Chainlink consolidation persists; where can investors seek gains

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- LINK has been trading sideways since the end of March.

- Monthly and quarterly LINK HODLers saw gains despite the consolidation phase.

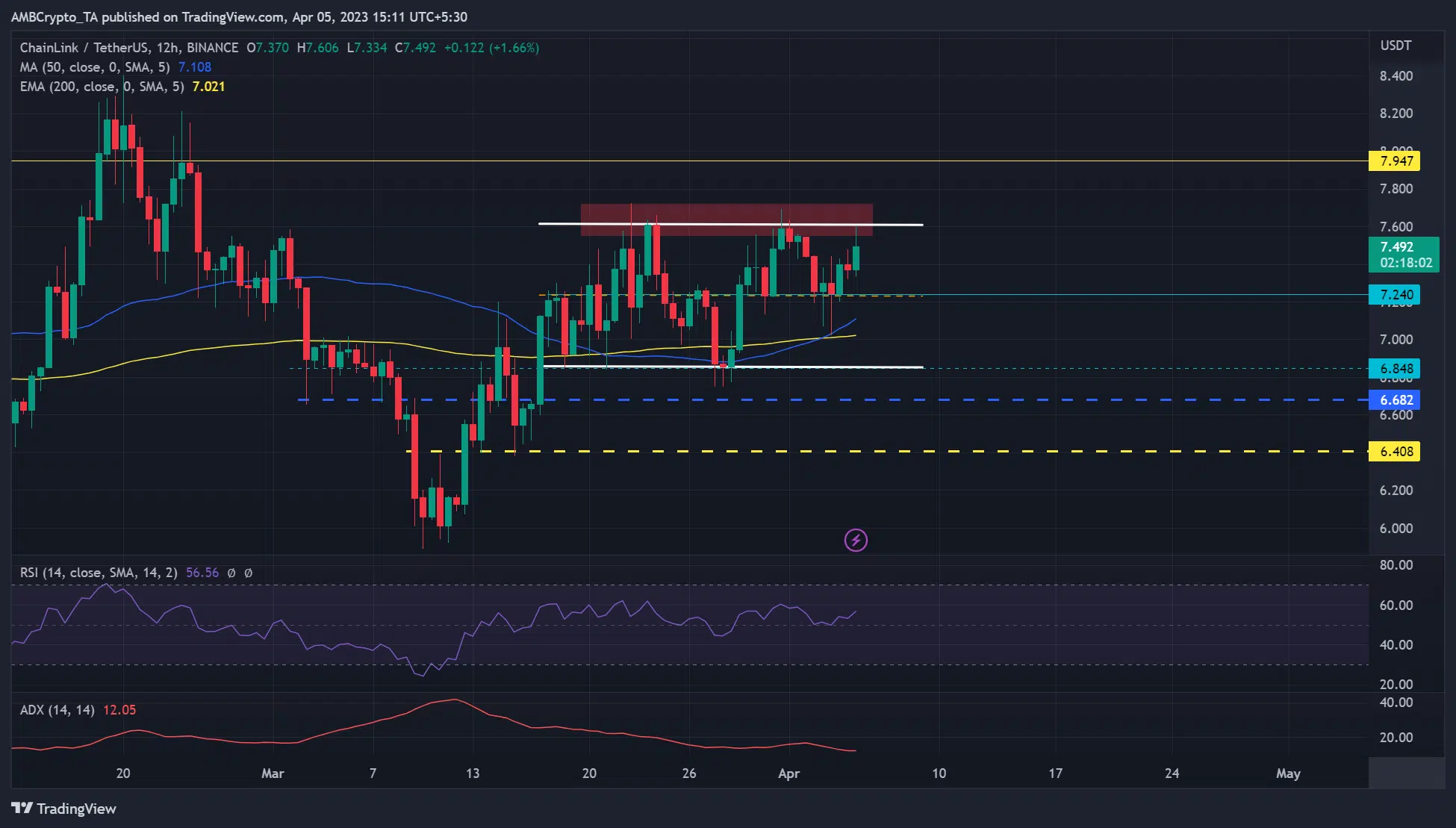

Chainlink [LINK] has been oscillating between $6.848 and $7.6 in the past few days. At press time, the price action was firmly within the upper range, indicating that bulls were adamant about exiting their position – a bullish signal.

Read Chainlink [LINK] Price Prediction 2023-24

However, the upper range boundary of $7.623 has been a key supply area for the past few days, thwarting any uptrend momentum beyond it. With the price hitting this key area, LINK could see a downward pressure that could drop it to its mid-range level or channel’s lower boundary.

Can bulls overcome the supply area of $7.6

LINK could sink to $7.240 or $6.848, offering shorting opportunities. But sellers must clear the obstacles at 50 MA ($7.108) and 200 EMA ( exponential moving average) of $7.021 to gain leverage.

On the other hand, bulls could seek buying opportunities if LINK hits the lower boundary of $6.848. In such a case, the target for bulls will be either the mid-level of $7.240 or the supply zone area of $7.6. If bulls overcome the $7.6 barrier, the next likely target will be $7.947.

In the past few days, the RSI (Relative Strength Index) has fluctuated between 50 and 60 levels, showing that buying and selling pressure has remained relatively equal since 17 March.

Conversely, the Average Directional Index (ADX) moved southwards, indicating the uptrend momentum seen in mid-March weakened and a further consolidation or retracement could be likely.

30-day and 90-day MVRVs were positive

According to Santiment, the 30-day and 90-day MVRV (Market Value to Realized Value) improved and were positive despite the price consolidation phase. It shows that monthly and quarterly LINK HODLers enjoyed profits in the sideways market structure.

Is your portfolio green? Check LINK Profit Calculator

But the profits could be threatened if LINK experiences more downward pressure after hitting the supply area.