Ethereum: Shapella upgrade forked with Goerli testnet, this is what went down

- Ethereum upgrade launched on the Goerli testnet.

- Issues emerge; however, validator interest remained consistent.

The much-awaited Shanghai upgrade was executed on Ethereum’s [ETH] Goerli testnet on 15 March. The Goerli network is a decentralized network designed to be a testing and development environment for Ethereum-based decentralized applications.

Goerli forked!

— timbeiko.eth ☀️ (@TimBeiko) March 14, 2023

Read Ethereum’s [ETH] Price Prediction 2023-2024

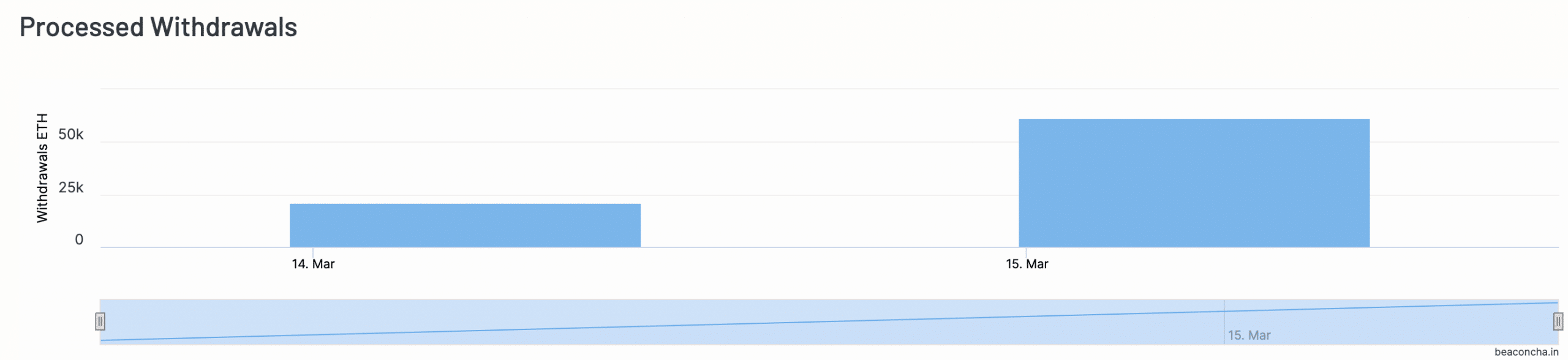

Through the Shanghai upgrade, which is also called Shapella upgrade by developers, validators can withdraw their staked ETH from the beacon chain. At press time, 17583 withdrawals have been successfully processed on the test network.

Even though a lot of transactions were processed, there are some issues that are being faced by the network. One such problem was that many validators on the testnet did not upgrade due to a significant number of changes to withdrawal credentials.

Deposits are being processed (https://t.co/CxYtPcGMCp), but it seems like several validators haven't upgraded. Looking into it ?

One challenge with testnet validators is that given the ETH is worthless, there's less incentive to run a validator/monitor it.

— timbeiko.eth ☀️ (@TimBeiko) March 14, 2023

Until press time, developers were unsure whether these issues would exist when they were launched on the mainnet. This is because the testnet nodes used fewer resources compared to the mainnet.

While the developers were busy troubleshooting these issues, the number of validators on the Ethereum network increased by 6.35% over the last month.

Beware the hype

The excitement surrounding Ethereum is growing as the Shanghai Upgrade draws near.

One indicator of the increasing hype around Ethereum was the spike in the number of non-zero addresses on Ethereum, which reached an all-time high of 95,474,490 addresses on 14 March.

? #Ethereum $ETH Number of Non-Zero Addresses just reached an ATH of 95,474,490

View metric:https://t.co/beS1MtIgAZ pic.twitter.com/tqd4iEgGKO

— glassnode alerts (@glassnodealerts) March 14, 2023

Despite the increasing buzz around the Ethereum network, ETH holders could be tempted to sell their holdings. One reason for the same would be the increasing MVRV ratio of Ethereum. A high MVRV ratio suggests that most addresses holding Ethereum are profitable.

Is your portfolio green? Check out the Ethereum Profit Calculator

If the MVRV ratio continued to rise, the selling pressure on all these addresses would increase materially.

? #Ethereum $ETH MVRV (1d MA) just reached a 10-month high of 1.255

Previous 10-month high of 1.254 was observed on 21 February 2023

View metric:https://t.co/6HtdqX8ILX pic.twitter.com/hZjZHen9KL

— glassnode alerts (@glassnodealerts) March 14, 2023

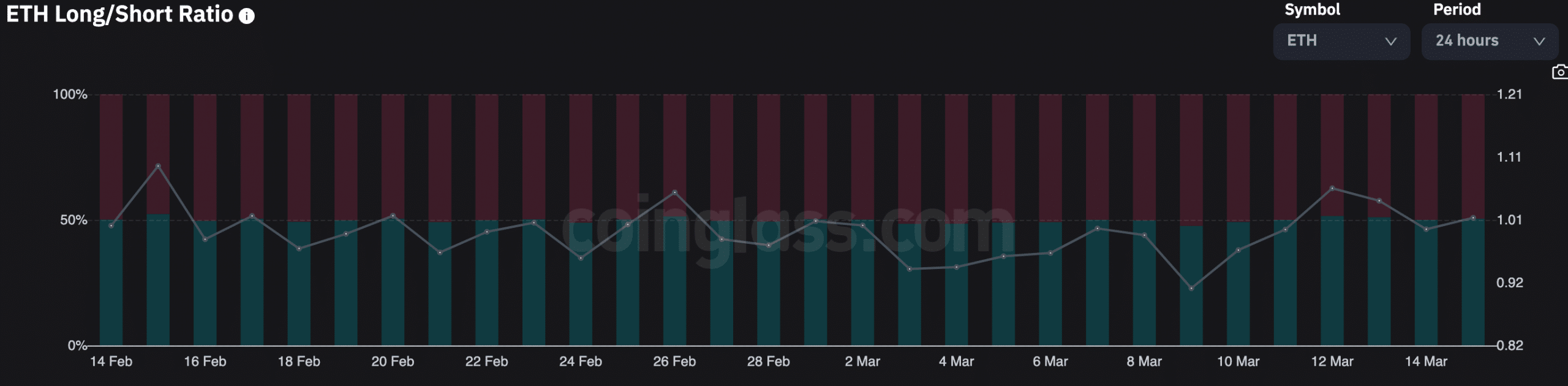

Although the selling pressure on Ethereum continued to rise, the traders’ press time sentiment remained relatively neutral. A roughly equal number of long and short positions have been taken against Ethereum over the last month, implying that there was no large consensus amongst traders regarding where ETH’s prices would land.