Fantom [FTM] is growing and this new update might just be very helpful

![Fantom [FTM] is growing and this new update might just be very helpful](https://ambcrypto.com/wp-content/uploads/2023/04/Fantom-2.jpg.webp)

- The total transaction fees collected in the last week were the highest since November.

- Despite the promising growth in transactions, network growth dipped 74% over the previous month.

Fantom [FTM] was one of the biggest gainers in the crypto market as per CoinMarketCap data, recording a 24-hour gain of more than 7% at the time of writing. On a year-to-date (YTD) basis, the token has more than doubled in value, underlining its dominance in the crypto space.

Its growing appeal was exemplified when it grabbed the fourth spot in the list of top coins, as per LunarCrush AltRank. Moreover, it recently clocked a six-month high in transaction fees. With healthy news coming from all quarters, the alt was getting ready for another major push.

Read Fantom’s [FTM] Price Prediction 2023-24

Sending FTM via Twitter?

iME, a messaging platform-cum-crypto wallet, showcased its new feature through which FTM and other native tokens of the Fantom ecosystem could be sent via Twitter.

In a demonstration video, iMe explained the entire process right from linking Twitter with its messenger to transferring FTM tokens to a particular handle.

Ready @elonmusk?

Send $FTM and other #Fantom based tokens via #twitter ?handle right in #iMe!

Select crypto, send, click “twitter handle”, type username, amount, fee, send and ✅#Fantom is now "twitter-enabled" thanks to iMe! You can also send #crypto via twitter handle… pic.twitter.com/yxWY1mtFPe

— iMe Smart Platform (@iMePlatform) April 12, 2023

The idea of crypto payments on Twitter has been a source of immense media coverage in the last few months. Ever since Elon Musk took over the reins of the social media giant, rumors of him adopting Dogecoin [DOGE] as Twitter’s official payments network have done the rounds.

FTM rides on bulls

As the ecosystem continued to expand, the total value of assets deposited on the chain surged to $529 million, as per DeFiLlama. The total value locked, or TVL bounced back strongly after witnessing a steep fall from mid-February to early March.

Over the last 30 days, it increased by 14% and was strongly chasing its 2023 peak of $656 million.

Realistic or not, here’s FTM market cap in BTC’s terms

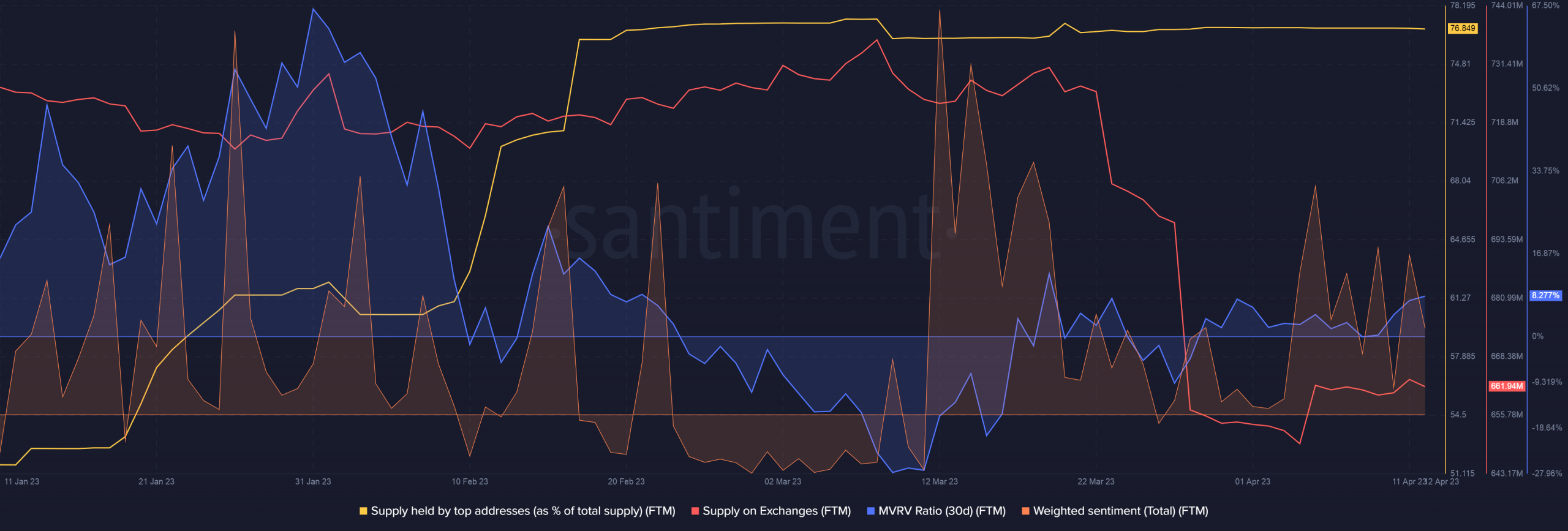

The on-chain metrics of FTM looked bullish, at the time of writing. The supply on exchanges tumbled 8% in the last month, indicating that investors were more interested in holding than selling.

The supply held by big addresses has stagnated after growing sharply for the first two months of 2023. However, these addresses still controlled more than 75% of the total supply of FTM.

Interestingly, the accumulation increased despite the MVRV Ratio being positive throughout March, implying that investors were betting for further gains. The weighted sentiment lent credence to this deduction.