Arbitrum in rough waters as the protocol shows a decline in these key metrics

- Arbitrum faces problems as stablecoin outflows on the protocol increase.

- Fees collected by the protocol declined, but Arbitrum held onto a high TVL.

Arbitrum [ARB] has managed to dominate the L2 space over the last few months. Reportedly, the interest in the protocol increased due to the much-anticipated airdrop of its token. However, it was discovered that Arbitrum could soon lose its top position, according to some data sets.

Realistic or not, here’s ARB’s market cap in BTC terms

Here’s how

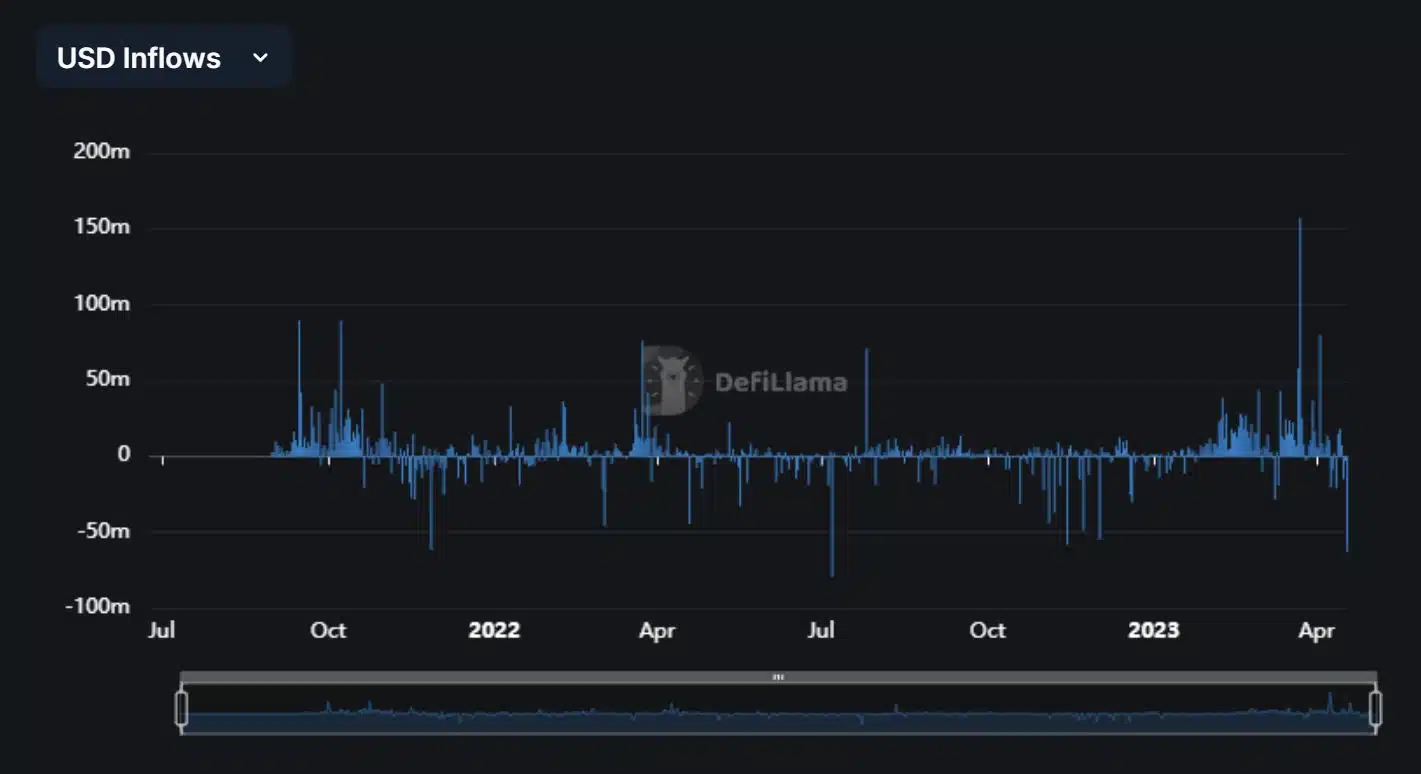

Well, the decline in the stablecoin outflow of Arbitrum has been a concerning factor. Based on DefiLlama’s data, Arbitum recently experienced its second-largest outflow of stablecoin liquidity with most of it coming from USDT.

