Bitcoin traders ought to know this before making their next trade decision

- As per CryptoQuant’s latest analysis, BTC’s MVRV ratio crossing 1.5 could be a sign of a bullish wave.

- However, at the time of writing, BTC’s RSI put up a neutral front and didn’t show any bullish momentum.

Now that the fear of Bitcoin [BTC] being crippled due to the results of the FOMC was out of the way, investors could have something to look forward to.

As per an analysis from CryptoQuant analyst onchained, BTC’s Market Value to Realized Value (MVRV) was fluctuating between 1.55 and 1.45. This could be taken as a healthy sign of a bull run.

So how is BTC’s MVRV ratio floating between 1.55 and 1.45 related to BTC’s bullish wave? Let’s find out…

Is your portfolio green? Check the Bitcoin Profit Calculator

The importance of 1.5

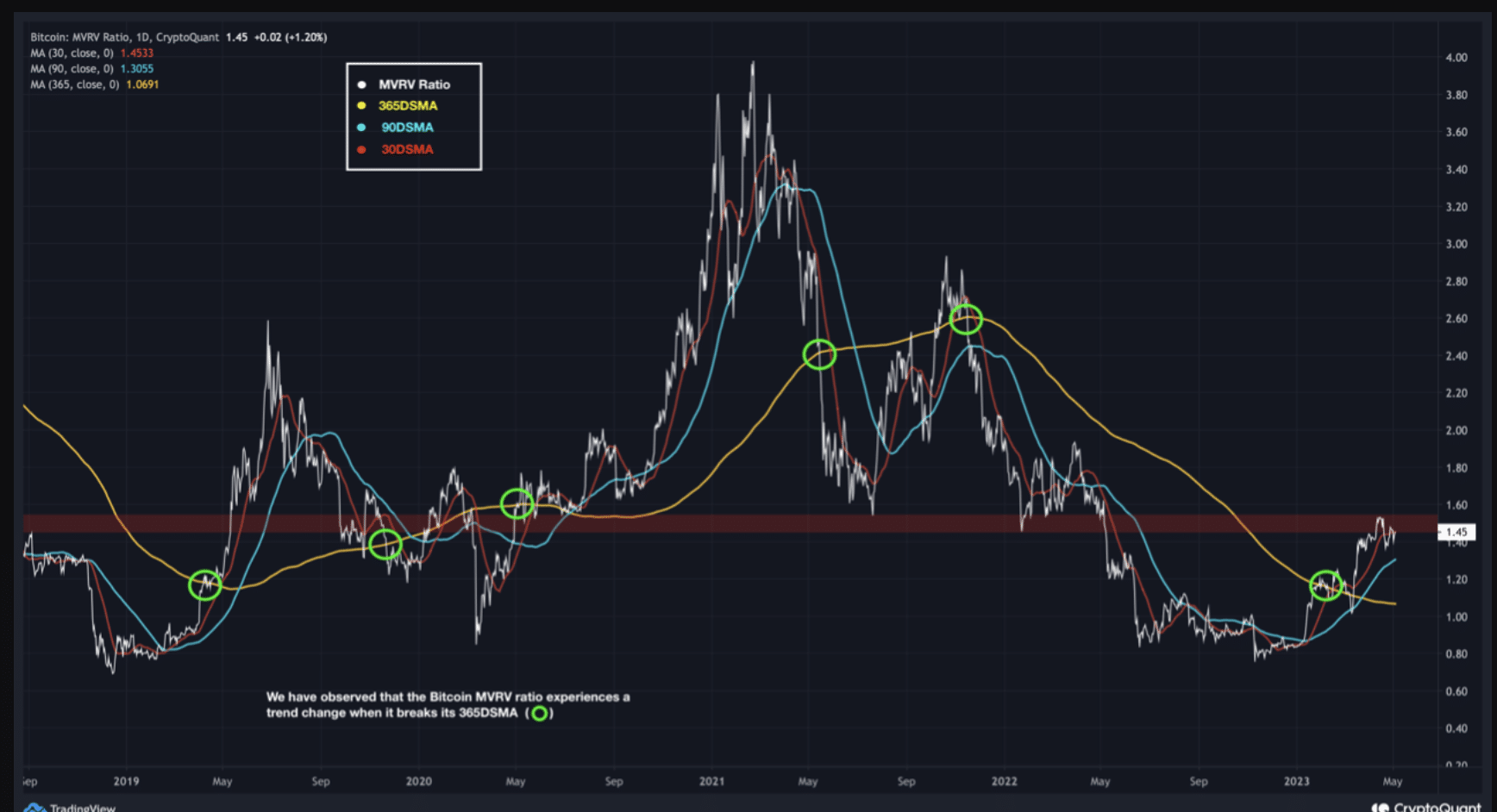

As per the CrytpoQuant analysis, the 1.5 threshold serves as Bitcoin’s entry point into a bull run. The analyst also stated that upon examining historical data, it was seen that BTC’s MVRV ratio witnesses a change when it breaks the 365D Simple Moving Average (SMA).

