As hurdles clear, Uniswap [UNI] remains steady – will its trend continue

– Uniswap’s DEX volume fell by 23% over the last week.

– Its native token, UNI, surged nearly 8% in the last 24 hours.

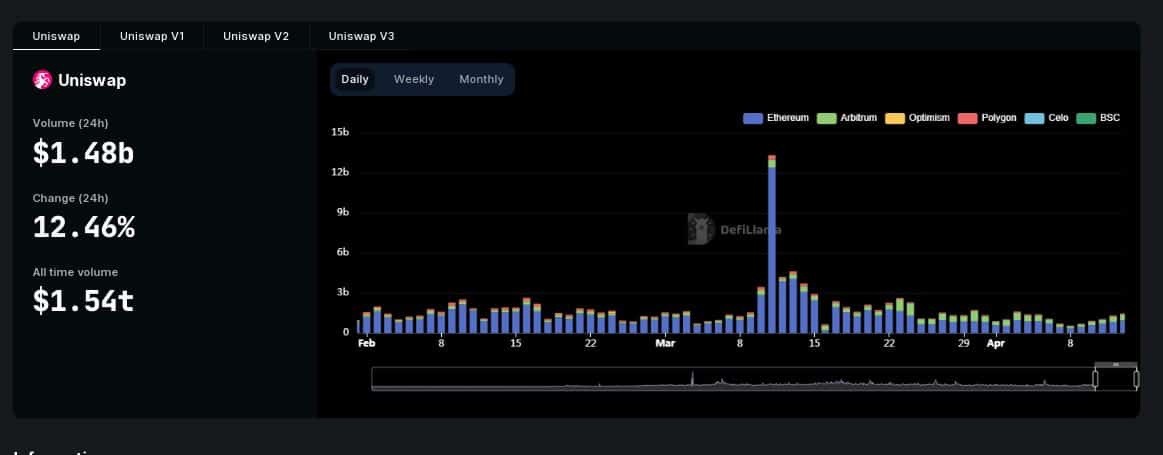

Uniswap [UNI] registered a meteoric rise in trading volume at the peak of the USD Coin [USDC] depegging chaos on 11 March. However, since then, the activity on the largest decentralized exchange has considerably tapered down, dropping 23% from the previous week, per DeFiLlama.

Realistic or not, here’s UNI’s market cap in BTC’s terms

On the other hand, its biggest competitor, PancakeSwap [CAKE], saw a jump of 40% in its volume in the same time period.

Nevertheless, a ray of light emerged, which could reinvigorate the DeFi behemoth.

Apple green lights mobile wallet

Uniswap announced the full-scale launch of its self-custodial mobile wallet application that will allow users to swap tokens between the Ethereum [ETH] mainnet and other layer-2 networks like Arbitrum [ARB], Optimism [OP] and Polygon [MATIC].

Apart from swapping, the wallet will have dedicated dashboards for token prices and NFT collections, using which they can track the trading activity and make purchases.

1/ THIS IS NOT A DRILL 🔥🔥🔥

The Uniswap mobile wallet is out of Apple jail and now live in most countries 🎉✨

Download our self-custody, open-sourced app today! 👇https://t.co/yWxuw79xTY pic.twitter.com/QhK06icKBL

— Uniswap Labs 🦄 (@Uniswap) April 13, 2023

It should be noted that the wallet app ran into some trouble earlier when tech giant Apple rejected the final build of the product just before its planned December 2022 launch.

However, Uniswap confirmed that Apple has given a go ahead, and the wallet had become available on the iOS App Store in several countries.

Users in the crypto space have increasingly leaned towards self-custody ever since the sensational collapse of centralized exchange FTX last year.

TVL remains rock solid

While DEX volume declined, the total value of assets held by Uniswap didn’t show signs of contraction. As per DeFiLlama, it was the sixth-largest DeFi protocol in terms of total value locked (TVL) at press time.

The bulk of the contribution came from its most advanced version, V3, which logged a monthly growth of over 35%.

Whales continue to hodl UNI

The news of the launch infused UNI with renewed energy as it surged nearly 8% in the last 24 hours, per CoinMarketCap.

Read Uniswap’s [UNI] Price Prediction 2023-2024

Moreover, big addresses continued to show their faith in UNI as it was the most widely held token by top ETH whales at press time, per Whalestats.

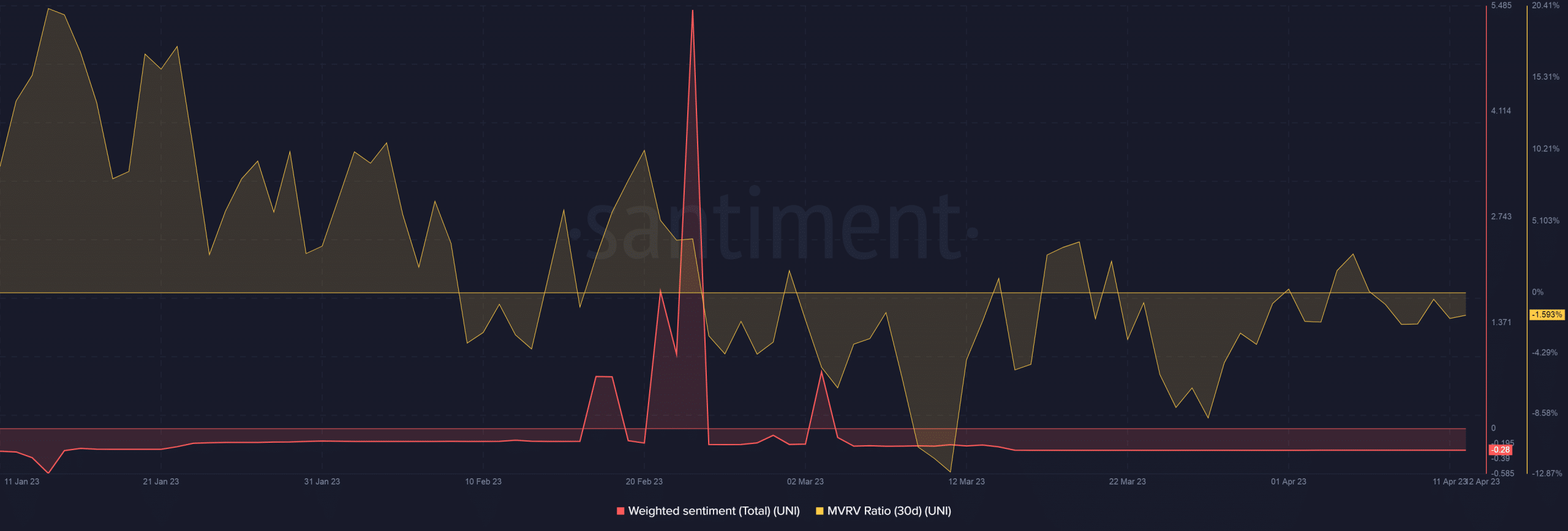

However, the MVRV Ratio of the token dipped into the negative territory, implying that most holders will incur losses if they offloaded their holdings. Investors remained pessimistic, as the weighted sentiment was yet to enter positive terrain.