Polygon zkEVM registers an increase in deposits, but how is MATIC faring

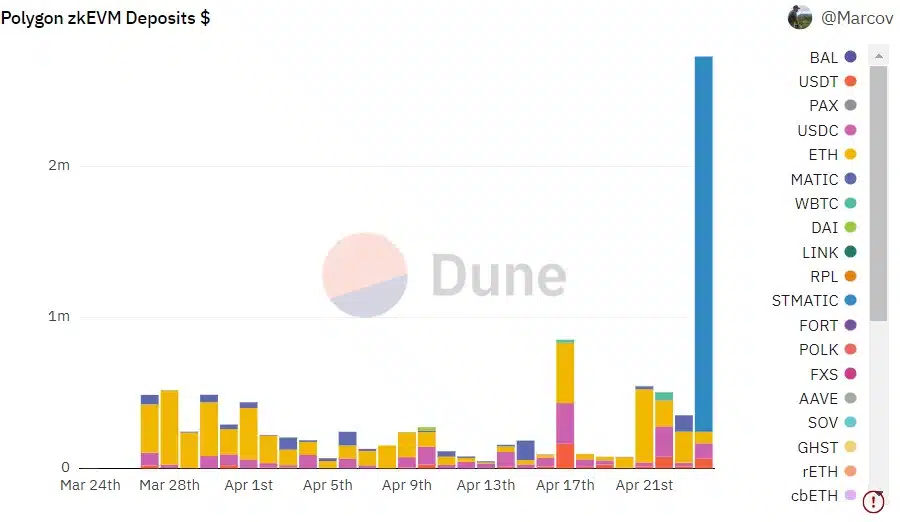

- Polygon zkEVM deposits surged considerably on 24 April but unique depositors declined.

- MATIC’s exchange reserve rose while funding rate declined sharply.

A month has passed since the launch of Polygon’s [MATIC] much-awaited zkEVM. Over the past month, zkEVM remained a hot topic of discussion and also made a few achievements. Highlighting zkEVM’s first month of launch, Polygon posted a tweet on 25 April, mentioning the solution providers and different categories that are deployed on zkEVM.

Is your portfolio green? Check the Polygon Profit Calculator

A look at the categories of providers

Polygon tweeted about the solution providers across eight categories that are deployed on zkEVM. For instance, there are RCP providers such as Chainstack, Ankr, Luganodes etc.

Scaling Ethereum means scaling the entire Ethereum ecosystem, infrastructure and all.

Now that Polygon #zkEVM Mainnet Beta has been live for a month+, a SURGE of solution providers across 8 categories are deployed on Polygon zkEVM.

Let’s break it down:

— Polygon (@0xPolygon) April 25, 2023

According to the tweet, Polygon Labs also revamped the bridge UI for Mainnet Beta. But that’s not the only way to reach the frontier now, as multiple other bridges are also deployed on zkEVM, like Multichain, Celer Network, and others.

Apart from these, the other categories Polygon mentioned include indexers, oracles, wallets, general infra, account abstraction/relayers, and fiat onramps.

zkEVM sees a boost

Since its launch zkEVM gained much traction from the crypto community and also hit a few milestones. The first month ended on a good note, which was evident from Dune’s data.

Polygon zkEVM deposits surged considerably on 24 April, with Lido Staked MATIC [stMATIC] being the major token with deposits exceeding 2 million. It was also quite interesting that in the last 24 hours, stMATIC’s price increased by more than 2%.

Another positive sign was that after a steep decline, the number of daily transactions on zkEVM showed signs of recovery from 19 April. However, unique deposits plummeted considerably since the launch, which was a negative signal.

MATIC under selling pressure?

