Solana enters a neutral position- Here are key levels to consider

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- SOL’s structure was neutral at press time.

- Weekly price volatility eased, but funding rates improved.

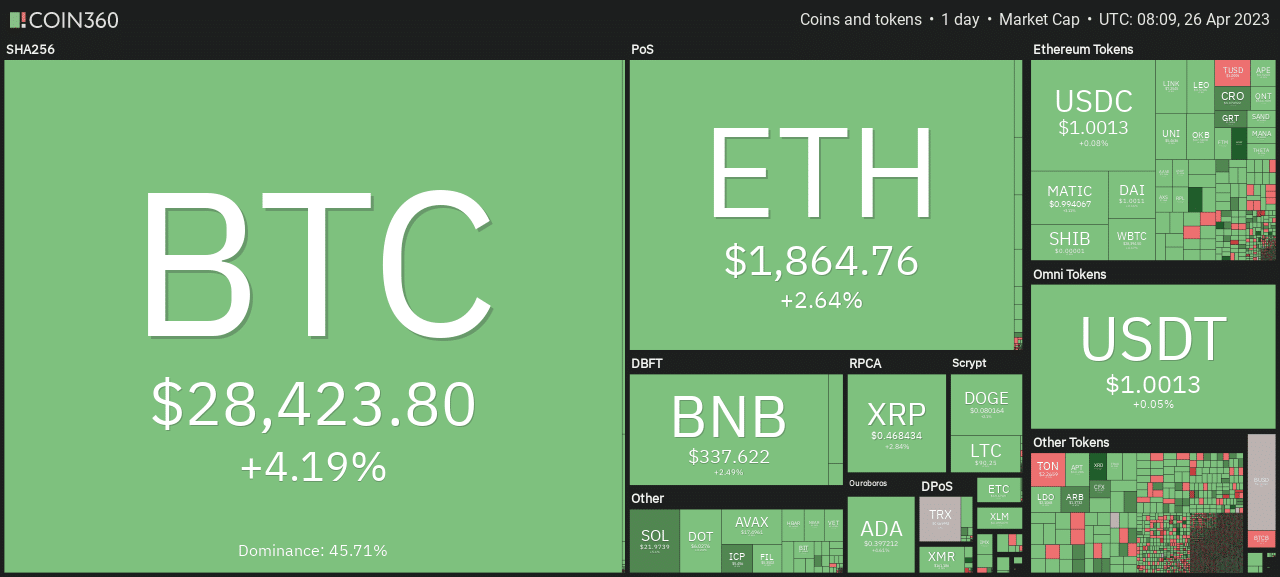

At the time of writing (26 April), altcoins, including Solana [SOL], were all green after Bitcoin [BTC] reclaimed the $28k price range. In particular, SOL was up 5% in the past 24 hours but was yet to recover last week’s losses.

Is your portfolio green? Check SOL Profit Calculator

Notably, SOL shed about 6.5% in the past seven days after BTC fell to the $27k price zone and could experience significant volatility, especially early next week (2-3 May) due to the FOMC meeting.

Indecision amongst buyers and sellers – Which way for SOL?

