Assessing Litecoin’s [LTC] state as miners’ costs cool down

- The Litecoin mining sector has been leaving its period of extreme difficulty.

- With the halving coming up, LTC could trend in the upward direction afterward.

Litecoin [LTC] miners seem to have experienced some ease lately as the cost of operation has been lower than the revenue generated. As one of the oldest cryptocurrencies, the mining operation has been challenging for the drivers, especially in 2022.

Read Litecoin’s [LTC] Price Prediction 2023-2024

Sliding away from losses

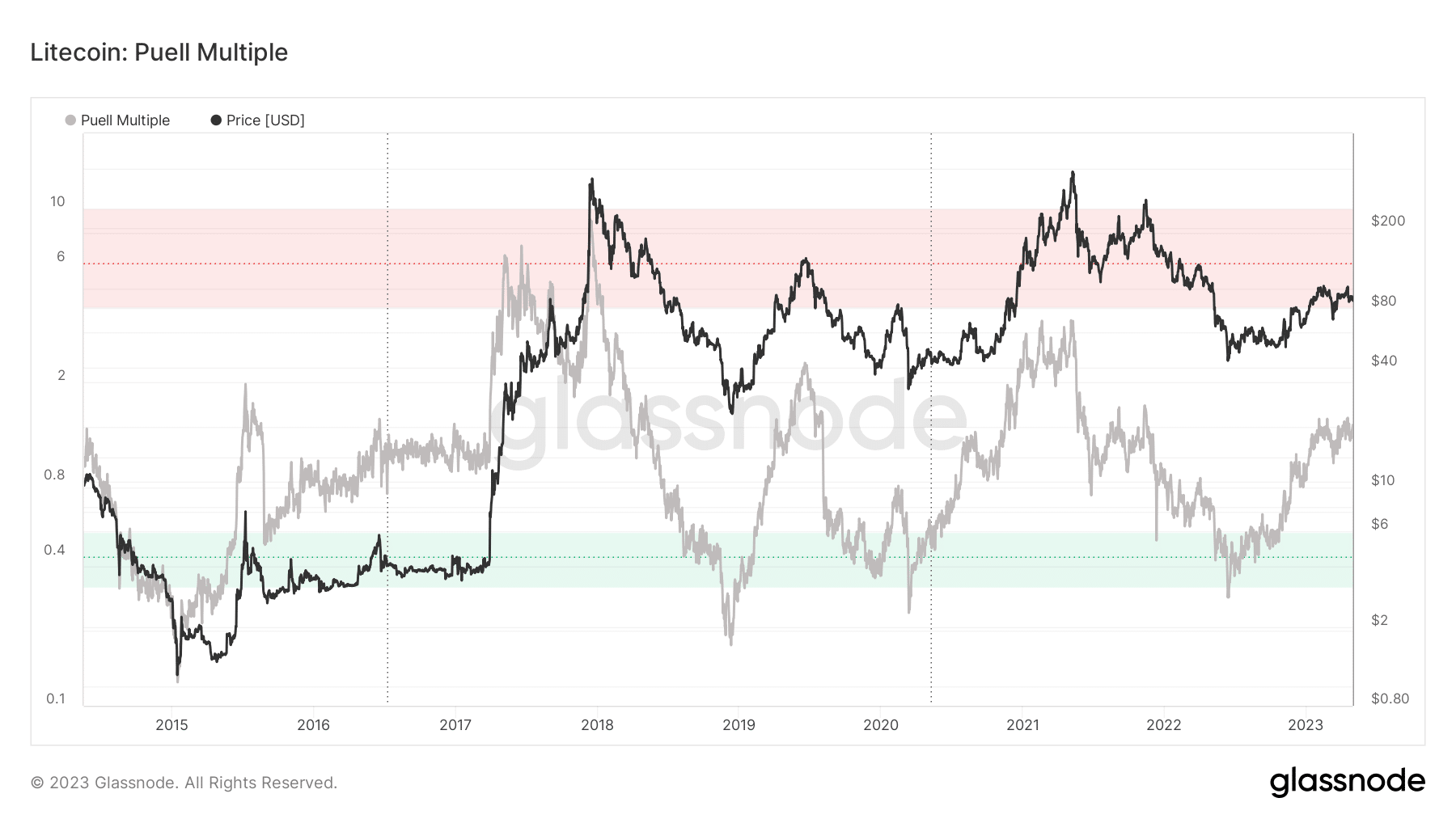

However, the Puell Multiple increases seem to have confirmed an ongoing process of exiting the extremely difficult season. According to Glassnode, the metric had increased to 1.39 at press time.