Furthermore, a bull run can be anticipated when the MVRV ratio breaks the moving average in an upward trend. Thus, the MVRV ratio reaches a point between 2 to 3.75. The analyst also stated that BTC’s 365DSMA as of 4 May stood flat. This was because the MVRV ratio managed to break the 1.5 level.

Are we tagging along for the bull ride?

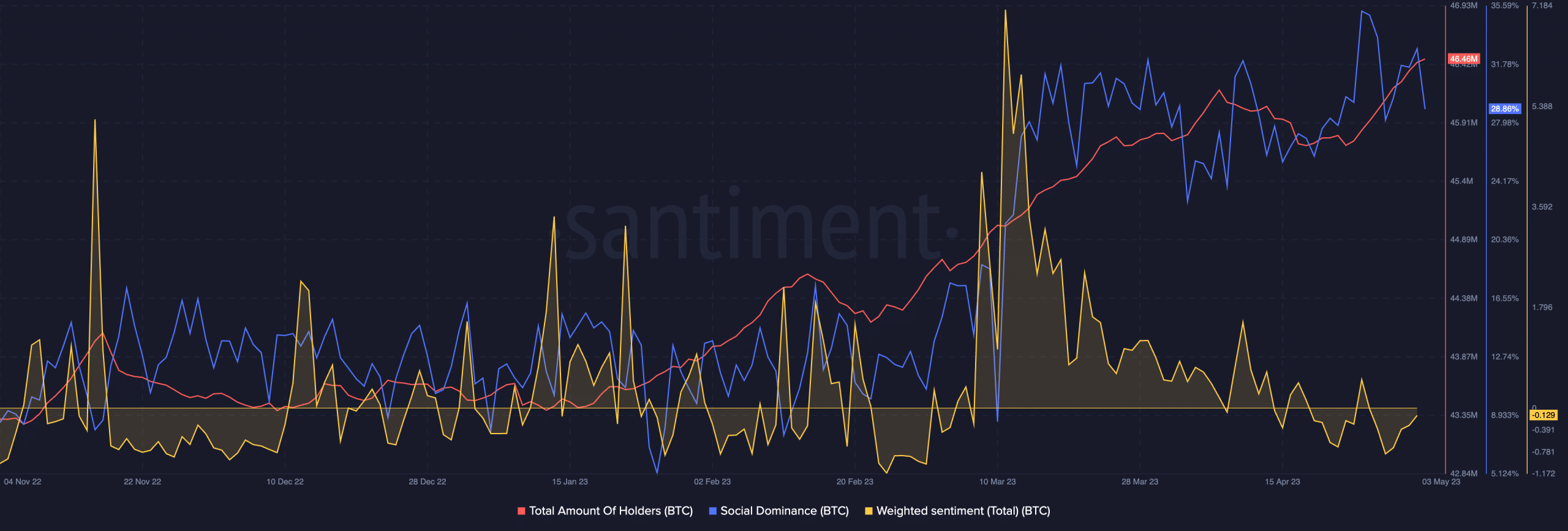

At press time, data from Santiment showed that BTC’s social dominance witnessed a drop in the last few days. The cryptocurrency’s social dominance also managed to witness quite a few peaks and drops over the last few months.

However, the total amount of BTC holders did witness a straight rise and stood at 46.46 million at the time of writing. The rise in the number of holders was surely a positive indicator of investors having faith in the king coin.

However, at press time, its weighted sentiment managed to lay low at -0.129 despite witnessing a surge since the end of April.

