Lido Finance rides the wave of Ethereum’s upgrade, here’s how

- Lido’s TVL has touched $10 billion ahead of the Shanghai Capella Upgrade on the Ethereum mainnet.

- LDO sees a drop in buying pressure.

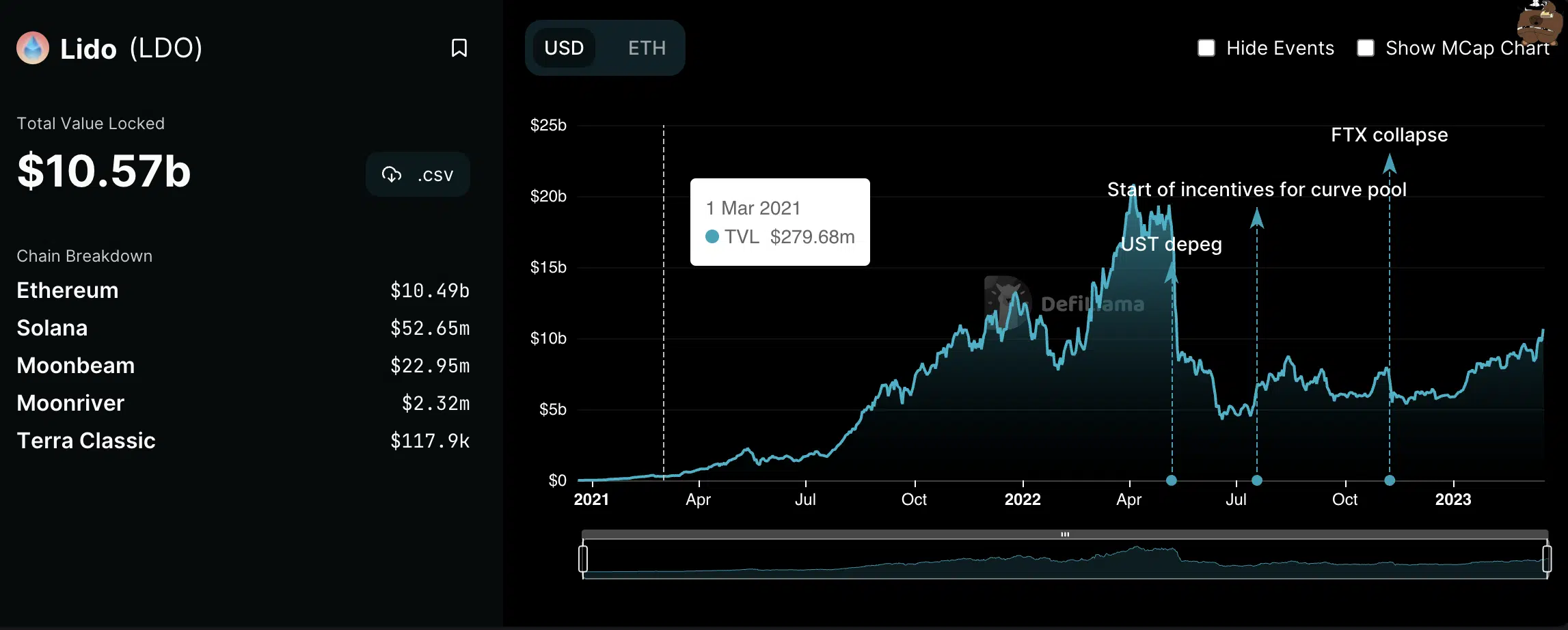

In anticipation of the Shanghai Capella Upgrade on Ethereum mainnet in April 2023, liquid staking platform Lido Finance [LDO] has witnessed a significant increase in its total value locked (TVL) as Eher [ETH] stakers look forward to the unlocking of previously locked ETH tokens.

According to data from DefiLlama, in the last month, Lido’s TVL increased by 18%. Moreso, this went up by almost 25% in the last seven days.

At press time, the protocol’s TVL was $10.57 billion, representing a 21.66% share of the entire decentralized finance [DeFi] ecosystem.

Is your portfolio green? Check out the Lido Profit Calculator

ETH stakers have continued preference for Lido

As a result of the contagion brought about by FTX’s unexpected collapse in November 2022, Lido’s share of the ETH staking market dropped below 30% for the first time since April 2022.

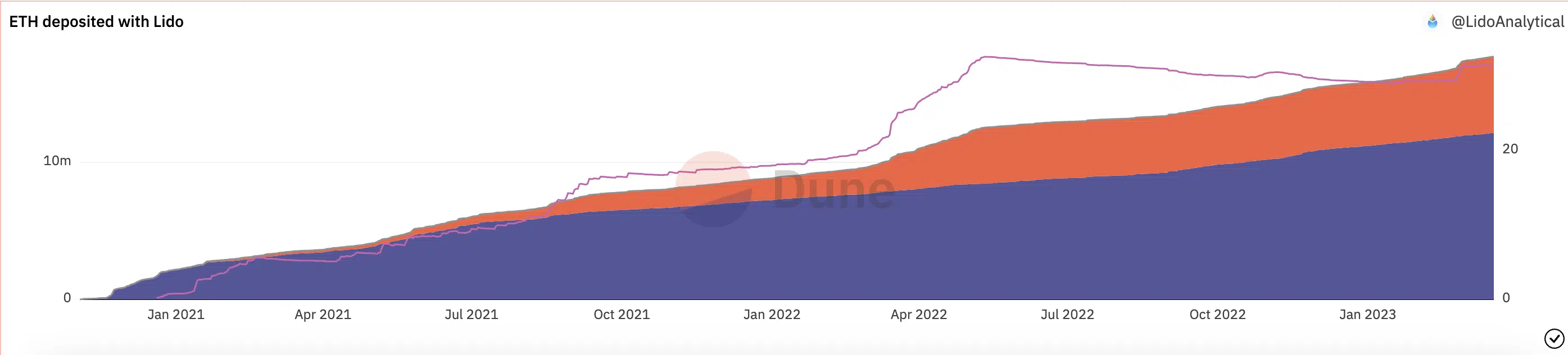

Even though Lido displaced MakerDAO [MKR] as the DeFi protocol with the highest TVL in January, Lido’s share of the ETH staking market lingered at 29% in the first two months of the year.

However, things took a different turn in March as Lido reclaimed its 30% market share and surpassed it. This has been due to the execution of the Shanghai Capella Upgrade on Ethereum’s Goerli testnet and the confirmation of a 12 April date for the mainnet upgrade.

At press time, 5,579,744 ETH tokens were staked through Lido, representing a 31% market dominance.

Further, on 12 March, Lido’s staking Annual percentage rate (APR) rallied to its highest point far this year, reaching an impressive 9.91%.

Per data from Dune Analytics, this growth was, however, ephemeral as the staking APR on the platform consequently plummeted. At press time, this was 5.94%.

Realistic or not, here’s LDO market cap in BTC’s terms

Brace for impact

While LDO’s price rallied in the last week, mirroring the general growth in the crypto market, an assessment of the token’s price movements on the daily chart revealed a fall in buying pressure.

In fact, the MACD indicator revealed that LDO has lingered under a new bear cycle since the beginning of March. At press time, the RSI and MFI were positioned at 47.75 and 40.15, respectively, indicating that LDO traders preferred to sell rather than hold.

Further, the dynamic line (green) of the asset’s CMF was positioned in the negative territory below the zero center line. This suggested increased liquidity exit, which, if it remains unabated, will further drag LDO’s value down.