VeChain [VET] wavers in the NFT space – can this launch turn things around

![VeChain [VET] is losing its grip in the NFT space; can this launch help?](https://ambcrypto.com/wp-content/uploads/2023/04/VET-1.png.webp)

- VeChain launched VORJ, a no-code Web3-as-a-Service platform.

- VET’s price action favored the investors, but CMF and MFI were bearish.

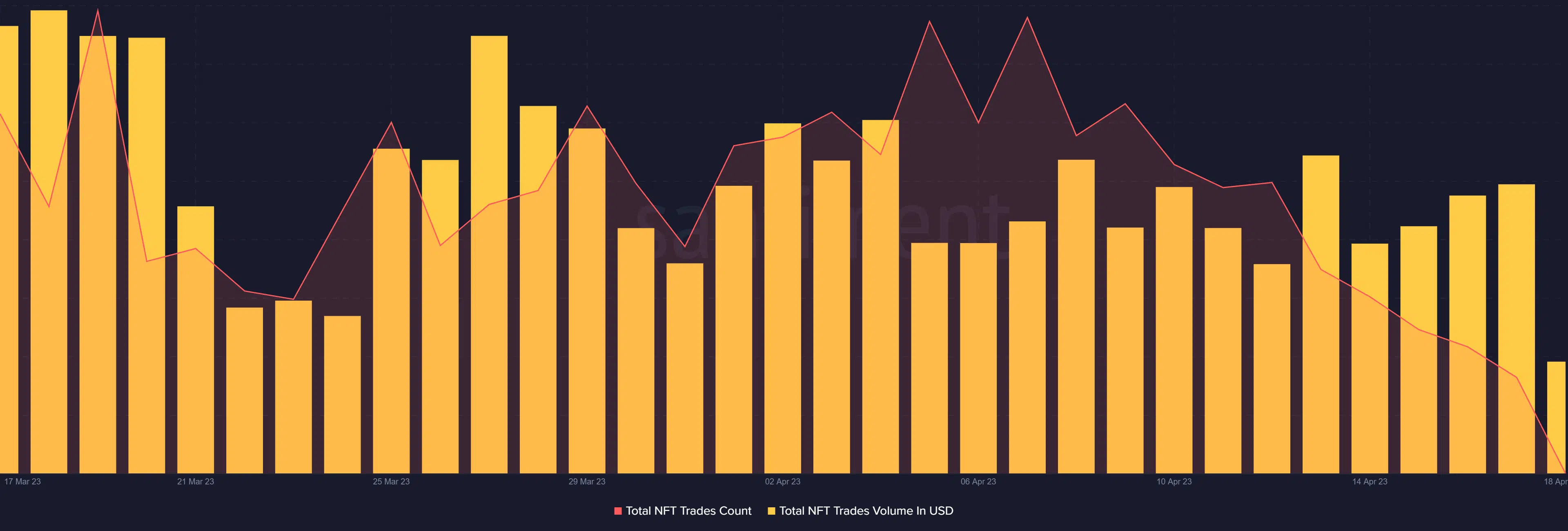

VeChain [VET] has been witnessing a decline in its NFT metrics over the last 30 days. Santiment’s chart revealed that VeChain’s total NFT trade count and trade volume in USD declined. In addition to that, the number of unique addresses that bought less than $1,000 worth of NFTs also declined in the last few weeks.

Realistic or not, here’s VET’s market cap in BTC’s terms

This can change the scenario

However, VeCHain’s NFT ecosystem can flourish again with the latest launch of VORJ, Vechain’s ‘Web3-as-a-Service’ platform.

It's finally here – VORJ, vechain's #Web3-as-a-Service platform is LIVE!

Deploy Web3 assets with just a few clicks, and never worry about transaction fees again. Building on #blockchain has never been so easy!

Learn more by reading our Medium post, or head straight to… pic.twitter.com/6weJYe93L0

— vechain (@vechainofficial) April 17, 2023

VORJ is a no-code Web3-as-a-Service platform that enables anyone to create, deploy, and interact with smart contracts on the VechainThor blockchain. This latest launch can greatly help VeChain in the NFT ecosystem. Additionally, VORJ also comes with NFT APIs, which provides aggregated data for NFT collections and tokens.

