The $30,000 question: Will Bitcoin push through or succumb to the sell-off

- The price range of $29,000-$30,000 might form an extreme resistance level for BTC.

- Accumulation intensifies as many expect BTC’s price to claim the $30,000 price mark soon.

As many anticipate when Bitcoin [BTC] will reclaim its $30,000 psychological price mark, pseudonymous CryptoQuant analyst Tarekonchain has found that the price range of $29,000-$30,000 might form an extreme resistance level for BTC.

According to the analyst, BTC’s price might experience several corrections before breaking through these resistance levels.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Pay attention to these UTXOs

Tarekonchain’s opinion came after an assessment of BTC’s Unspent Transaction Output (UTXO) index for coins within the 2-3 year age range and held by long-term investors.

According to the analyst, the realized price for this category of coins is $29,700, making the price mark a critical resistance level. Moreso, the UTXO ratio for this age range makes up 12.64% of BTC’s total UTXOs, indicating that there might be a significant sell-off of BTC holdings.

Further, the realized price for the 6-12 month index is $28,200, below the 2-3 year range. Tarekonchain found that “historically, every time there was a crossover between these two indexes, a price correction occurred.”

With a crossover set to occur, a potential correction in BTC’s price might be underway.

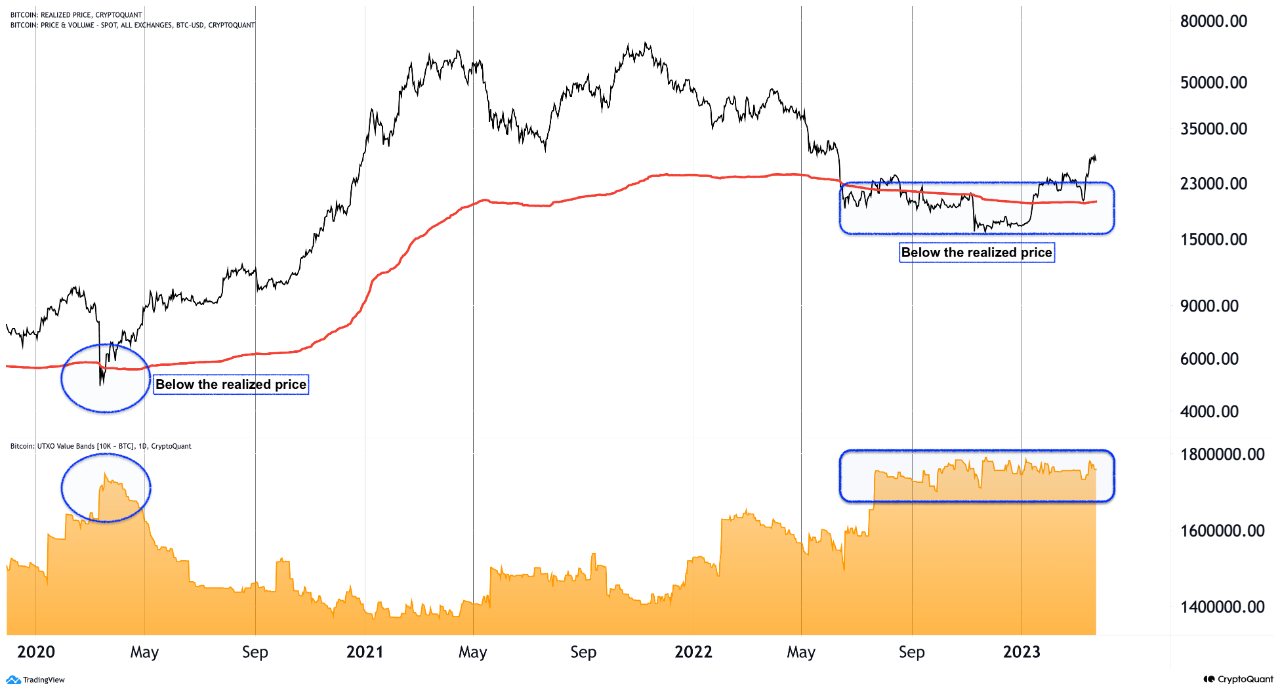

Woominkyu, another pseudonymous CryptoQuant analyst, warned that BTC’s 10K+ UTXO value bands formed another UTXO category to pay attention to.

