Institutional interest in crypto ETFs high, but no plans to buy: BBH Survey

- Institutional interest in crypto ETFs hasn’t waned.

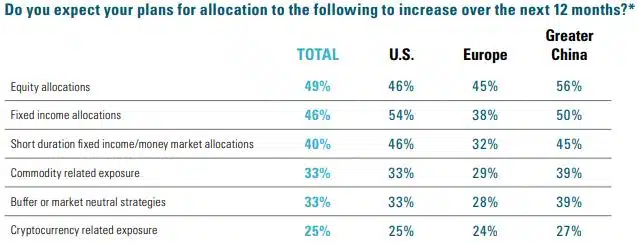

- Only a quarter of investors expect to increase their allocation to ETFs this year.

The financial services firm Brown Brothers Harriman (BBH) released its 2023 Global ETF Investor Survey yesterday, revealing that institutional interest in cryptocurrencies hasn’t waned despite the market being 60% lower than its all-time highs.

A majority of asset managers stated are “extremely interested” in crypto-themed Exchange Traded Funds (ETFs). Nearly three-quarters of institutional investors claimed they’re “extremely” or “very” interested in crypto ETFs.

However, only a quarter of respondents expect to increase their allocation to ETFs with cryptocurrency exposure, compared to 33% in 2022.

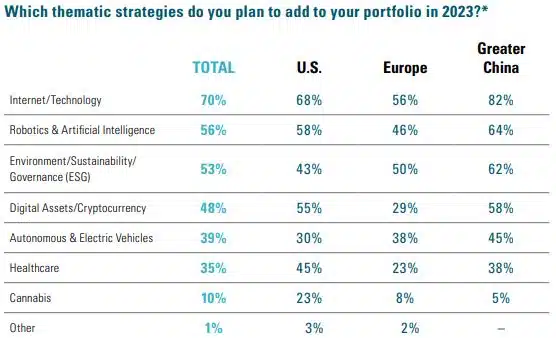

Though crypto- ETFs have fallen down the priority list for some, nearly half of respondents still intend to add crypto ETFs to their portfolios this year in order to diversify their investments. 48% of investors still intend to add cryptocurrency and digital asset-themed ETFs to their portfolios.

Can regulation increase investor interest?

According to BBH, the rise in interest in crypto ETFs is due in part to fund managers coming to terms with the inevitable volatility in the crypto market. Investors are diversifying their portfolios and adding more innovative products as they adjust to volatility. Despite a turbulent year in crypto, interest has not waned.

The report adds that a clearer crypto regulatory framework, such as the European Union’s Markets in Crypto Assets (MiCA) proposal, will increase demand for such ETF exposure by providing a safety net when doing business with the crypto sector.

The survey included 325 institutional investors, financial advisers, and fund managers from the US, UK, Europe, and China. Over 40% of respondents said they handle assets worth more than $1 billion, and more than half said they invest more than a quarter of their portfolio in ETFs.

Shawn McNinch, Global ETF Head at BBH, stated that people are looking at crypto ETFs as a possible opportunity. Because of the volatility in that asset class, crypto ETFs are not for everyone, he noted.