Bitcoin [BTC] stuck in new sideways structure: Will near-term bulls prevail

![Bitcoin [BTC] stuck in new sideways structure: Will near-term bulls prevail](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x800-47.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

– BTC consolidated near $30k.

– Declining CVD spot and exchange long/short ratio favored sellers over the weekend.

Bitcoin [BTC] crossed $30k only to enter another price consolidation within $29.6k – $31k. Despite the overall positive sentiment, BTC’s short-term prospects face mild selling pressure. According to Coinshares, BTC accounted for over 98% of inflows ($56m) in digital assets investment products in the previous week of April 2 – 9.

Read Bitcoin’s [BTC] Price Prediction 2023-24

However, trading volumes remained low at $970m, as short-Bitcoin saw minimal outflows of $0.6m. As such, the current bullish sentiment isn’t void of selling pressure, which may affect players’ short-term gains.

More consolidation, dump, or surge – which way for BTC?

Since mid-March, BTC consolidated around $28k. It broke out of the range on 10 April but has entered another price consolidation range of $29.6k – $31k. Notably, the price action was above the 50-EMA (Exponential Moving Average) and the 200-MA (Moving Average), showing BTC was above its short and long-term trends – thus capturing the prevailing bullish sentiment.

A bullish breakout could set BTC to retest the next resistance level at $32.5k – it coincides with one of its May 2022’s upper range boundary levels. The next target will be $34.3k if near-term bulls clear the $32.5k hurdle.

Note that the range’s lower boundary intersected with 50-EMA, meaning a break below the confluence area could point to a weakening structure. Southwards, the key support levels lay at $28.7K, the dynamic 200-MA, and the previous range lower boundary of $26.7K.

Meanwhile, the price action made new highs as RSI made new lows – an increasing divergence that may expose BTC to increased short-term selling pressure. In addition, the ADX (Average Directional Index) declined to suggest a weakening short-term uptrend with a potential extended consolidation or retracement.

CVD spot declined as shorts outdo longs

According to Coinalyze, BTC’s CVD (cumulative volume delta) spot declined but flattened at press time – showing sellers gained market leverage, but bulls weren’t exiting their positions.

Is your portfolio green? Check BTC Profit Calculator

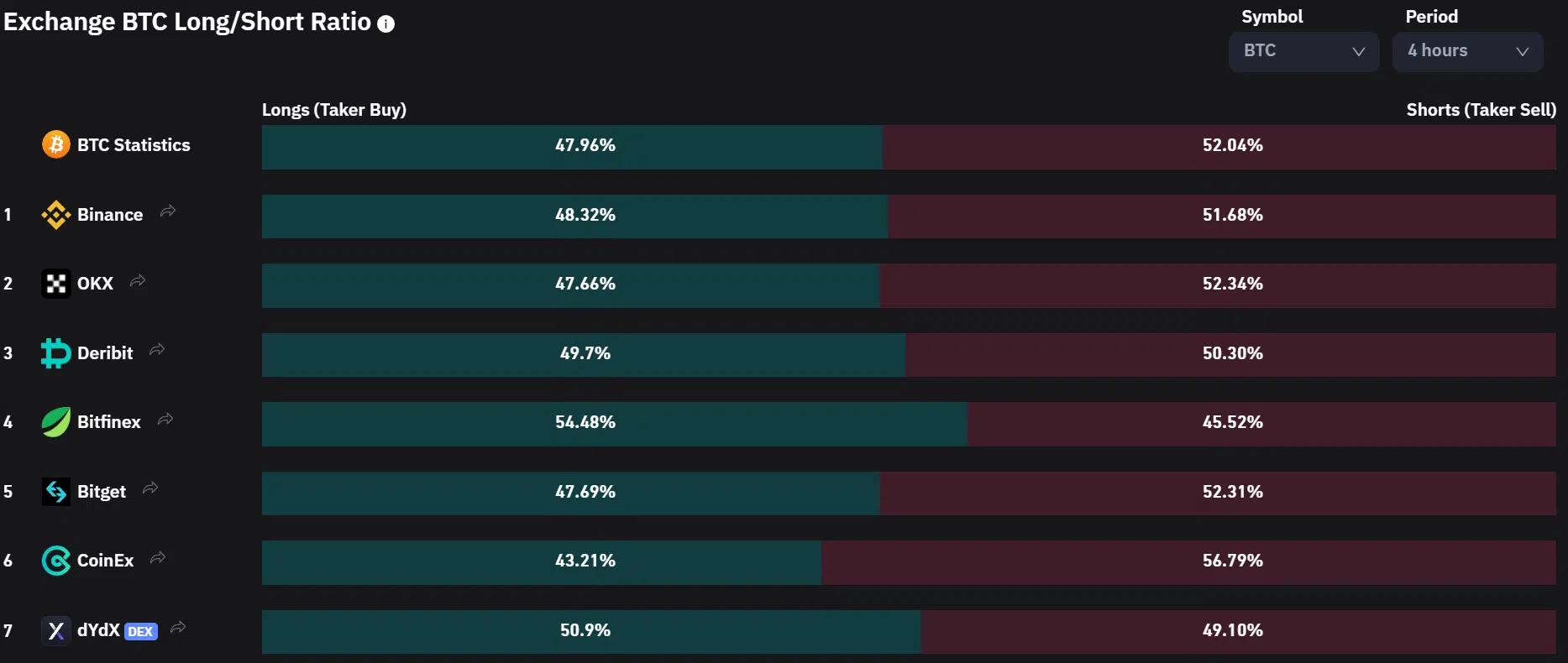

However, over $2.8m worth of long positions were liquidated in the past 24 hours compared to $742k of short positions, according to Coinalyze. Moreover, the exchange BTC long/short ratio showed sellers had slight leverage in the 4-hour timeframe, reinforcing the bearish outlook for BTC in the short term.

In conclusion, BTC is enjoying massive positive sentiment, but there is also increasing selling pressure that may curtail it temporarily in the short term.