Why BTC and ETH season to cool off may be near $30K and $2K

– Investors are cashing out, decreasing the possibility of further bullish direction.

– Whales have been obligatory in making large transactions but ETH and BTC could now be overvalued based on the present cycle.

The recent meteoric rise of Bitcoin [BTC] and Ethereum [ETH[ to the $30,000 and $2,000 price levels respectively has captured the attention of investors and cryptocurrency enthusiasts alike.

However, it could be time to bid farewell to these remarkable rallies as market observers were already speculating about the possibility.

Is your portfolio green? Check the Ethereum Profit Calculator

One factor that could potentially contribute to a cooling-off period is profit-taking by traders and investors who have benefited from the recent price gains. And according to Santiment’s April mid-month update, such occurrences were back alive.

Is it time for au revior?

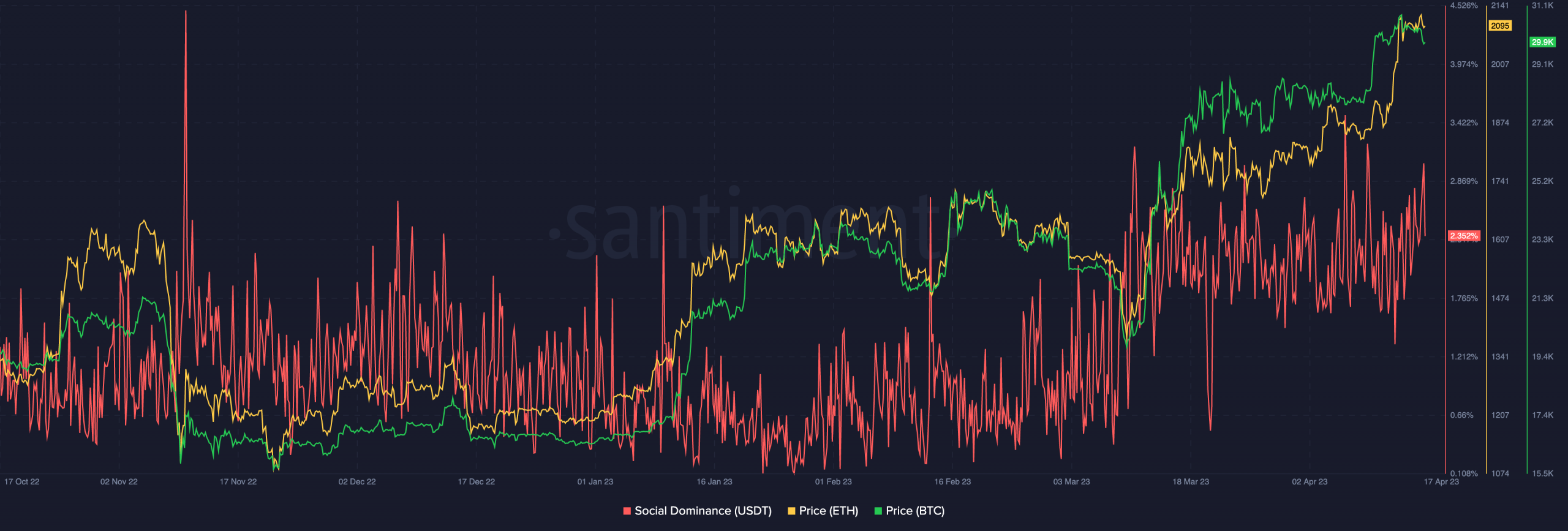

The on-chain analytic platform mentioned that there has been an incredible hike in the social dominance of stablecoins like Tether [USDT]. Social dominance helps to identify assets that are getting hyped.

And since the USDT dominance reached 3.01% on 17 April, it implies that investors could be locking profits as the price hits new highs. Therefore, this could lead to a temporary slowdown in buying pressure and a potential price correction.