According to Woominkyu, “the movement of the 10K+ UTXO value bands when Bitcoin was below its “realized price” has been interesting.”

The movements mirrored those between March and April 2020 during the onset of the Coronavirus pandemic. These movements could be indicative of large holders of BTC accumulating the cryptocurrency at a low price, the analyst opined.

Warning traders and investors to take note of these UTXO movements when making investment decisions, Woominkyu concluded:

“Based on past examples, this group typically buys when the price is low and sells when the price is high, so it’s always worth keeping an eye on their UTXO movements.”

Read Bitcoin’s [BTC] Price Prediction 2023-24

More buying, fewer sell-offs

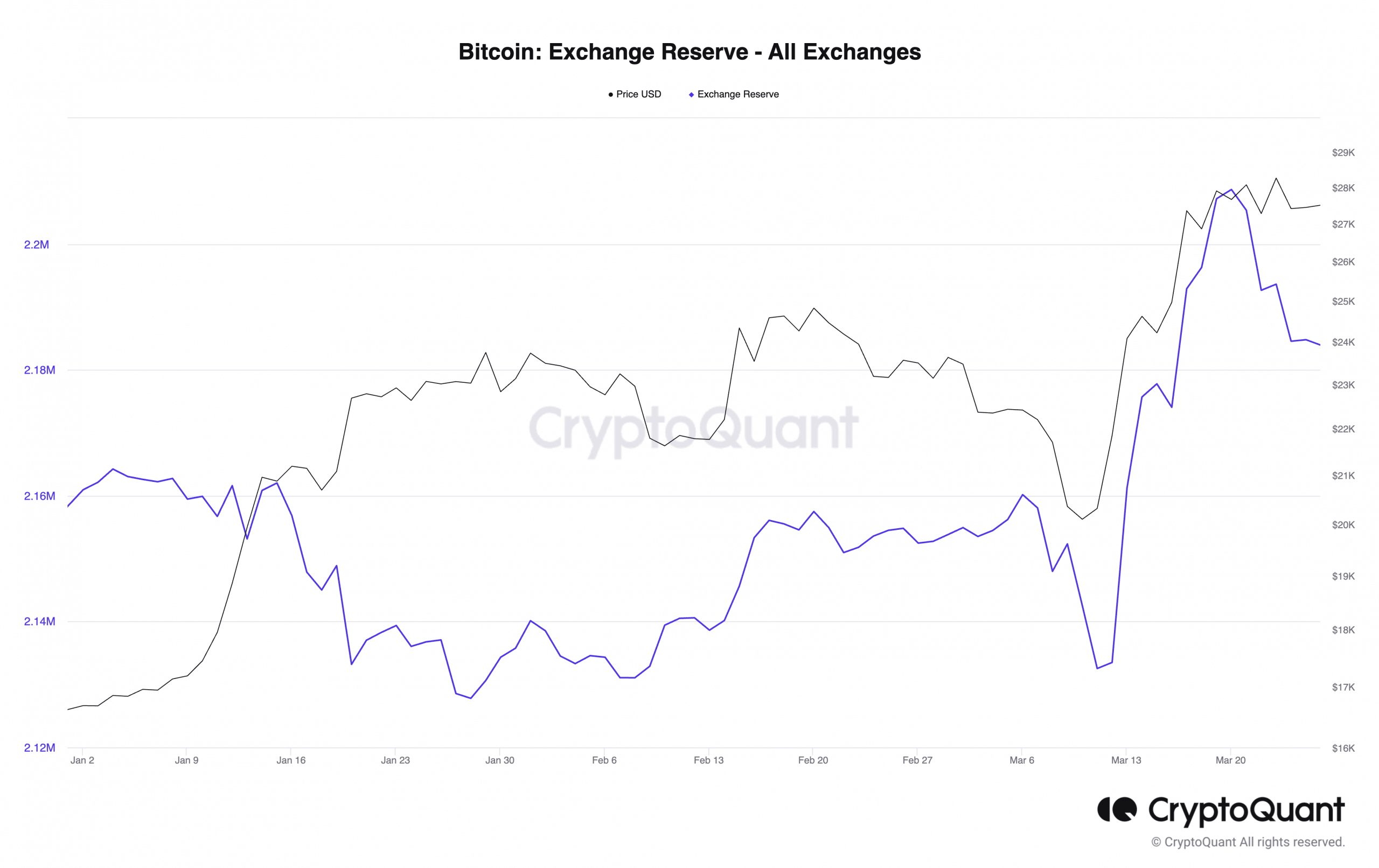

While BTC witnessed increased sell-offs at the onset of the collapse of Silicon Valley Bank (SVIB) due to a sudden fall in the coin’s value, the last has seen a depletion in the amount of BTC held on exchanges.

According to data from CryptoQuant, BTC’s Exchange Reserve was 2.18 million at press time and has trended downwards since 19 March.

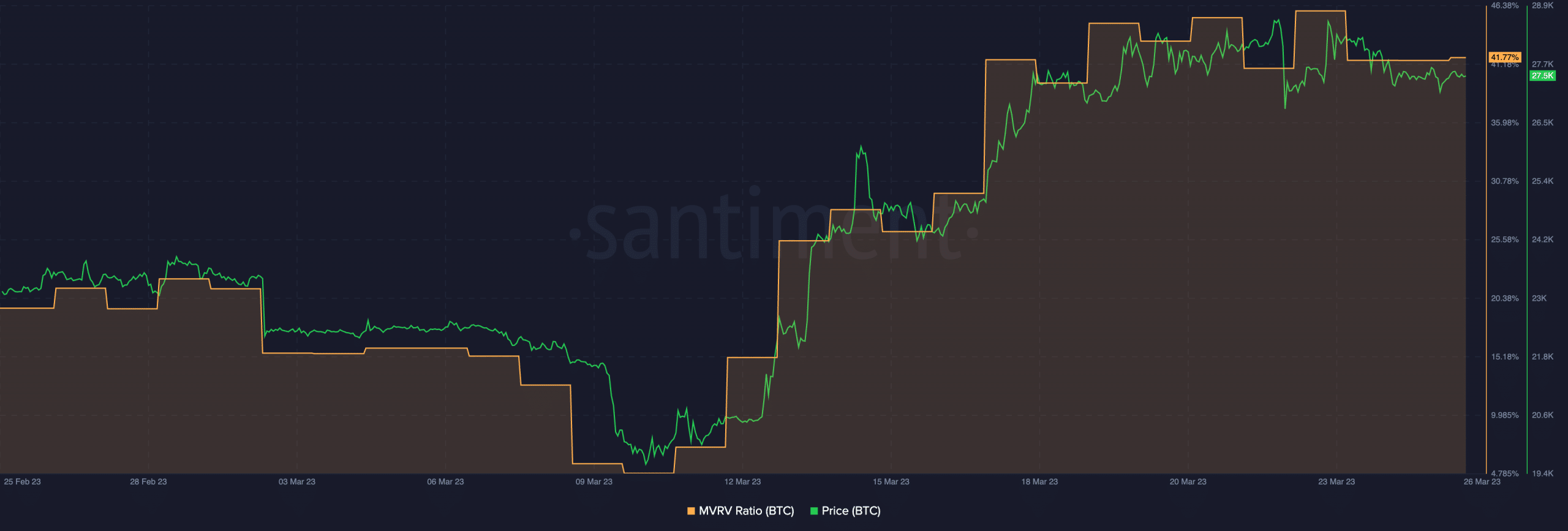

With the coin’s MVRV ratio still housed within the positive territory, investors are incentivized to accumulate more BTCs.

At 41.77% at press time, BTC’s MVRV revealed that, on average, holders would generate a profit of 2x if they were to sell their coins at the current price.