Bitcoin [BTC]: Are global markets entering a liquidity cycle? If so, this is how BTC will react

![Bitcoin [BTC]: Are global markets entering a liquidity cycle? If so, this is how BTC will react...](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_An_image_of_a_wave_with_the_Bitcoin_logo_superimposed_91c87329-b65b-4a3f-8927-84d473e53378-e1683274128435.png)

- A global liquidity cycle could lead to improved BTC prices according to recent data.

- Despite Bitcoin showing bullish signs, traders continue to remain bearish against BTC.

Bitcoin’s [BTC] rising prices have led to massive amounts of speculation amongst the crypto community. Although some traders are skeptical about the increasing BTC prices, some data suggests there’s more positivity on the way.

Read Bitcoin’s Price Prediction 2023-2024

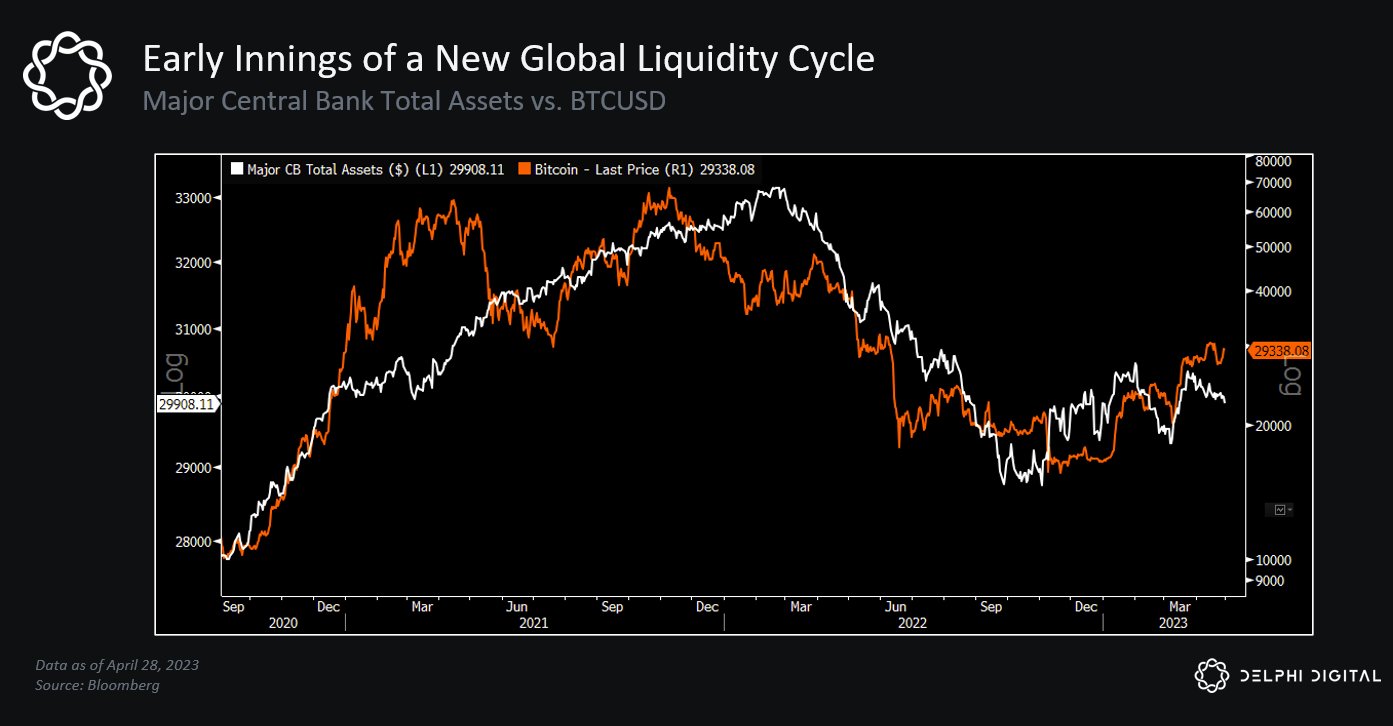

According to Delphi Digital, the 75% spike Bitcoin witnessed over the last few months could indicate that the global markets are entering into a new liquidity cycle.

A new global liquidity cycle refers to a period where there is a significant increase in the availability of money and credit in the global financial system.

This can be due to factors such as central bank policies, government stimulus programs, and increased investor confidence.

If the market enters a new global liquidity cycle, it could potentially have a positive impact on the value of BTC. This is because increased liquidity and credit availability can lead to higher investment activity and asset prices, which could drive demand for BTC.

Taking things positively

Another positive indicator for BTC would be its MVRV ratio. According to data provided by CryptoQuant, there is a likelihood that BTC could enter another bull run.

In January 2023, the MVRV ratio for Bitcoin broke the 1.5 level, indicating the start of a bull market. The MVRV ratio was fluctuating between 1.55 and 1.45 at press time, with large investors monitoring it closely to buy discounted Bitcoins during dips.

The analysis also showed that the 365DSMA should be taken into consideration as well, with the MVRV ratio breaking it to signal a trend change.

If Bitcoin’s MVRV ratio breaks the 1.5 level again, it’s likely to shift to a range of values between 1.8 and 2, that is if BTC price reaches 30K.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bears claw their way in

Despite all these bullish signs, traders continued to remain cynical about BTC’s growth. Based on data from TheBlock, the Put to Call ratio for Bitcoin has experienced a significant increase over recent months.

This suggested that a large number of traders have taken positions betting on a potential future decrease in BTC’s market price.