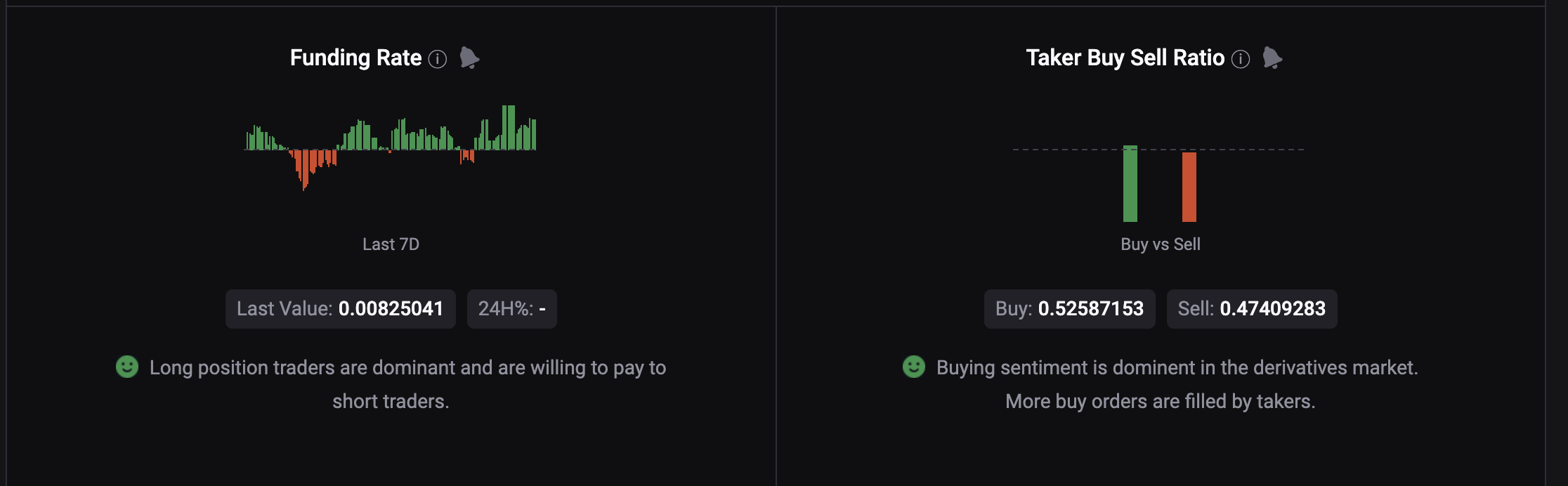

At the time of writing, BTC’s funding rate painted a positive picture for the cryptocurrency. Long position traders dominated the market over the last 24 hours as per the chart given below. Furthermore, the taker buy seller ratio also favored the buying sentiment in the derivatives market.

Not all that rosy here

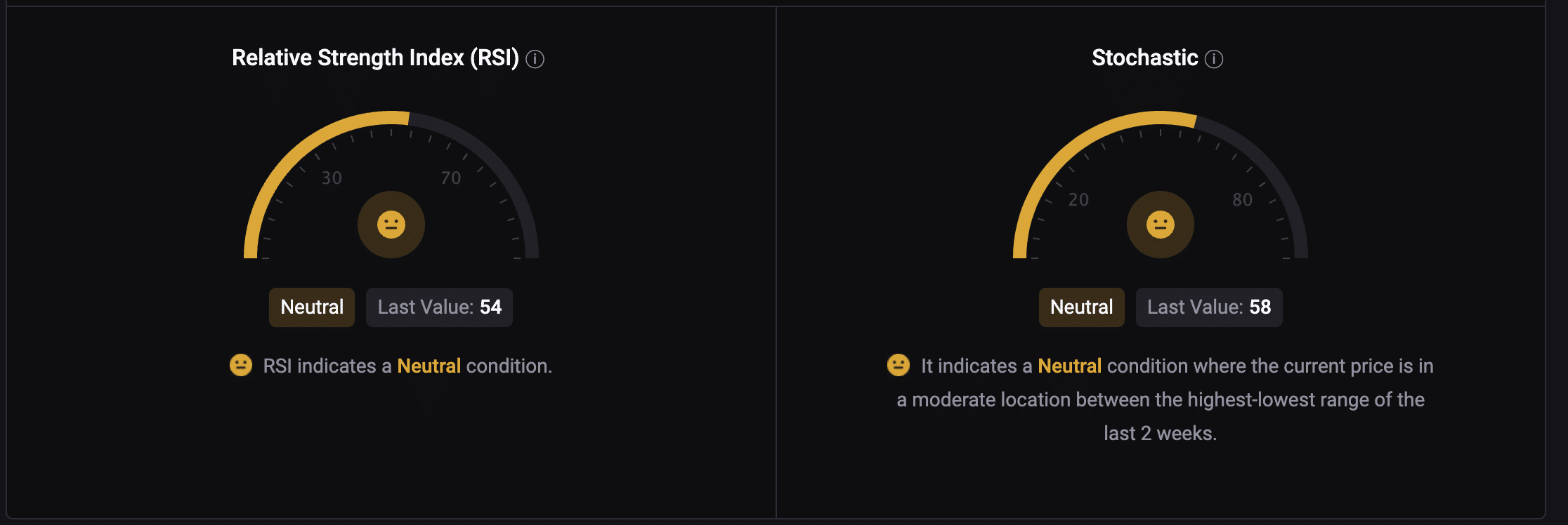

Despite the positive picture painted by the aforementioned information, BTC’s Relative Strength Index (RSI) didn’t seem at its best. At the time of writing, BTC’s RSI stood slightly above the neutral position at 54.

Although the good news was that the RSI stayed above 50, a downside could be that BTC could turn bearish in the absence of enough momentum.

Furthermore, the Stochastic RSI also stood at a neutral positon of 58.

How much are 1,10,100 BTCs worth today?

As per data from CoinMarketCap, although BTC was trading 1.27% higher in the last 24 hours, it was exchanging hands 3.42% lower than the last seven days.

However, the CryptoQuant analyst stated that if BTC manages to break past the $30k level, BTC’s MVRV ratio can shift rapidly. Additionally, the MVRV ratio would then be expected to stand anywhere between 1.8 and 2. This could act as a much needed bullish momentum for BTC.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)