Bitcoin [BTC] miners see green: Will there be a relief in selling pressure

- Bitcoin miners are seeing profits due to increased BTC prices and decreased transaction costs.

- Retail interest is high, but the influence of BTC whales could lead to price volatility.

In the latter half of 2022, many Bitcoin [BTC] miners were facing the heat as the king coin’s prices kept decreasing. The costs of energy and machinery were causing them to sell their BTC to remain profitable. However, as the prices of BTC surged, mining started turning profitable.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Some relief for BTC miners

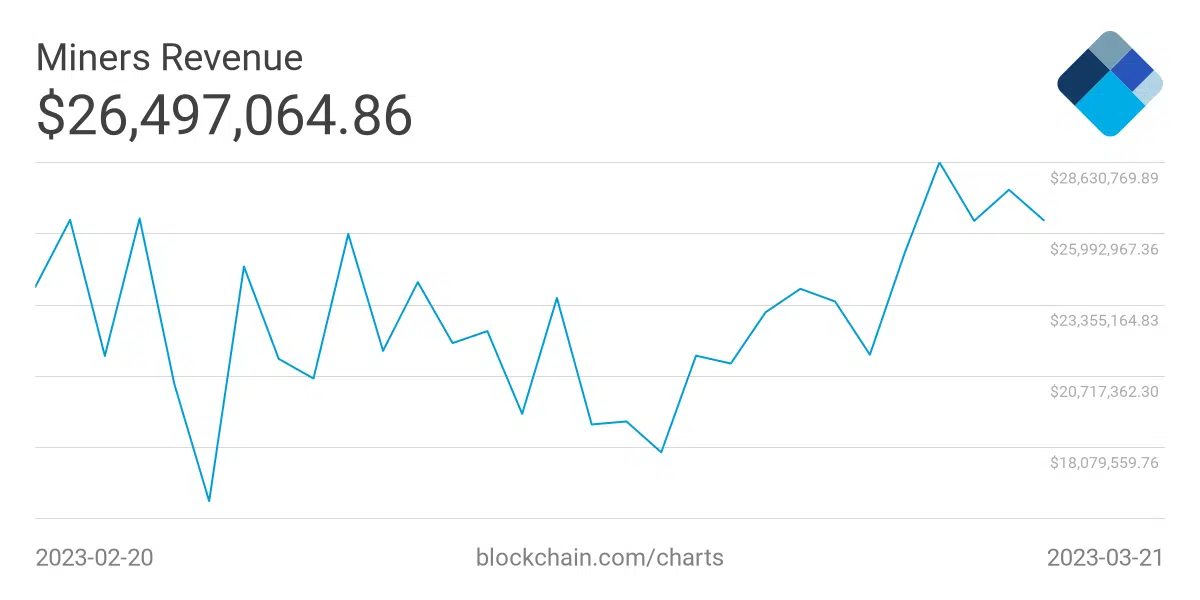

According to Glassnode’s data, after BTC crossed the $26.1k threshold, efficient cohorts of miners earned a 2x premium on their mining rigs. This surge in BTC’s price created a positive environment for miners, and many have earned more revenue.

#Bitcoin prices are now trading above the estimated cost of production model for a post-halving environment ? at $26.1k.

This means the most efficient cohort of miners are producing $BTC at 2x premium to input costs.

