How Cardano [ADA] shrugged off losses, extended growth hike across board

![How Cardano [ADA] shrugged off losses, extended growth hike across board](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-22T125635.885.png)

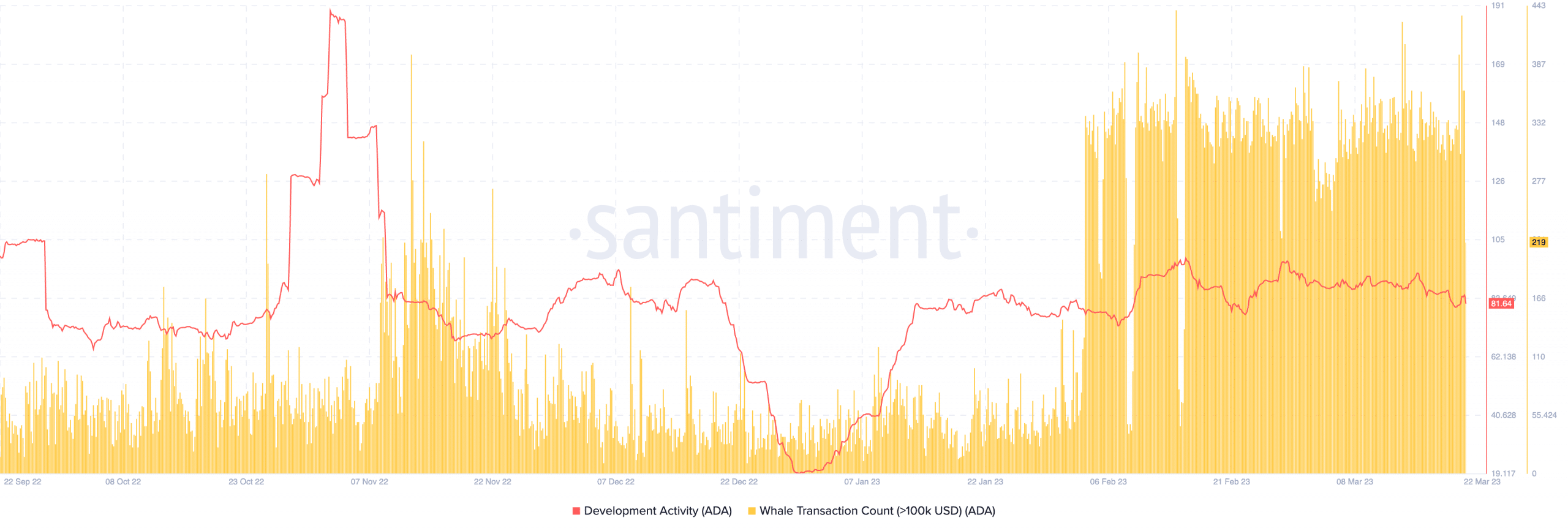

- ADA’s price significantly increased as whale transactions reached a monthly peak.

- Holders of the last 30 days jumped into gains.

After enduring a long period in red, Cardano [ADA] investors finally had their day of respite. At the time of writing, the native token of the Proof-of-Stake (PoS) blockchain registered a 9.14% uptick in the last 24 hours. Only Ripple [XRP] outperformed it out of the top 10 cryptocurrencies in terms of market capitalization.

How much are 1,10,100 ADAs worth today?

Stagnant development activity, but whales act as liberators

Although ADA may have edged out the bears, the escape was not without backing from activity on its network. Input Output, the project’s development arm put out a tweet about the Dynamic peer-to-peer (P2P) rollout on the Cardano Mainnet.

ICYMI: Cardano's network is evolving and Dynamic P2P is now rolling out on mainnet. SPOs can now test automated connections of #Cardano nodes.

Find out more in this blog post: https://t.co/jbc8E15Hox

— Input Output (@InputOutputHK) March 21, 2023

According to its 16 March explanation of the P2P feature, the Charles Hoskinson-led project was a further boost to the network’s performance and decentralization The blog post also noted that the Dynamic P2P would minimize communication delays, and maximize the network’s strength against failures.

Meanwhile, the Cardano community has been testing the functionality, which requires updating the node version to 1.35.6. The presence of the node means that Cardano users can perform P2P transactions without the need for a development network protocol.

