AAVE outperforms LDO as DeFi TVL reaches YTD high, more inside

- Aave recorded the most asset deposits in its protocol.

- Though Lido underperformed, its TVL hit 2023 highs.

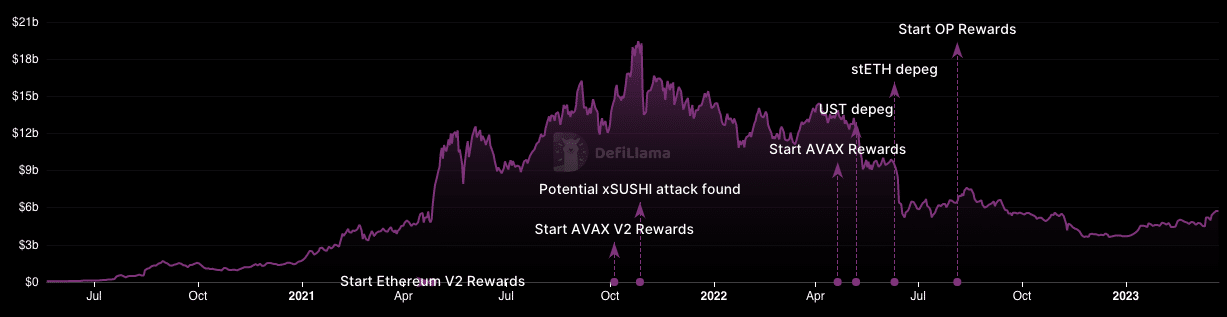

The Total Value Locked of Aave [AAVE] gained as much as 8.69% in the week ended 25 March. The rise in unique smart contract deposits made the protocol the best-performing one as the overall TVL hit $5o.01 billion — a Year-To-Date (YTD) high. However, the TVL fell to $49.42 billion at press time

How much are 1,10,100 AAVEs worth today?

The TVL considers factors like the circulating supply, asset locked, as well as user interest in a protocol to measure the protocol’s health. So, Aave’s hike implied that many participants in the last seven days looked in the lending and borrowing direction.

Aave takes the week and triumphs

Lido Finance [LDO] dominated the space for several weeks before Aave took over. Although the liquid staking protocol maintained its stay as the project with the highest TVL, it did not perform well enough to place second-fiddle to Aave. According to DeFi Llama, Lido’s performance over the week yielded a less than 1% hike.

However, this does not take away Lido’s position as the project which has accommodated the most staked Ether [stETH] ready to be unlocked on 12 April when the Ethereum’s [ETH] Shanghai upgrade takes place.

Aave, on the other hand, may not boast of such, but its rise in popularity could also be due to Ethereum’s impact. With a $4.82 billion lifetime contribution, Ethereum has helped Aave record a substantial number in fees and revenue.

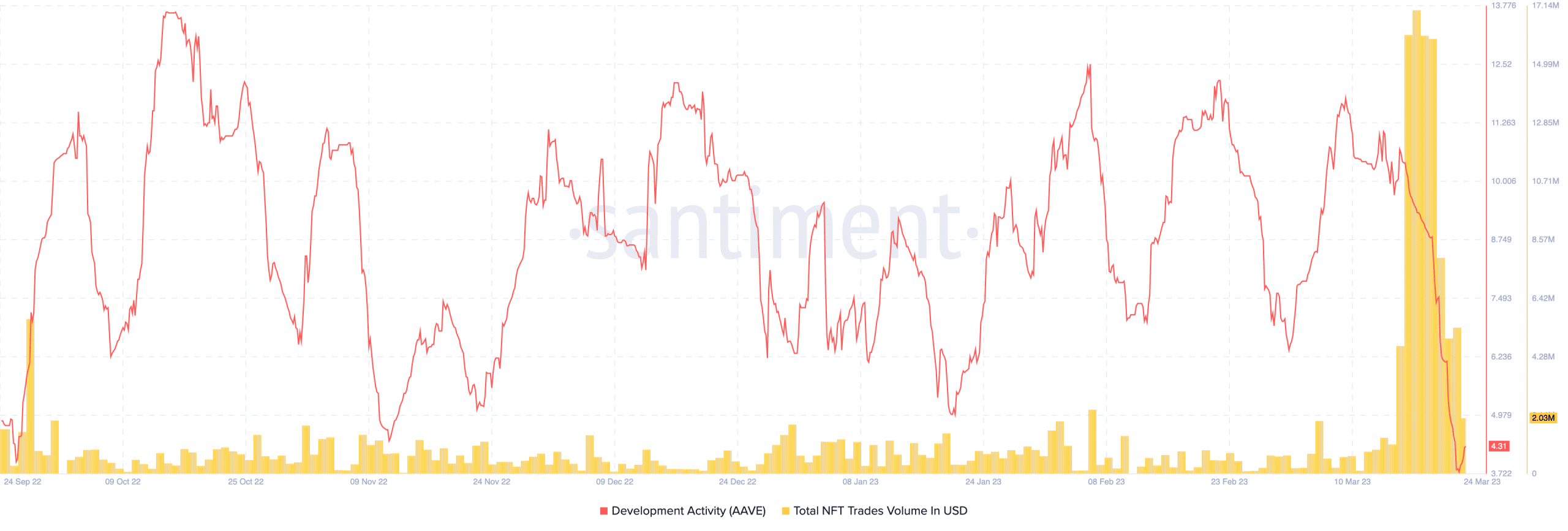

Meanwhile, the non-custodial liquidity protocols have not experienced significant strides regarding developments. As of 23 March, development activity reached a yearly low of 3.792.

A detailed understanding of the metric points to feature upgrades, and public commitment by the project’s developers to improve products under the blockchain.

But at press time, there has been some recovery as the metric improved to 4.31. This implies that the developers’ activity contribution has been notably restored.

NFT volume rises as…

In addition to the TVL increase, NFT sales on the Aave network were also impressive over the week. According to Santiment, the digital collectibles volume reached $16.05 million on 20 March. Although it was reduced afterwards, most of the daily sales surpassed those of the previous week.

Is your portfolio green? Check the Aave Profit Calculator

Furthermore, Aave’s activities during the week included playing its part in returning funds to those affected by the Platypus exploit. The exploit happened in February when a flashloan drained the Avalanche [AVAX]-based protocol of $9 million.

Although it threatened the project’s solvency, Aave’s governance was able to help out as the rightful owners got back their funds.

Following the Aave governance decision, funds related to the @Platypusdefi exploit just got sent back to their rightful owner.

We want to thank @bgdlabs for working on this rescue mission. pic.twitter.com/baFXm4b1qD

— Marc Zeller ? ? ?? (@lemiscate) March 24, 2023