Assessing why HBAR faces sell pressure despite its latest achievement

- Hedera’s TVL continued to decline, and HBAR’s state was concerning.

- The coin’s market indicators also favored the bears and predicted a further downtrend.

Hedera [HBAR] has reached a remarkable milestone in terms of network growth. In a 26 March tweet, Hedera revealed that its mainnet has processed 6 billion transactions since its launch.

It was also interesting to note that Hedera was able to process 1 billion transactions in 17 days.

#Hedera Mainnet: 6 BILLION Transactions

17 days; one billion transactions.#Hashgraph technology and our incredible, ever-growing community is showing #web3 the true potential of #DLT driven by real-world applications and #utility.

?See you at 7 – blink and you might miss it. pic.twitter.com/i8jyLstMfx

— Hedera (@hedera) March 26, 2023

Realistic or not, here’s HBAR market cap in BTC’s terms

Issues prop up on the Hedera network

This milestone was achieved while Hedera faced an issue with its network on 24 March. As per Hedera Status, the team investigated an issue with the GCS recordstream being halted, which might have impacted mirrornode operators.

However, things got sorted out as the developers fixed the issue soon after the investigation.

Investigating: We are investigating an issue with the GCS recordstream being halted which may impact mirrornode operators. Hedera-managed testnet mirrornode is not impacted https://t.co/aFABlGnQ2F

— Hedera Status (@hashgraph) March 23, 2023

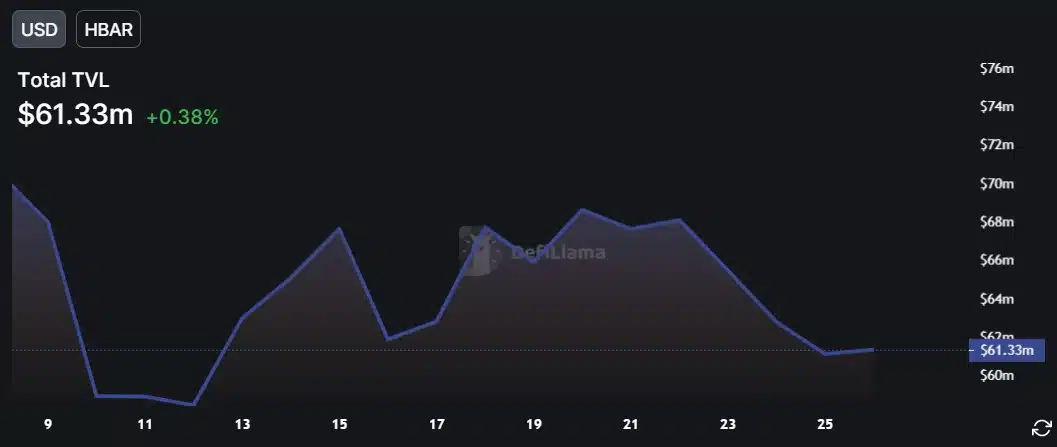

Even so, Hedera’s health was still in question as its value was on a declining trend, at press time. As per DeFiLlama, Hedera’s TVL declined sharply over the last few days, which looked concerning for the network.

Troublesome state for HBAR

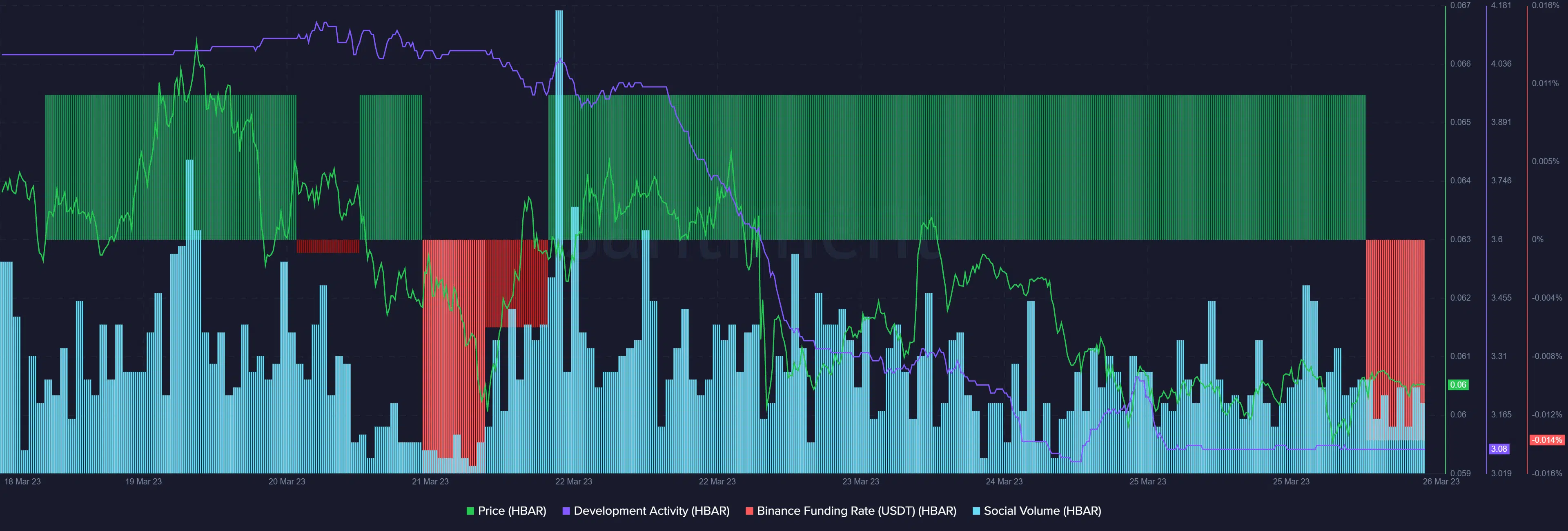

HBAR, which is Hedera’s native token, also did not benefit from the network’s recent achievement. According to CoinMarketCap, HBAR was trading nearly 4% lower than last week. At the time of writing, it was changing wallets at $0.06013 with a market capitalization of more than $1.8 billion.

Santiment’s chart showed that HBAR’s Binance funding rate dropped sharply, suggesting less demand from the derivatives market. Not only that, but the token also lost popularity, as evident from its declining social volume.

Moreover, the network’s development activity also took a hit. Therefore, it is doubtful whether HBAR would gain from Hedera’s success in the foreseeable future.

How much are 1,10,100 HBARs worth today?

Investors have to wait longer for an uptick

A similar bearish outlook for HBAR was also given by its daily chart. The Exponential Moving Average (EMA) ribbon displayed a bearish crossover. HBAR’s Money Flow Index (MFI) declined sharply and was headed below the neutral mark.

Another bearish development was the Relative Strength Index (RSI) taking a sideways path below the neutral mark. Furthermore, the Bollinger Bands revealed that HBAR’s price had entered a squeeze, at press time.

Thus, questioning the expectations of a sudden uptrend in the near term. Nonetheless, the MACD slightly favored the bulls.