Can ETH hit $2,000 before the Shanghai upgrade? This dataset suggests that…

- ETH’s upcoming Shanghai upgrade encourages more block trades

- ETH can robust demand but sell pressure and high leverage may undermine its $2000-target

Ethereum’s blockchain has reportedly seen a noteworthy surge in large trades over the last 2 weeks. The kind of trades that are usually associated with more market confidence.

Is your portfolio green? Check out the Ethereum Profit Calculator

Additionally, recent data seemed to suggest that 40% of trades on the Ethereum network were ETH block trades. A classic case of buy the rumour and sell the news?

Well, major upgrades have historically attracted strong demand days ahead of the main event. The trades might be related to large trades executed towards the end of March. Additionally, the data also highlighted that ETH’s demand currently outweighs sell pressure, as indicated by higher calls than puts. These observations seem to be in line with the bulls’ influence on the market.

ETH block trades accounted for 40%, with the main trades concentrated at the end of the month, clearly a big bet on Shanghai upgrade. Calls are now trading in majority, especially during yesterday's pump, buy-calls were traded hotly, pushing up IVs across major maturities. By… pic.twitter.com/S2GNWugAPA

— Wu Blockchain (@WuBlockchain) April 6, 2023

Additionally, further investigation revealed that the confidence boost among ETH investors is not limited to block trades. In fact, Glassnode found that the retail segment is also responding positively to the Shanghai upgrade countdown. For instance – The number of addresses holding at least 0.01 ETH is now at a new ATH.

? #Ethereum $ETH Number of Addresses Holding 0.01+ Coins just reached an ATH of 23,559,362

Previous ATH of 23,559,338 was observed on 05 April 2023

View metric:https://t.co/XXb0u19ouH pic.twitter.com/MFU9ZAnVKs

— glassnode alerts (@glassnodealerts) April 6, 2023

Can ETH sustain its bullish demand?

