Will a drop in Ethereum’s [ETH] price lead to an increase in withdrawals? Analyzing…

![Will a drop in Ethereum's [ETH] price lead to an increase in withdrawals? Analyzing...](https://ambcrypto.com/wp-content/uploads/2023/05/Ethereum.jpg.webp)

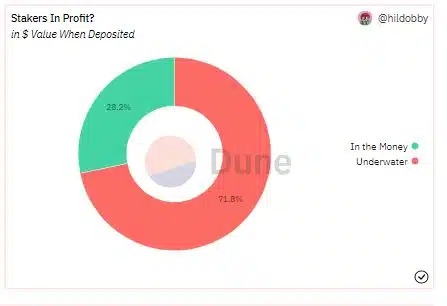

- More than 70% of stakers suffered losses since they locked their ETH on the network.

- In the last 24 hours, Ethereum recorded a net staking inflow of more than 82,000.

The successful launch of the Shapella Upgrade was an important milestone in the growth trajectory of Ethereum [ETH], as it closed the loop on some of the key aspects of the proof-of-stake (PoS) transition that couldn’t make it to the Merge last year.

Read Ethereum’s [ETH] Price Prediction 2023-24

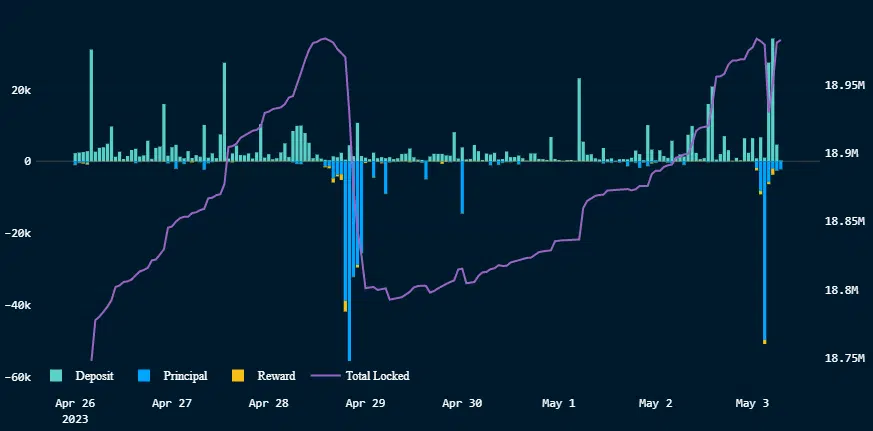

With FUD surrounding staking coming to an end, investors appeared to be more comfortable staking their ETH. As per Nansen dashboard, after the initial burst in withdrawals, deposits on the largest PoS blockchain started to increase sharply.

In the last 24 hours, Ethereum recorded a net staking inflow of more than 82,000.

Will ETH’s fall affect staking?

The price action of ETH, which resulted in gains of 3.15% over the past month, was a significant factor in boosting interest in staking. A rise in price means higher rewards can be earned on the staked value in the future.

However, the recent drop in ETH’s price had the potential to reverse this trend, as indicated by a researcher from Delphi Digital.

The researcher used data from a Dune dashboard to highlight that more than 70% of the stakers were in losses since they locked their ETH on the network. A lot of this staking occurred between $1,600 and $3,500, during the peak of the 2021 bull run.

However, at press time, ETH exchanged hands at $1,870.18, down 1.63% on a weekly basis.

A steady drop in prices could lead to conservative stakers withdrawing their stake and cashing them out in the market. Having said that, the researcher ruled out staking having a massive impact on overall market structure.

Stakes are high

As highlighted earlier, the Shapella Upgrade provided an impetus to the staking activity on the Ethereum network. As per Glassnode, April 2023 witnessed the largest amount of ETH staked in a single month.

Is your portfolio green? Check out the Ethereum Profit Calculator

On 2 May, the amount of ETH transferred to ETH 2.0 deposit contract reached 95,458 with the number of new depositing addresses going past 3,000.

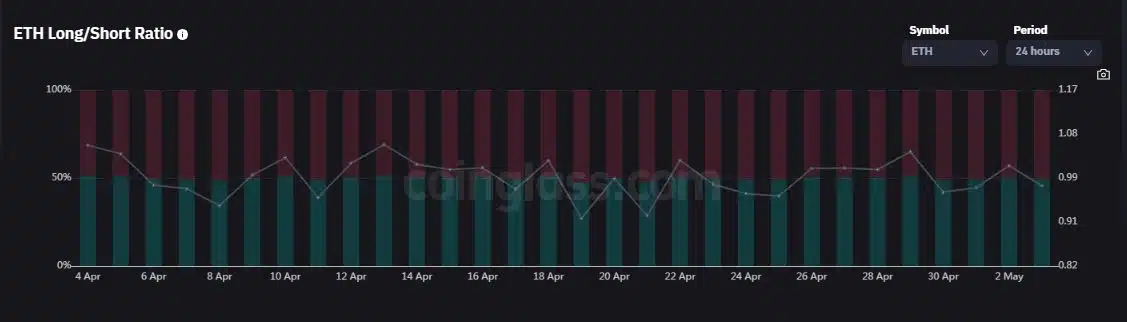

The boost in staking activity was still not enough to ignite bullish sentiments for the king of altcoins, as the number of short positions taken for ETH futures increased when compared with longs, data from Coinglass revealed.