However, the project’s development activity stayed put at 81.17. The metric tracks the public GitHub repositories of a project while measuring commitment by developers.

But Cardano’s seemingly stagnant position did not mean it was worse off, as ProofofGitHub ranked it only behind Polkadot [DOT].

GitHub Daily Development Activity:

#1: 1169 Polkadot / Kusama

#2: 671 Cardano

#3: 648 Internet Computer

#4: 562 Status

#5: 411 Decentraland

#6: 408 Hedera

#7: 397 Cosmos

#8: 381 Audius

#9: 381 Ethereum

#10: 368 ChainLink pic.twitter.com/NaGKQ5dyxs— ProofofGitHub (@ProofofGitHub) March 22, 2023

Furthermore, ADA whales seem to have been influential in the token’s price action. This was because Santiment showed that transactions in the $100,000 range have been increasing since 19 March. In fact, this metric hit a monthly high of 433 on 21 March, even though it had decreased to 219 at press time.

At last, a folder without the reds

The whale activity points to increased interest in the token. And subsequently, this leads to buying pressure, which is eventually reflected in the token value.

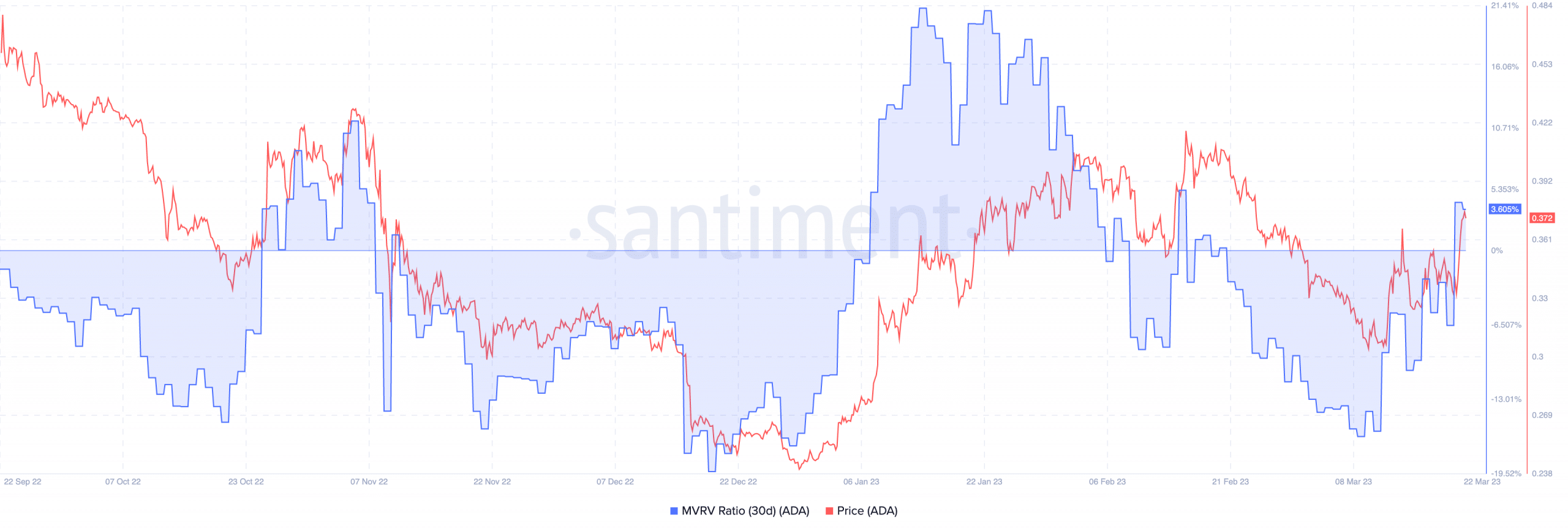

At press time, ADA exchanged hands at $0.372 — a point it had struggled to reach since 14 March. Following the price rise, the ADA 30-day Market Value to Realized Value (MVRV) ratio heeded in a similar direction.

Is your portfolio green? Check the Cardano Profit Calculator

The metric acts as a prominent indicator for traders to determine an undervalued or overvalued state of an asset. Moreso, it also reflects the gain rate recorded within a specific period.

Hence, the MVRV ratio increasing to 3.605% implied that a notable number of investors who accumulated in the last 30 days were now in profit.