Ordinals Finance rug pull: All there is to know about this market exit

- ETH-base DeFi protocol Ordinals Finance exited the market on 24 April.

- The rug pull led to a loss of at least $1 million

Another ‘rug pull’ or exit scam hit the market on 24 April 2023 when Ordinals Finance made an exit from the market. Ordinals Finance was an Ethereum [ETH]-based DeFi protocol that enabled the lending and borrowing inscriptions.

As reported by the Twitter handle CertiK Alert, the scam resulted in a loss of $1 million. Additionally, the deployer removed the OFI tokens from the OEBStaking contract and began swapping them for ETH.

We can confirm that the @ordinalsfinance exit scam has resulted in a loss of $1 million.

All social media accounts have been deleted as well as the project's website.

Funds have been consolidated into EOA 0x34e…25cCFhttps://t.co/0Pwlt3yibm https://t.co/RA7vSjNajI

— CertiK Alert (@CertiKAlert) April 24, 2023

Another one hits the ground…

At the time of writing, it could be seen that Ordinals Finance’s Twitter account had been disabled or deleted. The same was the case for its website. Furthermore, data from Certik’s website showed that the token had at least 1,287 holders at the time of the rug pull.

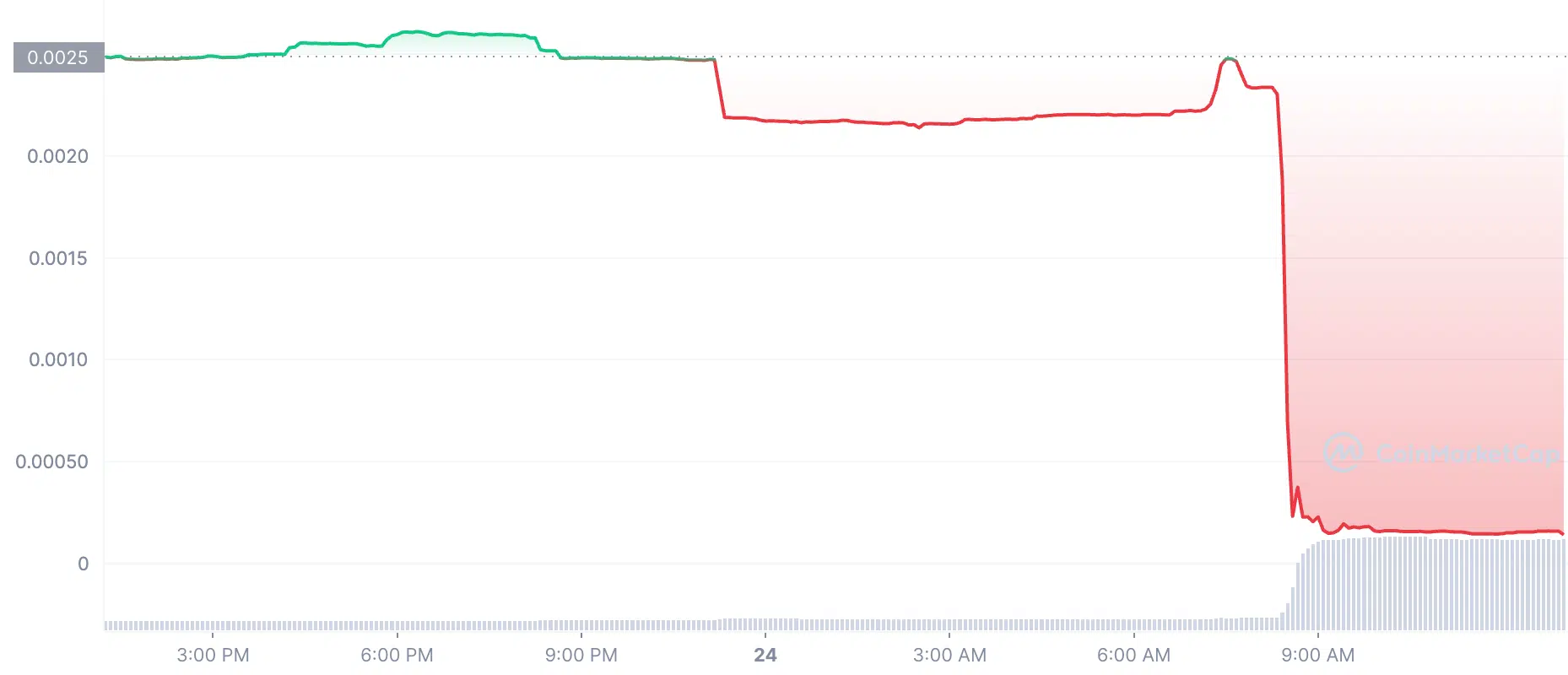

As per additional data from CoinMarketCap, at around 7.20 am PST the price of OFI stood at $0.002476. However, at the time of writing, the value of the token was down by a whopping 94.39%.

As per data from CoinMarketCap, Ordinals Finance joined the Ethereum network on 26 February 2023. The OFI token managed to reach an all-time high of $0.006921 almost 20 days before the deployer planned to exit the market.

A word of caution

Addressing the state of the crypto market, crypto reporter Wu Blockchain, published a tweet informing crypto investors of the downsides of investing without studying the market.

Although the crypto reporter pointed out the state of memecoins, he did mention that deployers could manipulate investors after accumulating large amounts of funds. This could be considered as the order of events that went down with Ordinals Finance.

Many MEME coins deployers have accumulated a large amount of funds before increasing liquidity, which means that there is a possibility of being manipulated by a certain group. MEME coins with similar behavior include WOJAK, TRAD, NEET, etc. . According to @x_explore_eth.

— Wu Blockchain (@WuBlockchain) April 24, 2023