h/t @paulewaulpaul for the model

? https://t.co/vBEh2poATZ pic.twitter.com/zbQPC3SQ4W

— glassnode (@glassnode) March 21, 2023

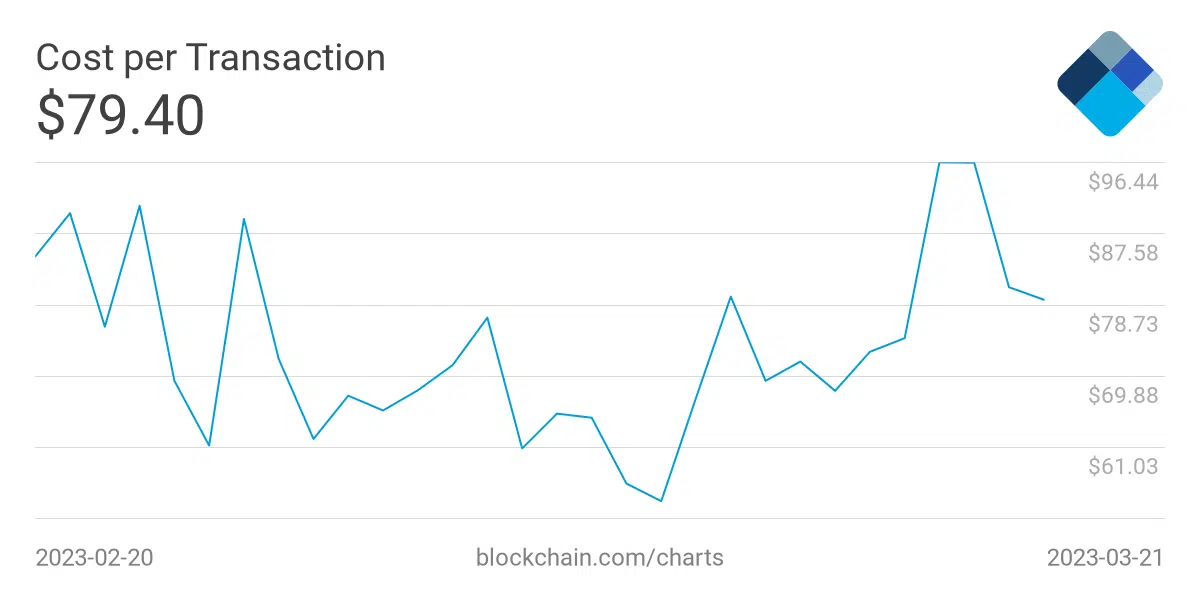

One reason for the same has been a decline in the cost of transactions for miners, which has decreased from $96 USD to $79 USD. This decrease in transaction cost has positively impacted profitability, as miners can now earn more with fewer expenses.

Many mining pools have seen profitability as well, with pools such as Foundry USA and Antpool taking up a large share of the BTC that was mined. Over the last six months, Foundry and Antpool have mined 7,769 and 5,189 blocks, respectively.