The Puell Multiple is used to gauge market cycles from mining profitability and sellers’ perspective. When the metric rise above a value of 4, it means revenue had increased, and operation costs had decreased.

But when it is below 0.5, the opposite happens. But a noticeable trend from the chart above is how the metric has been increasing since January. Although it had not yet touched the hardened easy area, the consistent rise implies that the challenges faced by miners had significantly reduced.

Developed as the faster and lighter version of Bitcoin [BTC], LTC uses the Proof-of-Work (PoW) algorithm to mine its coins. And the mining difficulty is adjusted after every 2016 blocks.

However, the hike in the Puell Multiple also has effects on the LTC value. As the metric increased, it means that the coin could be considered overvalued in this cycle. Hence, there could be an increasing miner’s motive to sell.

Litecoin eyes the chances

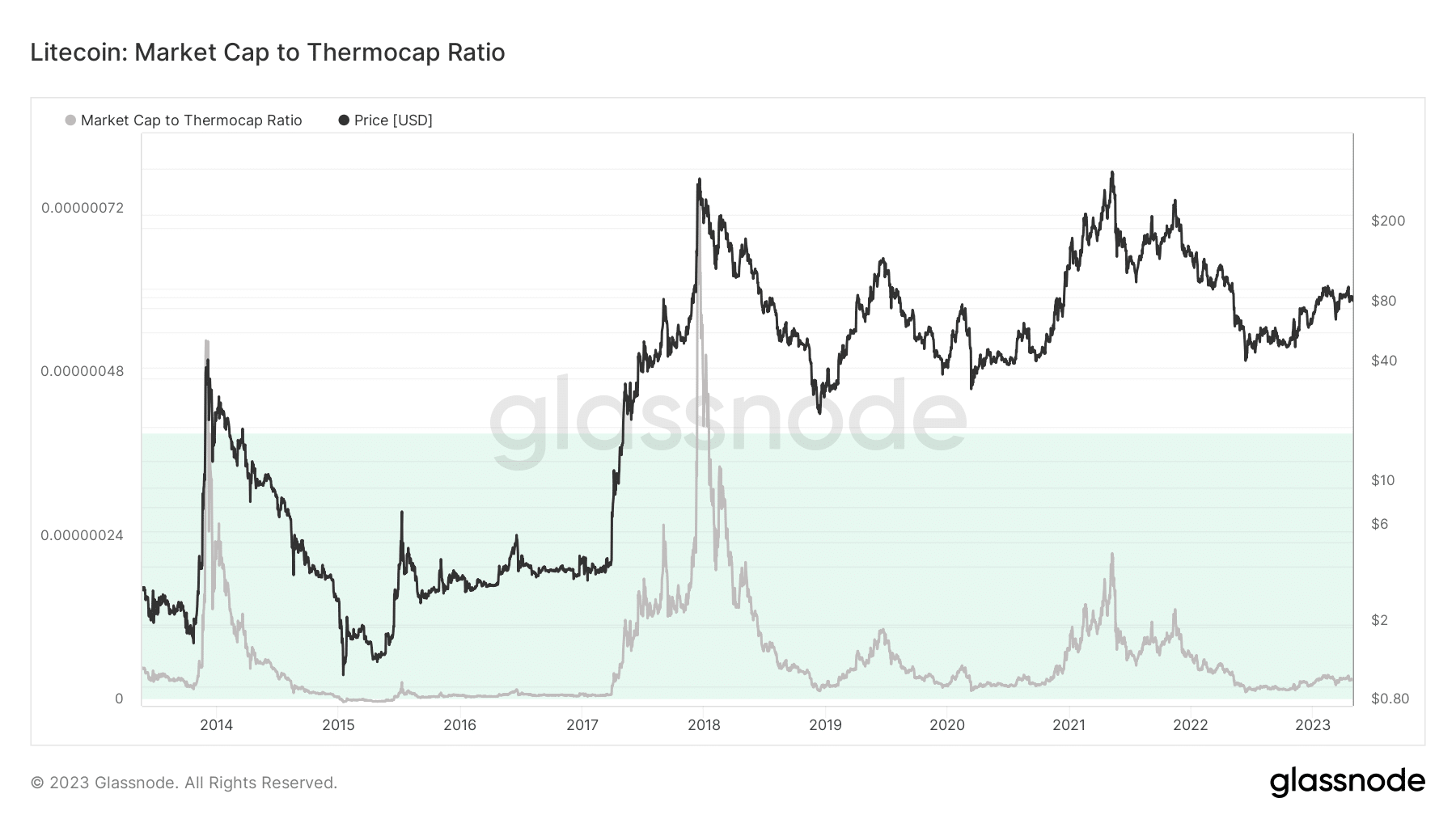

However, the market cap to Thermocap ratio did not share the same view as the Puell Multiple. This metric assesses if an asset is trading at a premium compared to the miners’ spend.