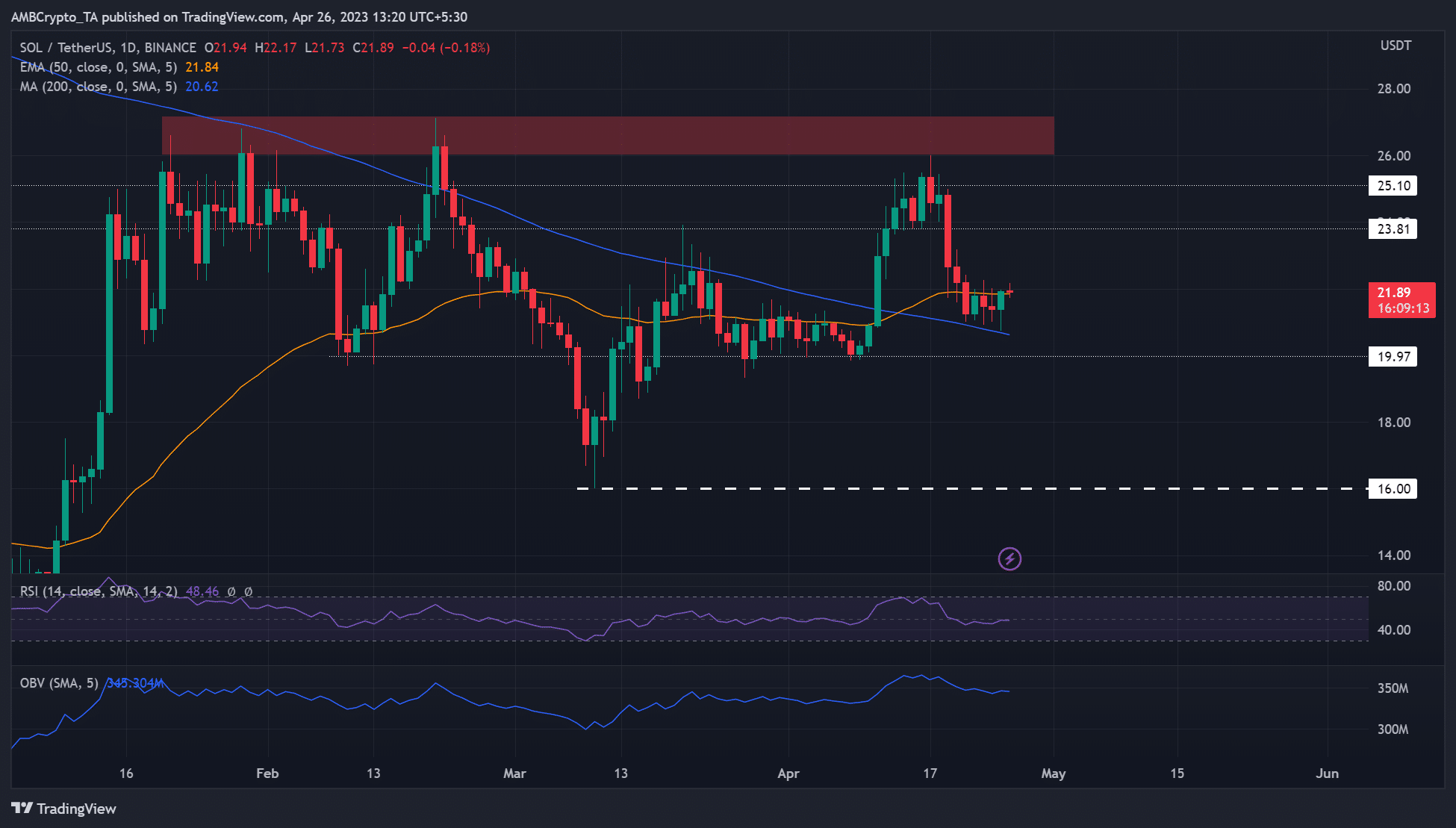

Since 22 April, SOL’s price action oscillated between the dynamic 50-EMA and 200-MA – denoting indecision among buyers and sellers. In particular, the 50-EMA (orange line) moved horizontally, highlighting the recent consolidation.

If the 50-EMA remains flat, an extended price consolidation could be likely for a while. The RSI and OBV were also flat, reinforcing the consolidation possibility. But the downsloping 200-MA indicate sellers still had the upper hand, at press time.

As such, SOL could oscillate between $19.97 and $23.81 in the next few days/weeks. Such a scenario could offer potential gains by targeting the range’s upper and lower levels. A surge beyond $23.81 could set SOL to retest the supply level at $26, especially if BTC reclaims the $29k.

However, a daily close below the 200-MA and the $19.97 support will indicate increasing weakness in the market. A breach of these two levels could easily set the SOL/USDT pair to sink to the March swing low of $16.

Weekly price volatility eased; funding rates fluctuated

Is your portfolio green? Check SOL Profit Calculator

A look at the on-chain metrics revealed that funding rates fluctuated since 19 April. At press time, funding rates were positive after flashing red for a considerable part of 25 April.

The fluctuating rates indicate wavering demand and could set SOL into an extended consolidation.

Despite the weekly price volatility easing, sentiment remained eerily negative – reiterating investors’ reservations about the asset.