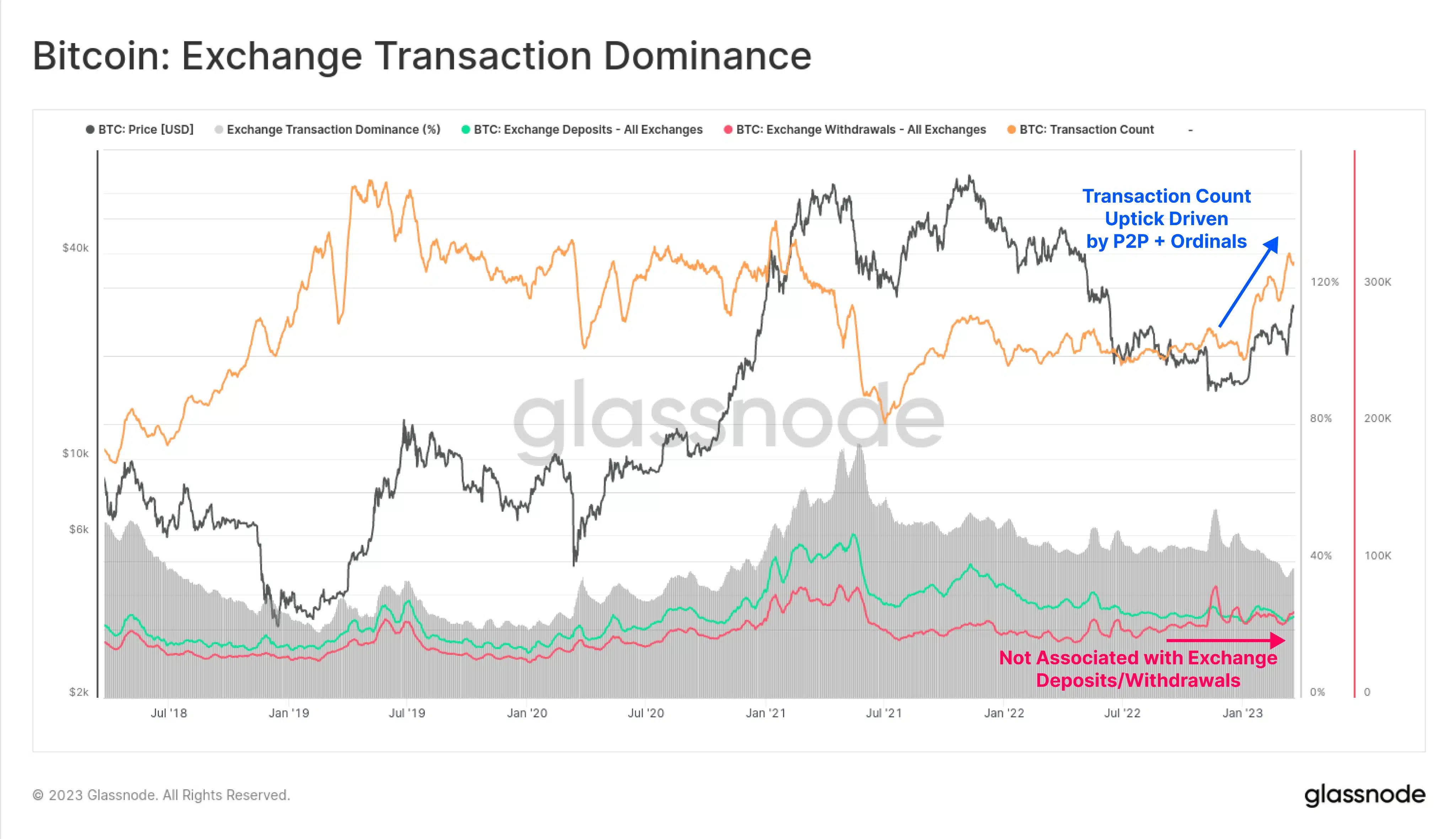

Another reason why miners have started to see profits is due to the increased activity on the network. As exchange transfers are relatively low, it can be deduced that most of this activity is due to peer-to-peer transactions and through the introduction of ordinals and inscriptions.

Additions of these ordinals attracted a large amount of retail investors to the Bitcoin network as well.

Is your portfolio green? Check out the Bitcoin Profit Calculator

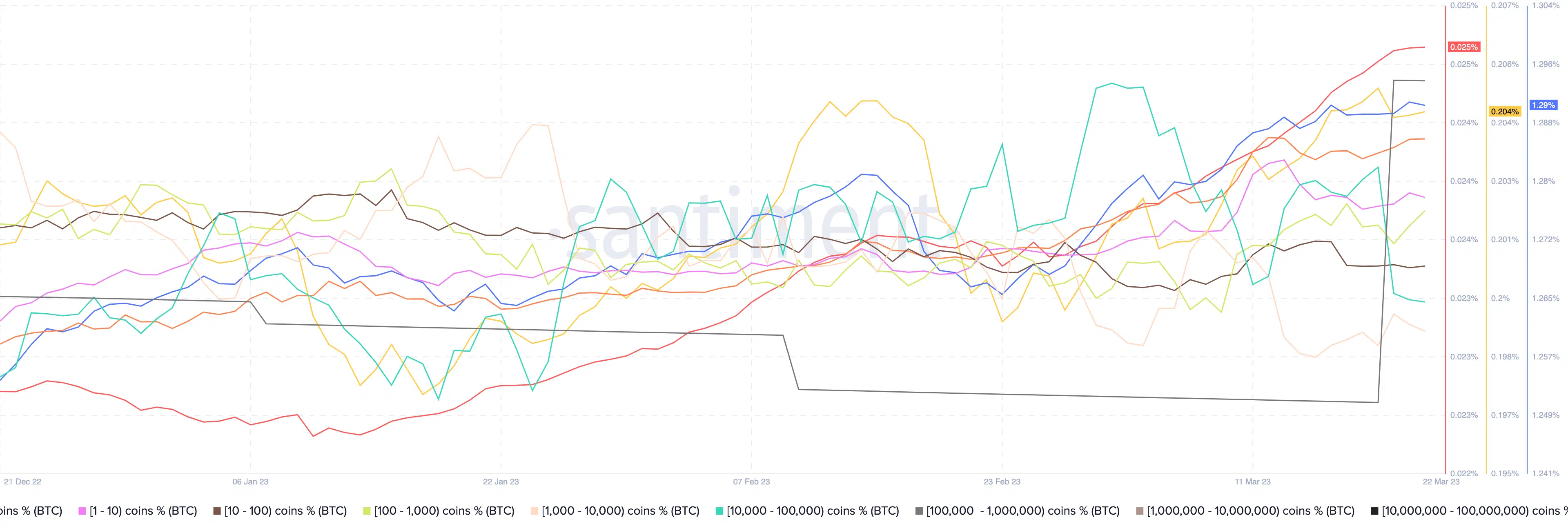

Even though a high retail interest could be good for BTC in the long run, a large amount of BTC is still held by whales. These whales hold a significant amount of BTC and could potentially influence market trends.

Therefore, retail investors could be susceptible to a sharp decline in prices if these whales decided to sell at press time.