A decline in stablecoin outflow suggests that the demand for the protocol’s services may have decreased or that other competing protocols have gained popularity.

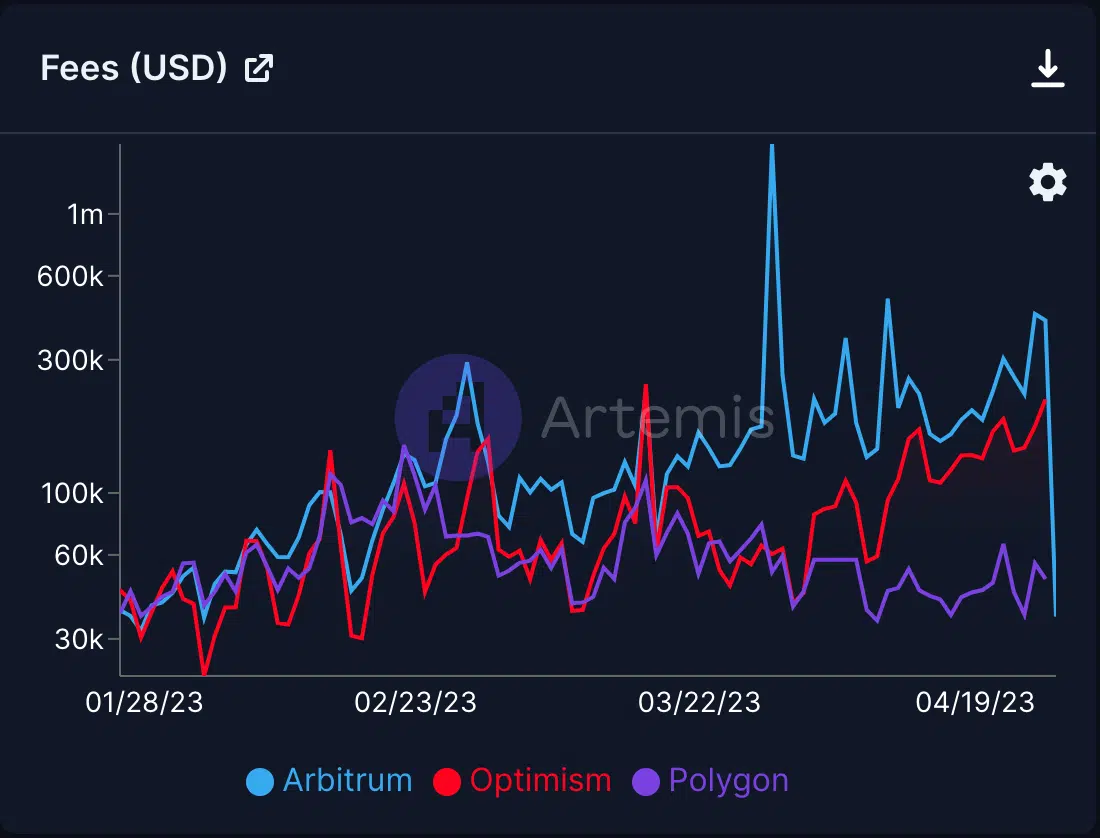

Another concerning indicator for Arbitrum was the sharp decline in fees collected by the protocol.

Despite observing high daily activity on its network with multiple transactions, Arbitrum failed to compete with another layer 2 solutions in terms of fees collected on the network.

