Ethereum holders might be elated to know this about exchange balance

- Ethereum exchange balance hit a five-year low as more holders moved their assets to self-custody options and DeFi platforms.

- The decline in exchange balance can be attributed to factors such as the rise of DeFi, the switch to PoS, and the downturn in the crypto market.

The beginning of the year ushered in a whirlwind of events that significantly influenced the crypto industry, with Ethereum being (ETH) no exception.

The current state of affairs, including the SEC’s regulatory crackdown and potential bank runs, has undoubtedly left ETH holders feeling disillusioned. However, other factors might be responsible for the dwindling ETH exchange balance.

Read Ethereum [ETH] Price Prediction 2023-24

Ethereum exchange balance declines

In 2022, the FTX crash sent shockwaves through the crypto world, causing many holders to question the safety of keeping their assets on exchanges.

The incident sparked a renewed interest in self-custody to secure crypto holdings. However, while Ethereum experienced a decrease in exchange balances in the months following the crash, this trend can be attributed to other factors beyond fear of exchange insecurity.

Ethereum exchange netflow flashes negative

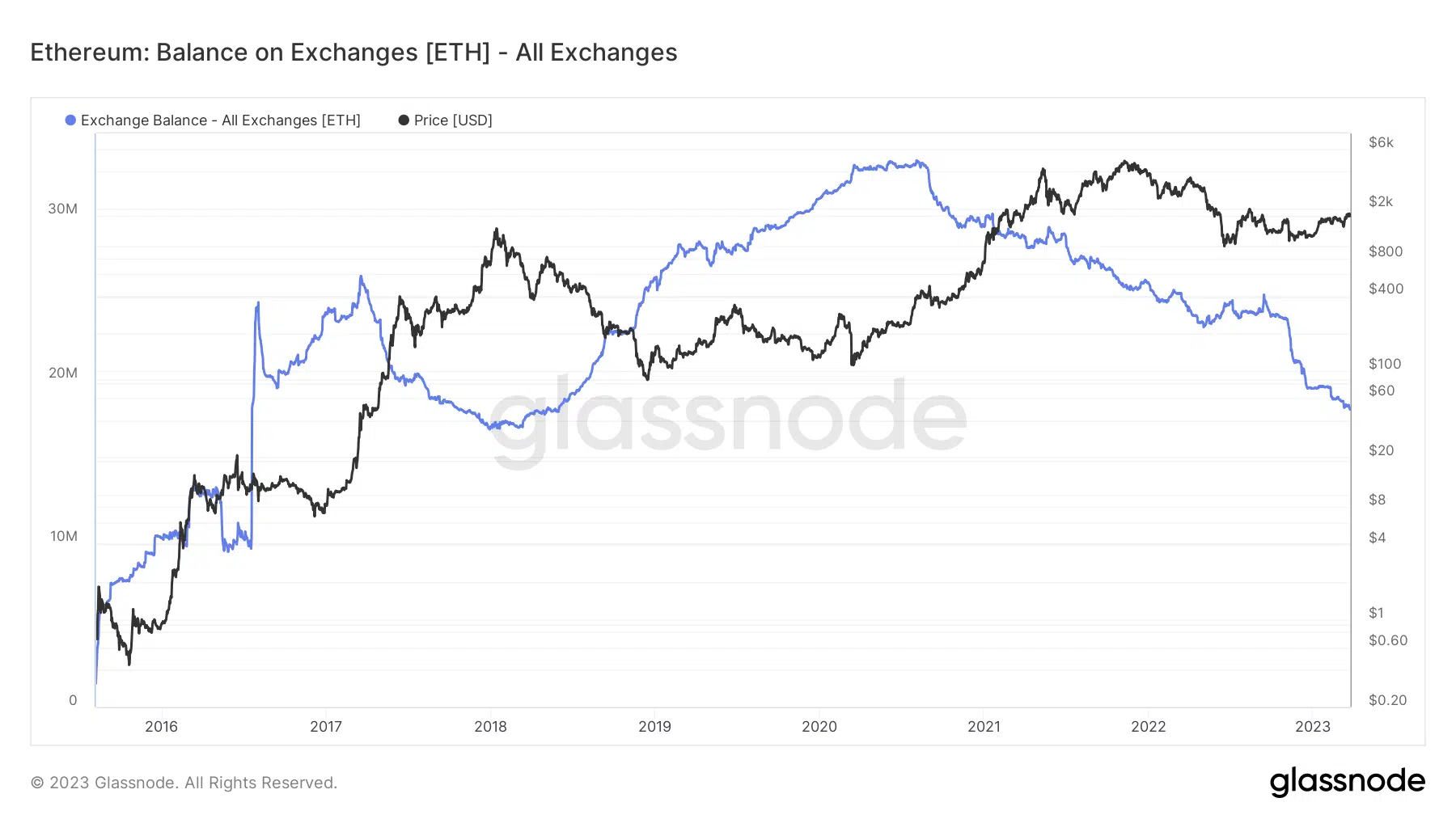

According to a recent Glassnode chart from Glassnode alerts, the balance of Ethereum held on exchanges has been steadily decreasing.

As of this writing, the exchange balance had reached a five-year low, hovering just above $18 million. This trend indicates that more ETH holders are opting for alternative storage methods rather than leaving their assets on exchanges.