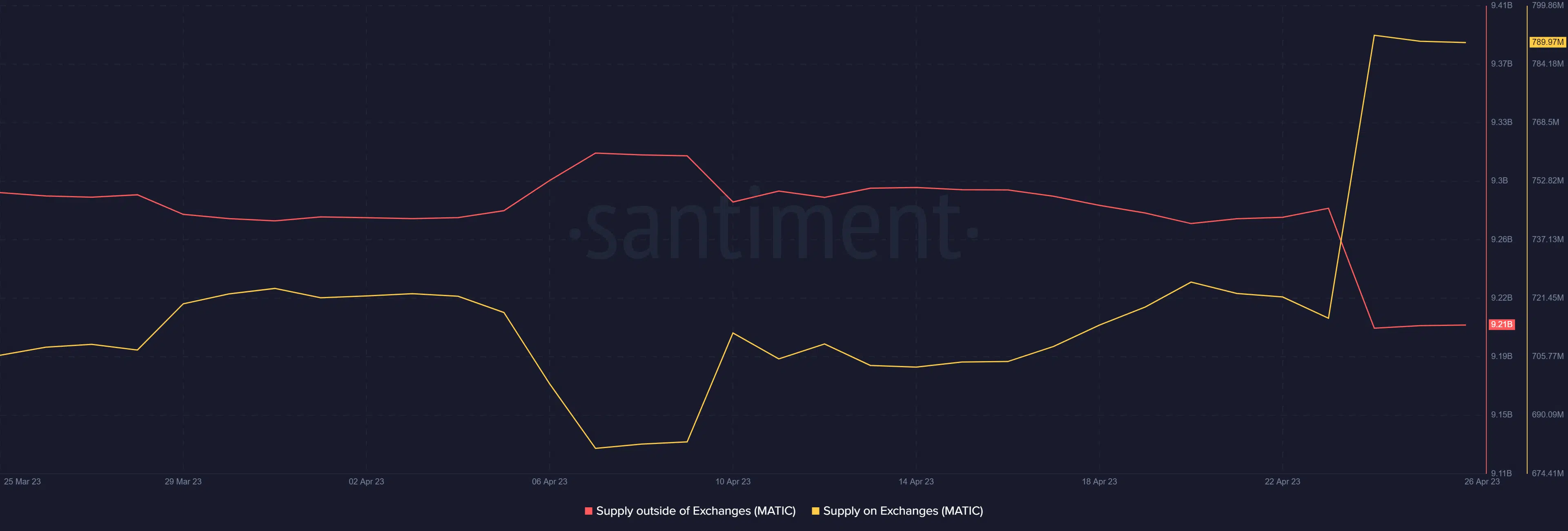

While Polygon celebrated zkEVM’s one month anniversary, Santiment pointed out in a tweet that MATIC might be under selling pressure. As per the tweet, one of the largest self-custodial Polygon addresses just moved 60 million tokens to an exchange.

This move seemed to be favoring the bears, as it can further increase selling pressure.

? One of the largest self custody #Polygon addresses just moved 60M tokens to an exchange, making the network's exchange supply jump to 7.92%, a 5-week high. Be cautious when whale exchange inflows happen. But note that the whale still owns 3.78B $MATIC. https://t.co/j0OdvJz8Fh pic.twitter.com/U9q59p6Ber

— Santiment (@santimentfeed) April 24, 2023

The transaction also negatively affected MATIC supply. Santiment’s chart revealed that MATIC’s supply on exchanges increased substantially. This was accompanied by a decline in supply outside of exchanges, which was bearish.

MATIC’s troubles are far from over

CryptoQuant’s data revealed that MATIC’s exchange reserve has increased. Moreover, MATIC’s active addresses also declined in the last 24 hours.

Read Polygon’s [MATIC] Price Prediction 2023-24

On top of that, MATIC’s funding rate plummeted, suggesting short-term traders have the upper hand and are willing to compensate long-term traders.

However, it was interesting to see that despite an increase in selling pressure, MATIC’s price went up by more than 3% in the last 24 hours. At press time, it was trading at $0.9941 with a market capitalization of over $9 billion.