State of VET in Q2

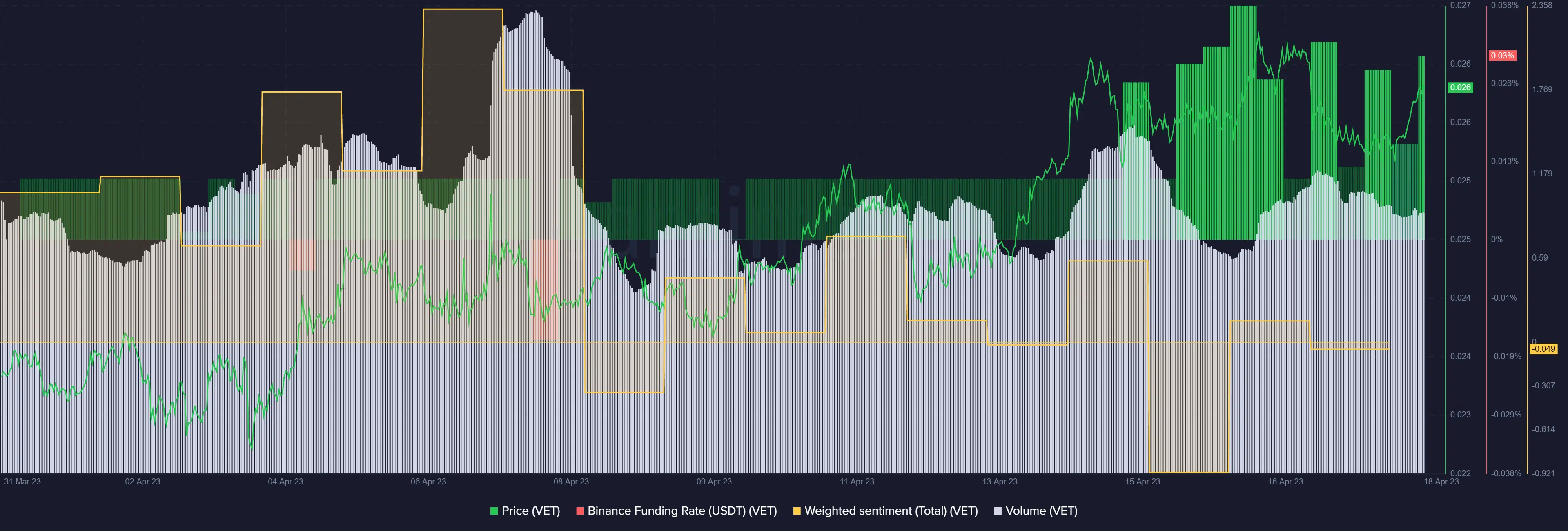

VET investors had a comfortable beginning in the second quarter of 2023 as the token price increased considerably. As per CoinMarketCap, VET’s price went up by over 4% in the last seven days. At the time of writing, VET was trading at $0.02599, with a market capitalization of more than $1.8 billion.

Lately, VET’s demand in the derivatives market registered an increase, which too was an optimistic signal. VET’s trading volume was also relatively high, suggesting a higher interest among investors in trading the token.

Nonetheless, VET’s weighted sentiment drifted towards the negative side over the past few weeks, which indicated that negative sentiment prevailed in the market for VET.

Will the growth see a roadblock

A look at VET’s daily chart revealed that quite a few market indicators were in favor of a continued uptrend. For instance, the Relative Strength Index (RSI) registered an uptick and was headed further away from the neutral mark of 50.

How much are 1,10,100 VETs worth today?

The Exponential Moving Average (EMA) Ribbon’s data pointed out bulls’ upper hand in the market as the 20-day EMA was above the 55-day EMA. VET’s Bollinger Bands suggested that the token’s price was entering a slightly higher volatile zone, further increasing the chances of an uptick.

However, the Chaikin Money Flow (CMF) suggested otherwise as it declined. The same was true with the Money Flow Index (MFI), which sank marginally.