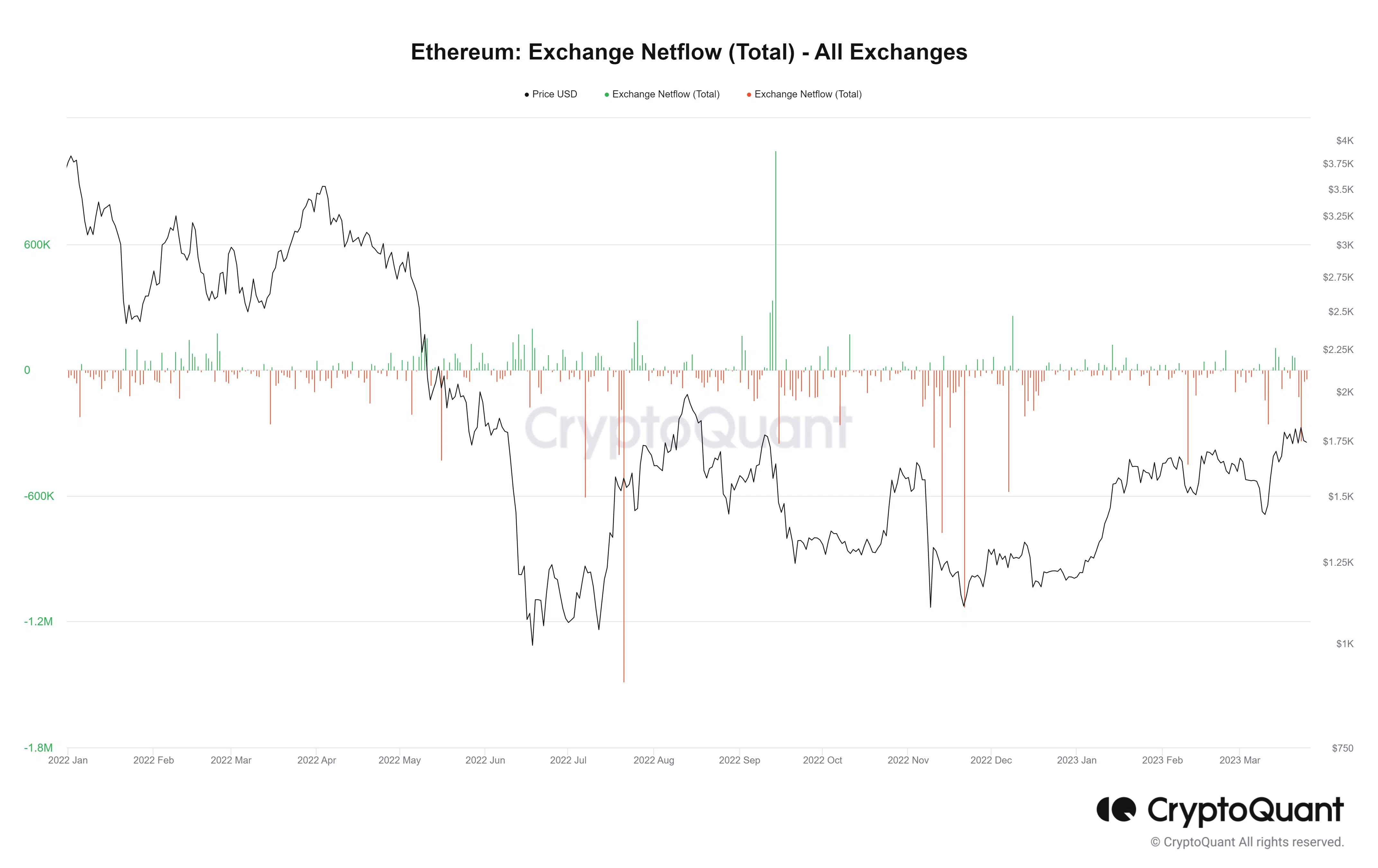

In addition, a closer examination of Ethereum’s exchange netflow reveals that the outflow of ETH from exchanges has exceeded the inflow, with few exceptions of inflow spikes.

Currently, the netflow of ETH on exchanges remains negative, with outflow continuing to dominate. At the time of writing, the netflow had surpassed 11,000 ETH already, highlighting the ongoing trend of ETH holders moving their assets away from exchanges.

Possible reasons for declining exchange balance

One possible factor is the rise of decentralized finance (DeFi) platforms built on the Ethereum network. Many holders have moved their funds from centralized exchanges to DeFi protocols to earn higher yields.

The yields come through liquidity provision, staking, or other forms of participation in decentralized finance. Also, ETH stakes account for 15% of the coins in circulation per staking rewards.

It is also possible that some holders took a more long-term investment approach by holding their assets in personal wallets. It is a means of storing value and avoiding short-term trading risks.

Also, the crypto market experienced a downturn in the latter half of 2022. The downturn may have led some holders to move their assets off exchanges and into personal wallets.

Daily timeframe move and 365-day MVRV

Despite experiencing a decent price run, Ethereum (ETH) had yet to regain the price zone it dropped back in May. As of this writing, it was trading at approximately $1,740 and had sustained losses for two consecutive days. However, ETH had maintained a support level of around $1,732 and $1,630, previously resistance levels.

Is your portfolio green? Check out the Ethereum Profit Calculator

The 365-day Market Value to Realized Value ratio (MVRV) revealed that for most of the period being analyzed, ETH was trading below zero.

However, as of this writing, the MVRV had surpassed the zero line and currently sat at 13.60%. This indicated that, on average, the holders of ETH were now profitable, given the price at which they acquired their coins.