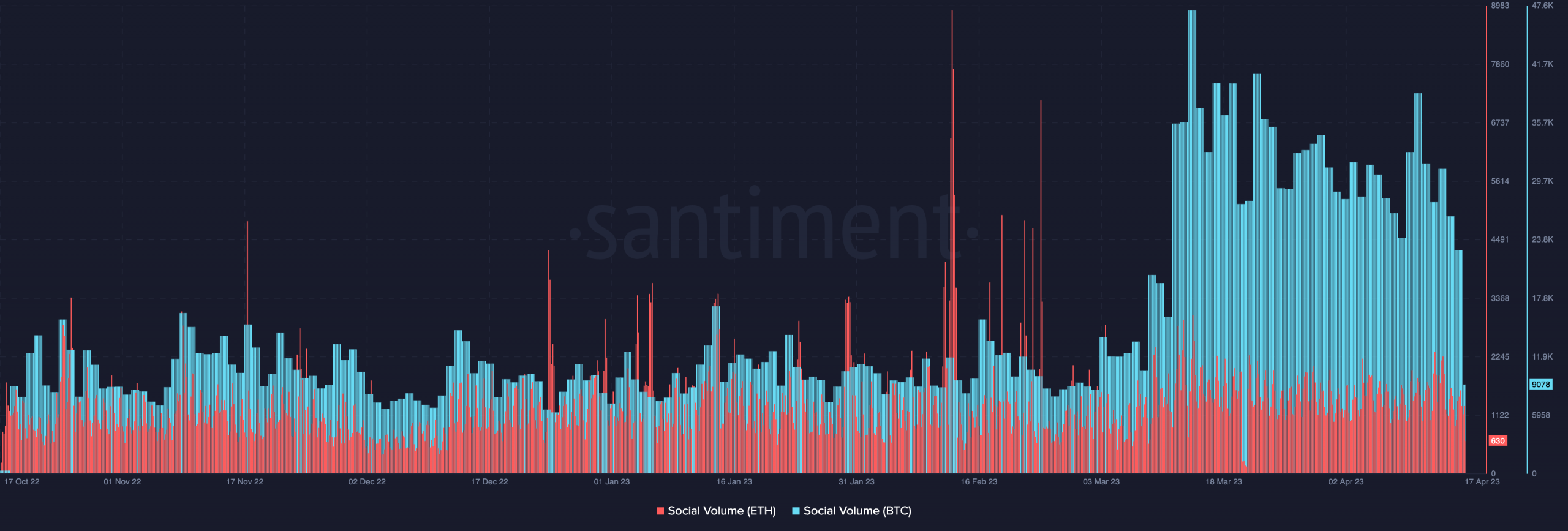

Another notable facet in terms of market sentiment is how optimism had reduced among investors. One metric that justifies this is the social volume, which describes the number of search terms related to an asset.

As of this writing, the Bitcoin social volume had dropped to 9078. With Ethereum, it was a minimal slide to 603. This implied that overall discussions around both cryptocurrencies were no more heavy. Hence, the exit of complacency could lead to a period of consolidation.

BTC & ETH: The lack of short-term opportunity

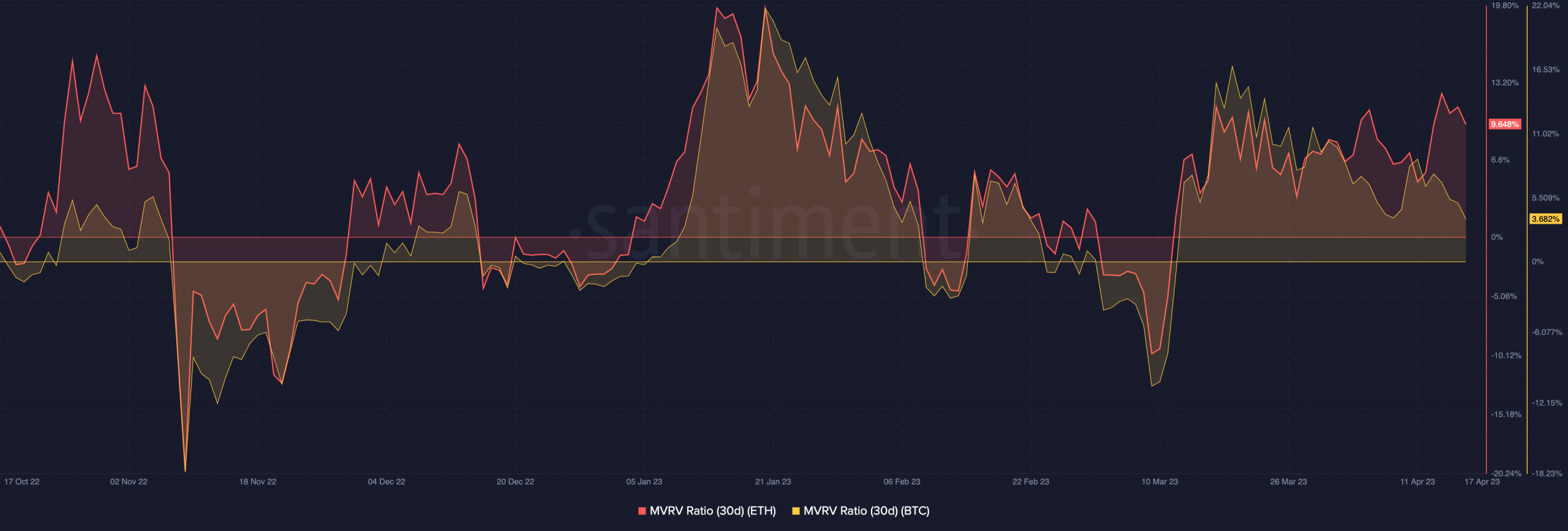

Furthermore, the Market Value to Realized Value (MVRV) ratio showed that BTC might have hit an overvalued point. Same as ETH which saw the 30-day ratio rise to 14.45% on 14 April.

By comparing the market capitalization and realized capitalization, the MVRV ratio is responsible for assessing market profitability and fair value.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Although the metric for both assets had decreased, it still did not present a solid opportunity zone for accumulation. To take a cue from Santiment’s insights:

“It does appear that they are a bit overvalued based on the fact that traders have been profiting in them so heavily since markets began to go on a tear in mid-January”

But in other cheery development, whales have been making impressive moves on the Bitcoin network. And an increase in these large transactions could help stabilize the BTC and ETH returns.

However, the effects of the market sentiment were already in motion as ETH had lost its hold on $21,000. BTC, following in the same route, had dropped below $30,000. But in the long-term, the cause for a sustained rally remains, especially as the Bitcoin 2024 halving approaches.