AVAX’s uninterrupted demand can stumble upon a few bears thanks to…

- Avalanche pulls ahead of the competition in terms of social visibility.

- AVAX bulls show strength as top coins give in to some sell pressure.

Social metrics are key when determining which blockchain network is more likely to receive attention. By that token, the Avalanche [AVAX] network was leading the charge this week according to recent findings.

Is your portfolio green? Check out the Avalanche Profit Calculator

A recent LunarCrush report revealed that Avalanche had the highest social volume and social engagement scores in the last 24 hours in the altcoin market. In addition, the network had the highest level of network activity during the same period.

These observations confirmed strong demand for Avalanche’s native cryptocurrency AVAX.

Avalanche has hit an AltRank™ of ? out of the top 4,358 coins across the market.

24-hour activity:

Social volume 13,089

Social engagements 30,113,242LunarCrush Insights: https://t.co/gDf1wRKeKf pic.twitter.com/wdKkMLR3jD

— LunarCrush (@LunarCrush) April 17, 2023

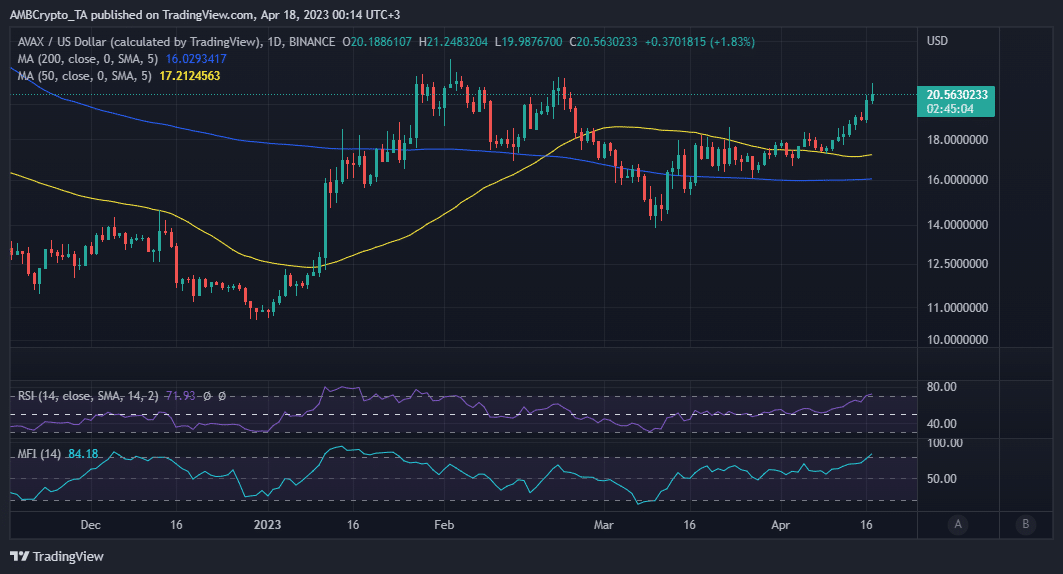

Unsurprisingly, AVAX was one of the best-performing top cryptocurrencies by market cap so far this month. It exchanged hands at $20.56 per coin and price tag represents a 23% upside on a month-to-date basis.

More importantly, the LunarCrush findings aligned with its performance in the last 24 hours, during which it remained in the green. This was while top coins including Bitcoin [BTC] and Ethereum [ETH] experienced some sell pressure.

Can AVAX maintain the bullish momentum?

The LunarCrush findings suggested that AVAX may currently be the darling of altcoin investors. If that remains the case, then AVAX may continue defying the overall market direction, a move that may potentially lead to more upside.

However, AVAX traders should note that it is already overbought and may have to contend with previously tested resistance above the $21 price level. Perhaps on-chain metrics may offer valuable insights into AVAX’s next move.