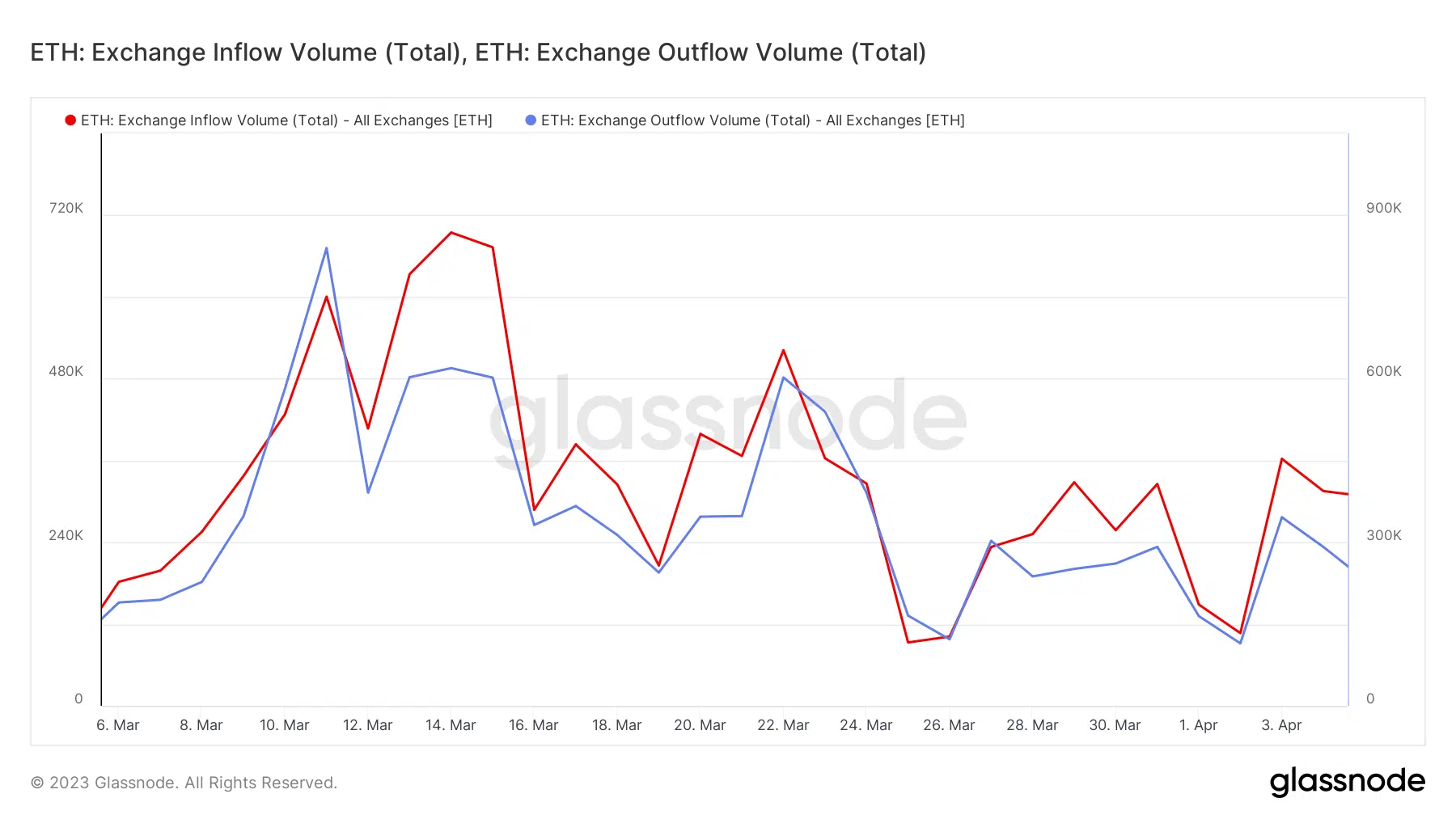

However, despite bullish expectations, exchange flow observations paint a different picture.

Exchange outflows were slightly higher than inflows towards the start of April, but that quickly changed. As a result, the amount of ETH flowing into exchanges has been higher than outflows over the last few days.

While exchange flows may not necessarily paint a clear picture of what is happening in the market, a look at whale flows might be a better option. This, because whales have more control over market direction.

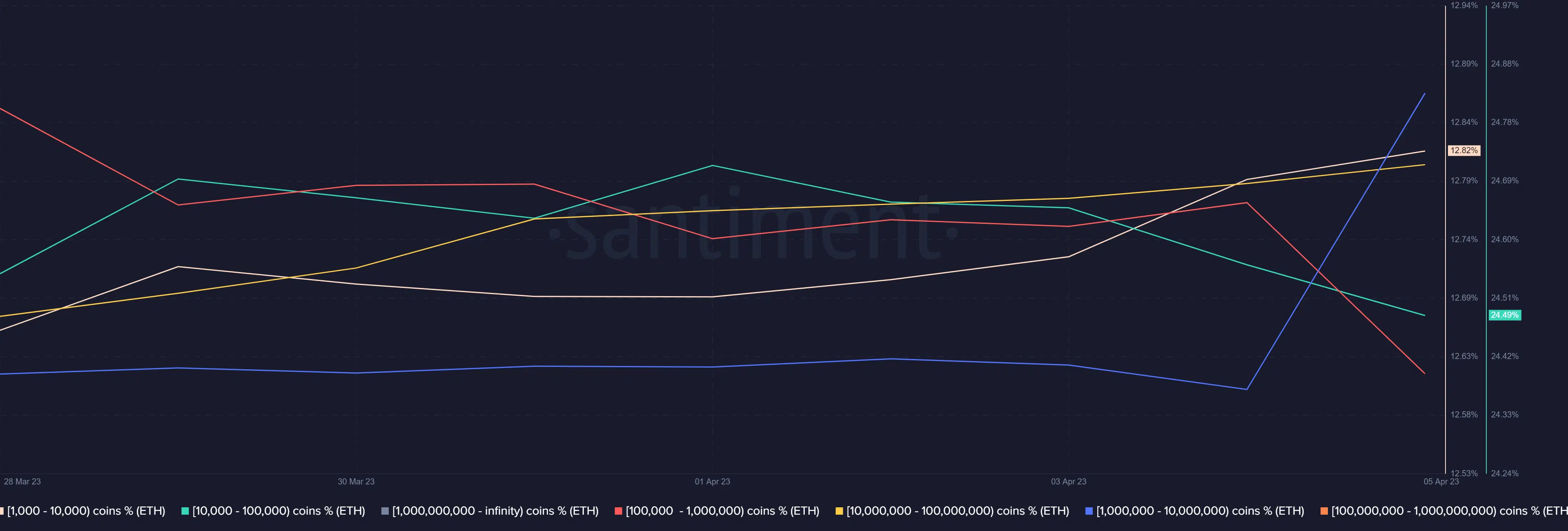

Interestingly, whale supply distribution revealed that whales holding over 1 million ETH in their addresses have been buying. This category collectively controlled roughly 24% of ETH’s circulating supply at press time.

On the other hand, whale categories holding between 10,000 and 1 million trimmed their balances over the last 24 hours. These two categories collectively controlled 41% of ETH’s supply at press time. This explains why exchanges have been experiencing higher inflows than outflows.

How many are 1,10,100 ETHs worth today

A quick look at the derivatives market revealed a strong uptick in Open Interest since end of March. The same was observed for leverage appetite, according to the estimated leverage ratio.

Here, it’s worth noting that the same metrics indicated a slowdown in derivatives demand in the last 24 hours.

This reflects the sell pressure observed during the same time, as well as the bullish momentum in ETH’s price since the start of April.

ETH slipped below the $1900-price level once again, with the alt valued at $1866, at the time of writing. A confirmation that sell pressure is still prominent, despite prevailing demand.

In other words, ETH may struggle to reach $2000 before the upgrade if sell pressure prevails. The higher leverage also makes it susceptible to liquidations.