Trader Joe [JOE]: Here’s what to expect as token unlock approaches

![Trader Joe [JOE]: Here's what to expect as token unlock approaches](https://ambcrypto.com/wp-content/uploads/2023/04/AMBCrypto_In_a_grand_opulent_library_a_figure_stands_at_the_cen_723576f8-acd6-49c5-93d6-a507ea53bb71-e1681652879748.png)

– Trader Joe’s token unlock event will occur on 3 May, with a daily unlock of 54,000 JOE tokens.

– Despite JOE’s recent downtrend, other metrics have all increased.

The buzz around Trader Joe [JOE], a decentralized exchange (DEX) on Avalanche [AVAX] and several other chains, has been hard to ignore lately. However, all eyes are about to be on the project’s native token as it gears up for its upcoming unlock.

Read Trader Joe’s [JOE] Price Prediction 2023-24

Trader Joe announces unlock date

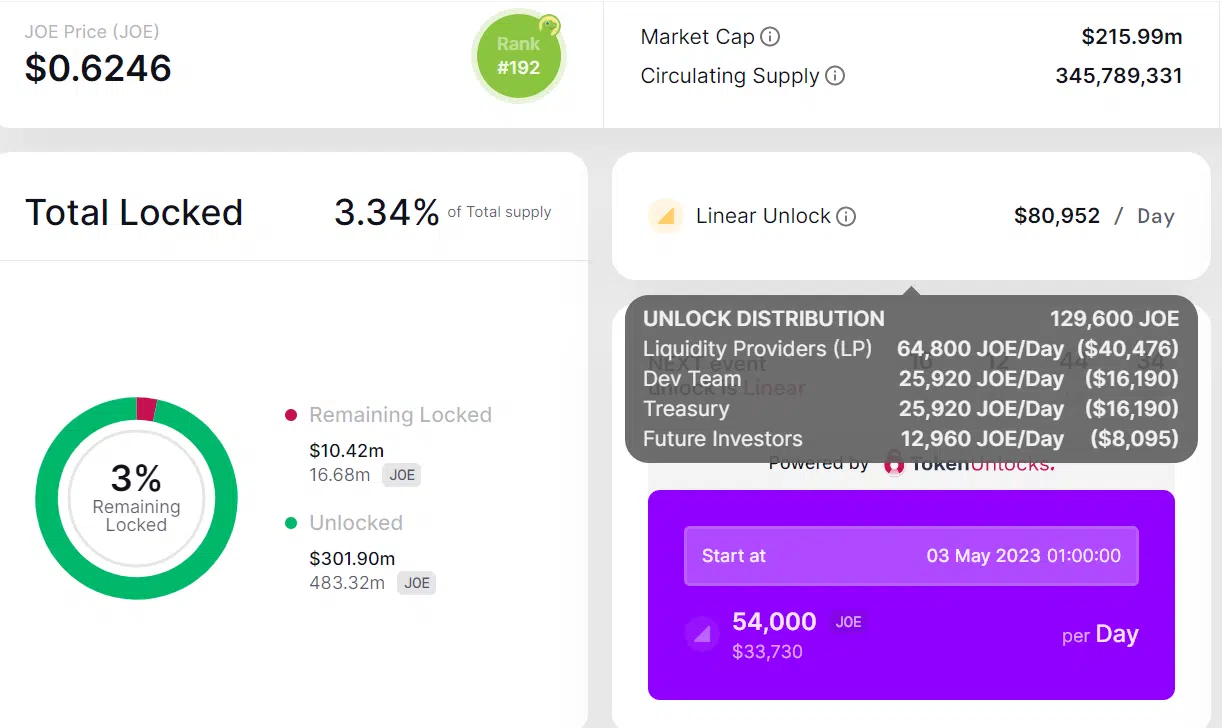

Token Unlocks shared that Trader Joe was preparing to unlock the remaining tokens that were previously locked. As per their data, only 3% of the total token was still locked. The total amount of locked tokens stood at approximately 16.68 million, valued at around $10.42 million at the time of writing.

In just about 16 days, around 3 May, the much-anticipated unlock event for Trader Joe’s tokens will take place. Interestingly, the unlock will be linear, implying that a specific number of tokens will be unlocked at each interval and not all at once.

Specifically, there will be a daily unlock of 54,000 JOE, translating to over $33,000. As of this writing, there were over 483 million JOE tokens in circulation, valued at more than $301 million.

Joe v2 sees uptrend in volume and TVL

Trader Joe has significantly upgraded its Liquidity Book, the automated market maker used for trading. The upgrade includes the introduction of auto-pools, which automatically manage depositors’ active positions in high-yield liquidity pools to reduce risk.

Additionally, the exchange launched a new rewards program that rewards those who participate in Trader Joe’s concentrated liquidity by distributing tokens to them.

The recent launch of Trader Joe v2 has yielded impressive results, with notable improvements in key metrics. According to DefiLlama, the Total Value Locked (TVL) on Joe v2 has been on an upward trend since March.

Although a slight dip was observed in April, the TVL quickly resumed its upward trend. As of this writing, it was at an impressive $57.3 million, most of which came from the Avalanche chain.

Additionally, the platform has experienced an uptick in trading volume since the spike observed in March. Currently, the trade volume has surpassed $66 million, reflecting the platform’s growing popularity and increased user activity.

Furthermore, the active user metrics also posted some decent numbers. However, the level of uptrend that was seen in its volume and TVL was absent.

Trader Joe [JOE] on a daily timeframe

Taking a closer look at JOE on a daily timeframe, the token showed a downward trend. As of this writing, JOE was trading at around $0.62, representing a less than 1% loss. Despite this plunge, the overall trend for JOE was still bullish.

How much are 1,10,100 JOEs worth today?

The Relative Strength Index (RSI) was still above 65, which suggested that the current move could be a correction in price rather than a significant change in trend. Overall, monitoring JOE’s price movements in the coming days is important.

Given the activity level on Trader Joe’s platform, the upcoming unlock may not negatively impact JOE’s price. The linear model employed in the unlock process also suggests that JOE’s price may see regular activity come May, which could help stabilize the token’s value.