Shiba Inu bulls struggle to stay afloat as bears press their advantage

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure was bearish despite the move into a bullish OB

- A session close below $0.00000965 would likely initiate a move downward

Shiba Inu [SHIB] was trading at a significant zone of demand, but the demand appeared extremely weak. The buyers were fighting an uphill battle to push back the waves of selling pressure.

How much are 1, 10, or 100 SHIB worth today?

At the same time, Bitcoin [BTC] was indecisive and the bulls were unable to drive a move past $30k. The resistance at $30k meant that a reversal to $27.8k was possible, which could see Shiba Inu post losses over the next few days.

The series of lower highs showed bears continued to dominate

The 6-hour chart showed that there was an H6 bullish order block at the $0.0000099 level (marked in cyan). This was a relatively significant order block because there was a strong reaction from this area back in March.

However, the retests thereafter were weak. After facing rejection from the $0.0000117 on 16 April, SHIB sank back to the bullish order block at the aforementioned support level on 21 April. Yet the bulls were unable to force a strong price reaction upwards.

Instead, the bears continued to apply pressure. Since 27 April the price has not been able to form a higher high, which was even more apparent on the lower timeframe charts such as 1-hour.

The OBV gradually sunk lower over the past week. The RSI retested neutral 50 as resistance to show that bearish momentum remained behind Shiba Inu.

Realistic or not, here’s SHIB’s market cap in BTC’s terms

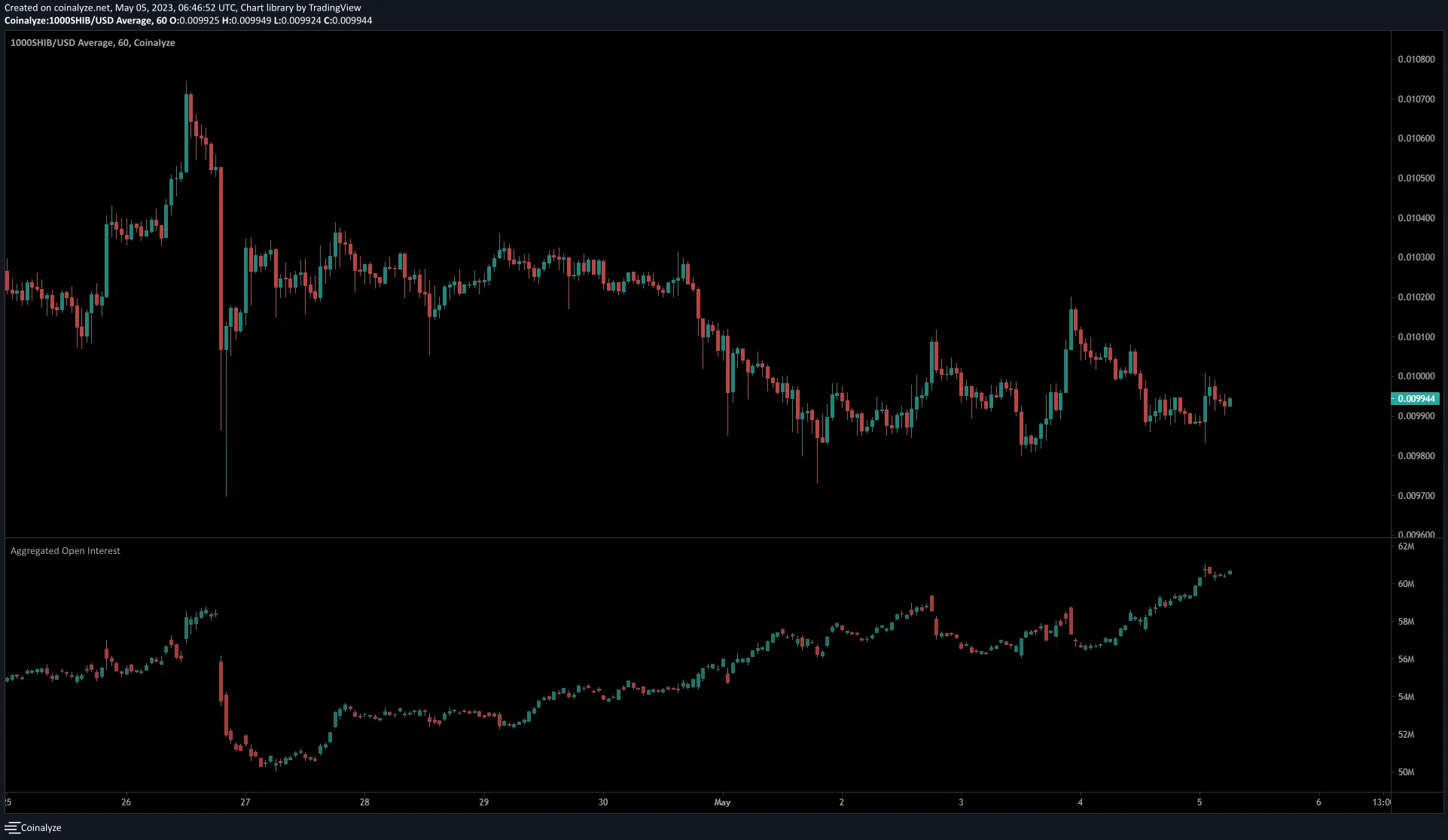

The rising Open Interest showed bearishness from speculators

Source: Coinalyze

The 1-hour chart from Coinalyze showed that the Open Interest has steadily been rising since 29 April. On 30 April and 1 May, the OI rose alongside falling prices. This showed extreme bearish pressure and abundant short selling.

Over the past two days, the price saw a lower timeframe rejection from $0.0000102. The Open Interest soared during this time, indicating bearish speculators. This supported the idea that Shiba Inu would likely see further losses.