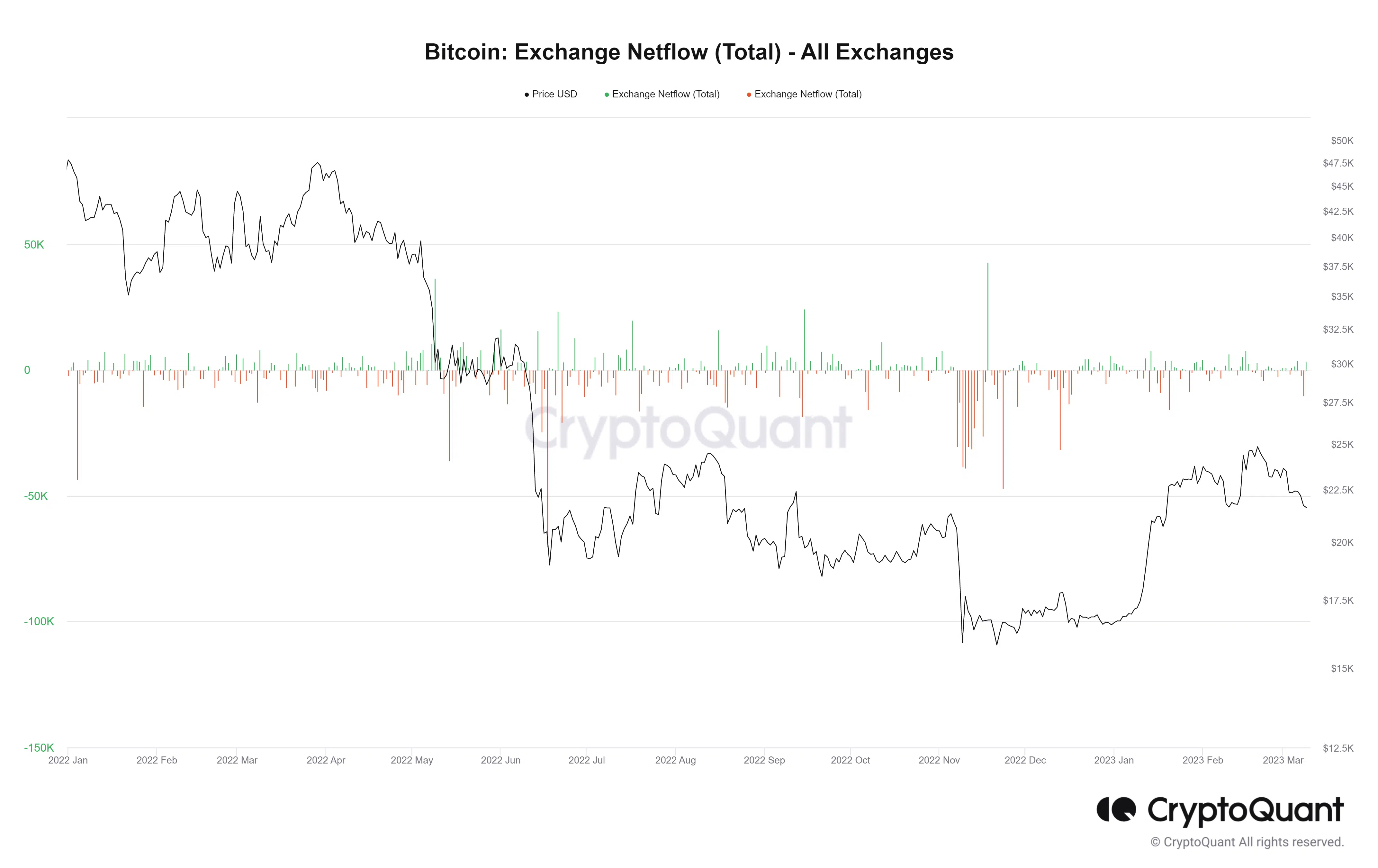

The Netflow metric, however, represented typical activity notwithstanding whatever sentiment that other metrics could be showing.

According to the Netflow indicator on CryptoQuant, there were more inflows than outflows as of this writing. What was noteworthy, though, was that there were no apparent surges in the inflow volume.

The current position of the indicator suggested that BTC owners were not in a panic, indicating that a further price decline might not be anticipated.