Huobi Global sees sharp drop in inflows- Is danger lurking around the corner

- The net inflows into Huobi Global dropped on a 24-hour, weekly as well as monthly basis.

- At press time, Huobi Token slid 30% on a month-to-date (MTD) basis.

Justin Sun recently transferred 5,250 Arbitrum [ARB] tokens which he received as part of an airdrop, to Huobi Global, where he is an advisor.

While it was not clear whether this was done to shore up liquidity in the popular cryptocurrency exchange, data coming from DeFiLlama was alarming.

The net inflows into the exchange dropped on a 24-hour, weekly as well as monthly basis.

Reserves signal an alarming trend

After the United States Securities and Exchanges Commission (SEC) initiated a probe against Tron [TRX] founder Justin Sun, the focus shifted to Huobi Global, which is part of the ecosystem.

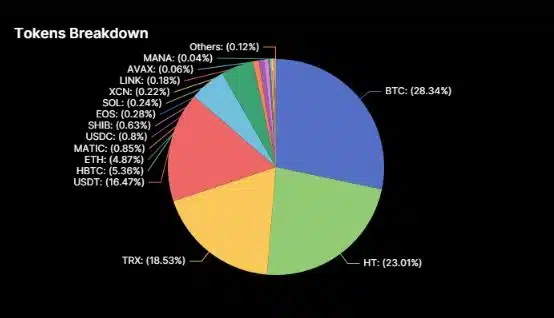

A look at the breakup of the exchange reserves disclosed that TRX accounted for 18.5% of the share. On the other hand, 23% of the reserves were held in Huobi Token [HT], the native coin of the exchange.

The total reserves on the CEX were $3.08 billion, as per DeFiLlama. However, if the native coins of the ecosystem like TRX and HT were excluded, the remaining value, also known as clean assets, was just $1.8 billion. The clean reserve ratio in this case was 58%.

It should be noted that if only the HT token was considered, the clean reserves stood at $2.37 billion, taking the clean reserve ratio to over 76%.

Incidents like the FTX collapse heightened fears around the dominance of native coins on the balance sheet of the exchanges. To allay the fears of investors and maintain transparency, exchanges started publishing their proof-of-reserves after the incident.

HT in darkness?

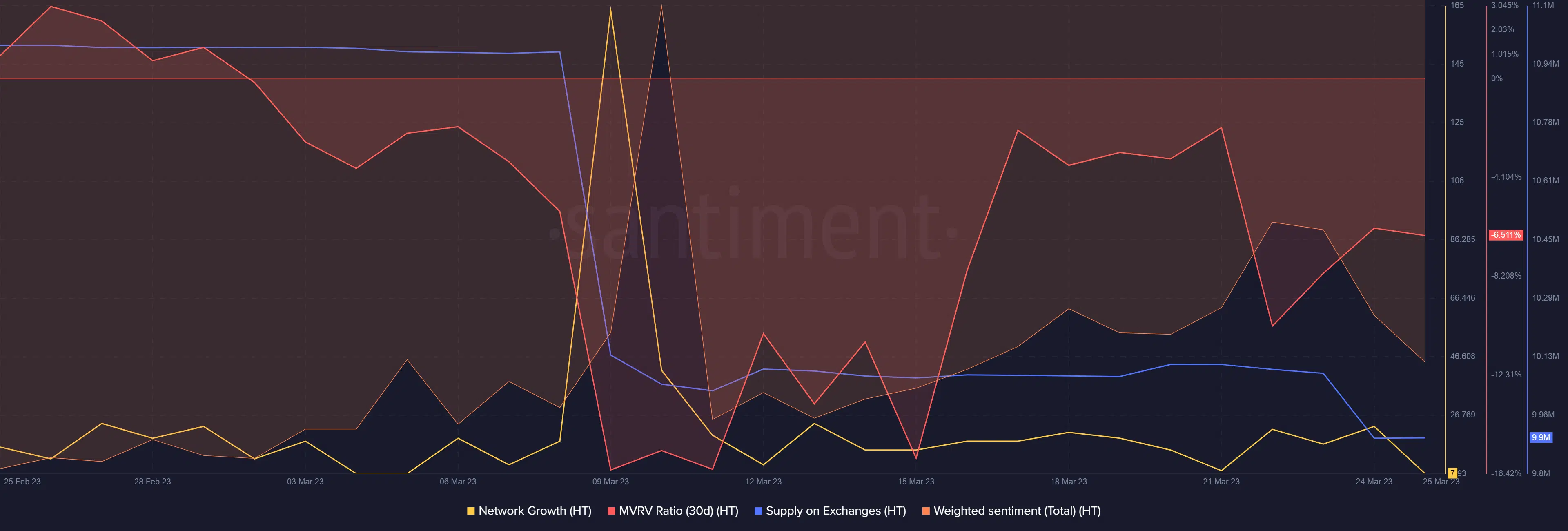

Meanwhile, HT slid 30% on a month-to-date (MTD) basis, per data from CoinMarketCap. At press time, it exchanged hands at $3.6671. The coin sent shockwaves in the crypto space earlier this month when it flash-crashed by over 60% on 9 March.

As per data sourced from Santiment, the number of new addresses being created across the network tumbled since the flash crash, indicating that users were not very keen to trade HT.

The supply on exchanges also witnessed a steep decline since the event, as users may have offloaded their holdings owing to liquidity concerns in the exchange.

The negative 30-day MVRV Ratio implied that most holders would incur losses if they were to sell their coins. A gloom engulfed the network as the weighted sentiment was also negative.

Well, Huobi Global recently announced that it was in the process of applying for a trading license in Hong Kong, following the region’s plan to allow retail investors to trade in popular cryptocurrencies.