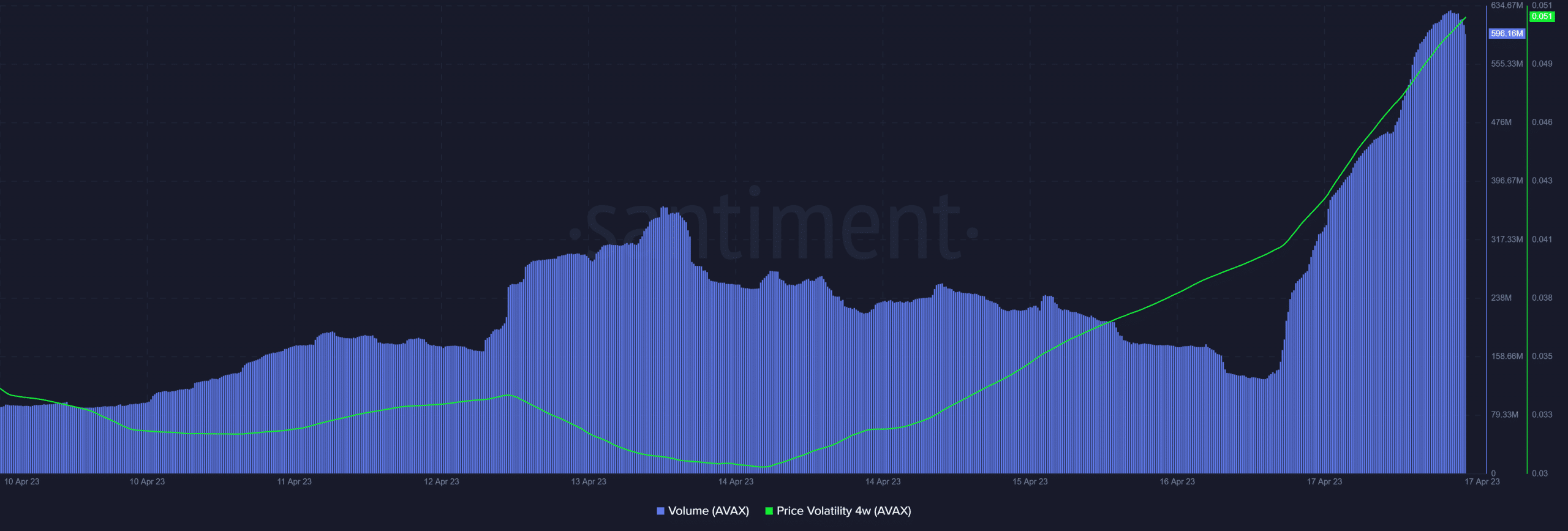

It registered a large volume surge to the highest weekly levels in the last 24 hours. This combined with the bullish resilience confirmed that the volumes represent a significant buying pressure.

Realistic or not, here’s AVAX market cap in BTC’s terms

The volatility metric was also at its highest weekly levels. The above outcome was also accompanied by a strong surge in demand for AVAX in the derivatives market.

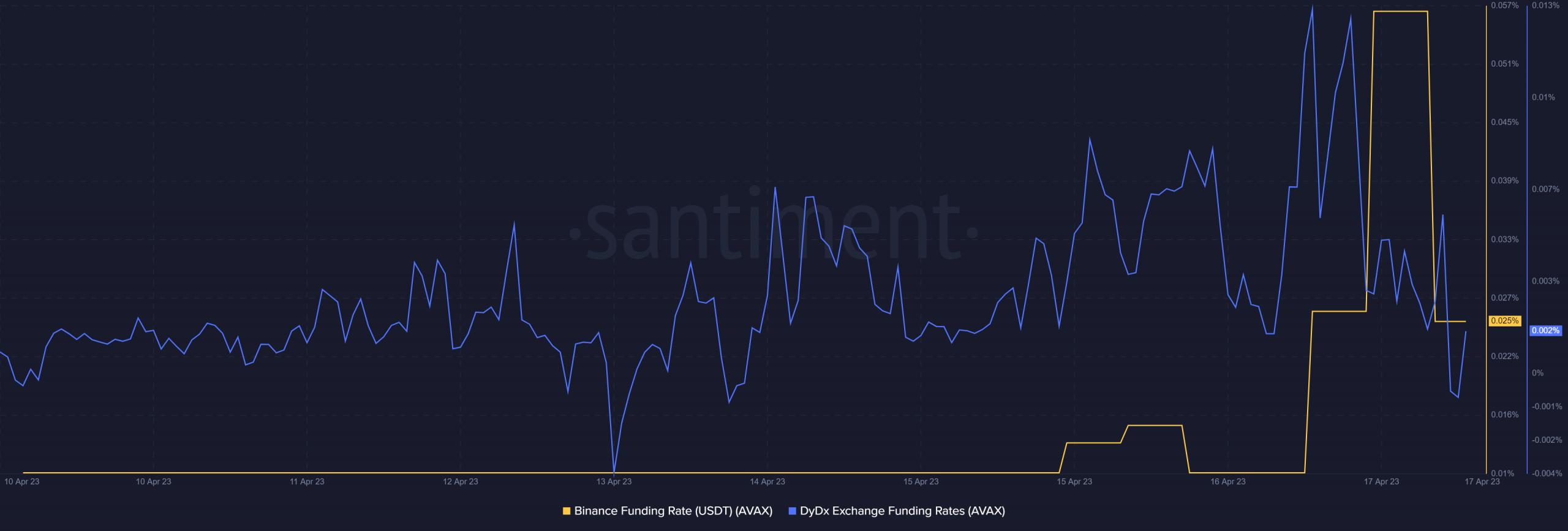

It manifested as a strong surge in the Binance and DYDX funding rates. Both soared to their seven-day highs in the last 24 hours at press time, confirming that derivatives demand reflected in the spot market.

Assessing the likely outcome

At press time, AVAX demonstrated strong demand and visibility. Nevertheless, there still stood a significant probability of short-term sell pressure especially if the overall market conditions continue leaning in favor of the bears.

On the other hand, AVAX might hold on to its recent gains if the market conditions improve. A resurgence of sell pressure cannot be ruled out even though recent observations suggest that it current demand may continue fueling the bulls.

![Will Ethena [ENA] crack the $0.60 ceiling next? 3 signs say yes](https://ambcrypto.com/wp-content/uploads/2025/05/Erastus-2025-05-14T110529.238-min-400x240.png)