In times past, values under 0.00000004 indicate market bottoms, while those above 0.000004 suggest the tops. At the time of writing, the Litecoin market cap to Thermo cap ratio was 0.00000004. Thus, inferring how there could be a lot of opportunities for holders on the network.

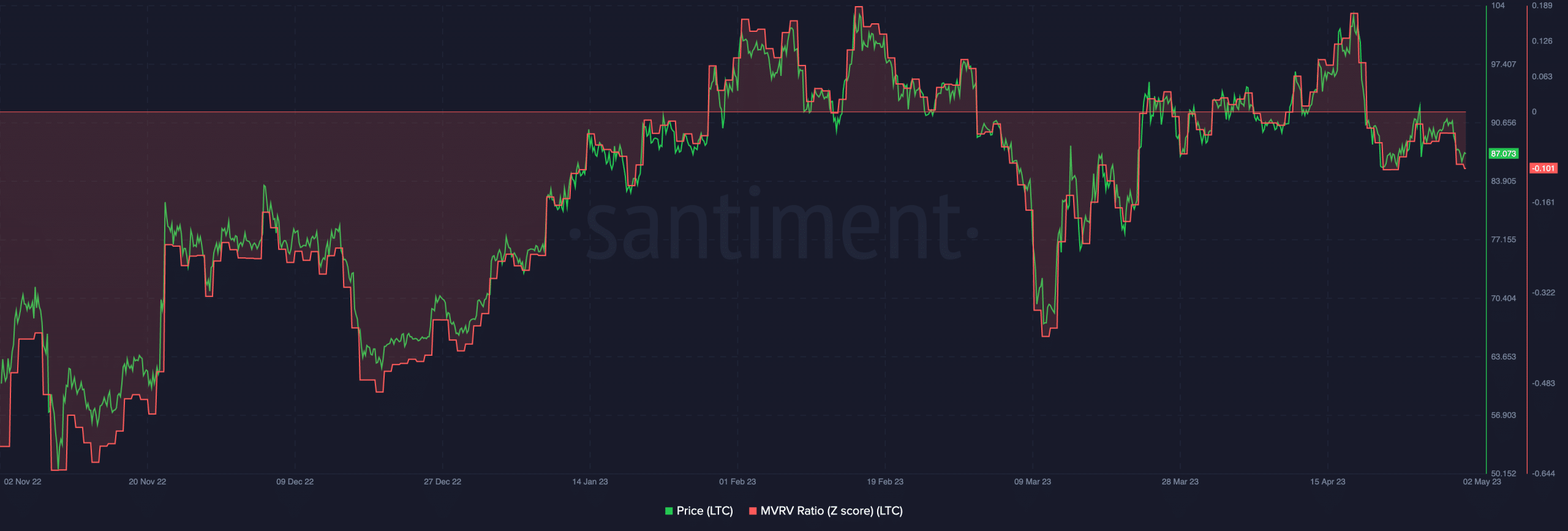

Furthermore, the Market Value to Realized Value (MVRV) Z-Score had slumped to -0.101 at press time. Historically, this metric has been used to identify when the market value is unusually above or below the realized value.

Realistic or not, here’s LTC’s market cap in BTC’s terms

At press time, LTC’s market value was below the realized value. Therefore, this has the capability to precede outsized returns in the long term.

Amid all this, another factor that could affect the LTC value is the halving. This event had severally produced a strong upside. So, investors might be optimistic that this year’s own, estimated to occur on 2 August, will make a repeat of the aftermath.