On the brighter side

Arbitrum’s TVL on its smart contracts remained impressive despite the decline in fees, surpassing that of other protocols such as Polygon and Optimism.

Artemis data indicated that Arbitrum had $2.3 billion in TVL, while Polygon and Optimism lagged behind with $1.1 billion and $950.2 million, respectively.

This preeminence of Arbitrum could be exaggerated further through the success of its dApps. According to data provided by Artemis, Odos Protocol, which is a DEX aggregator on the network, witnessed a spike of 500% in terms of daily active users on its network.

Is your portfolio green? Check out the Arbitrum Profit Calculator

Notably, at press time, there were more than 20,000 users on the dApp. New dApps on the Arbitrum network could help the protocol attract more users to its platform.

?Artemis BAM ? App of the Day

What’s the TRENDING dApp on $ARB?

? @odosprotocol is a DEX aggregator that grew to 20k daily active users up 500x in a month ? pic.twitter.com/NIvLfFvo4x

— Artemis ? (@Artemis__xyz) April 19, 2023

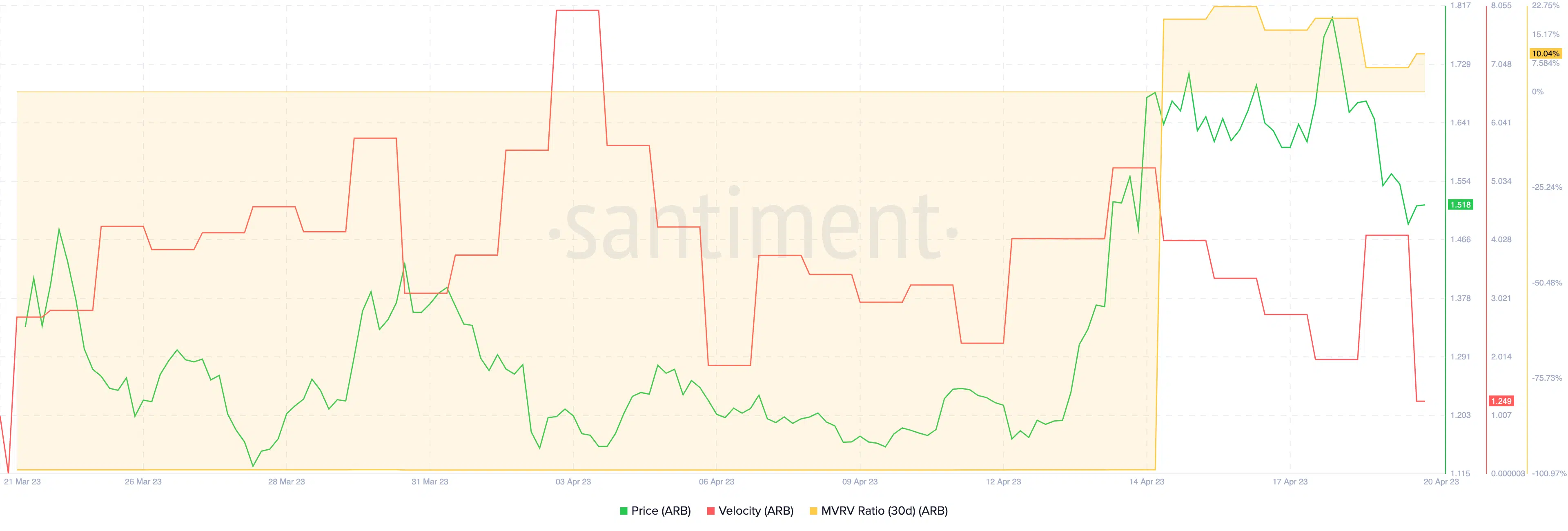

When it comes to the ARB token, there has been a significant decline in its price over the past few days.

The MVRV ratio of ARB remained high, indicating that some addresses are still holding profitable positions. This could lead to continued selling pressure on the token and hence, a further decline in price.