Polkadot [DOT] stuck near key support – When will it rebound?

![Polkadot [DOT] stuck near key support - When will it rebound?](https://ambcrypto.com/wp-content/uploads/2023/05/image-1200x900-1.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- DOT’s structure was bearish on lower and higher timeframe charts, at press time.

- It saw trading volumes and funding rates fluctuations in the past few days.

The crypto market saw considerable short-term downside in the first week of May as investors remained uneasy following Fed’s interest rate hike. In particular, Polkadot [DOT] suffered over 6% loss in the past seven days, per CoinMarketCap data.

Is your portfolio green? Check out Polkadot [DOT] Profit Calculator

On the contrary, Bitcoin [BTC] only dropped by 1.1% in the same period. It indicates that some altcoins like DOT sustained more losses than the king coin.

Will the support withstand the shelling?

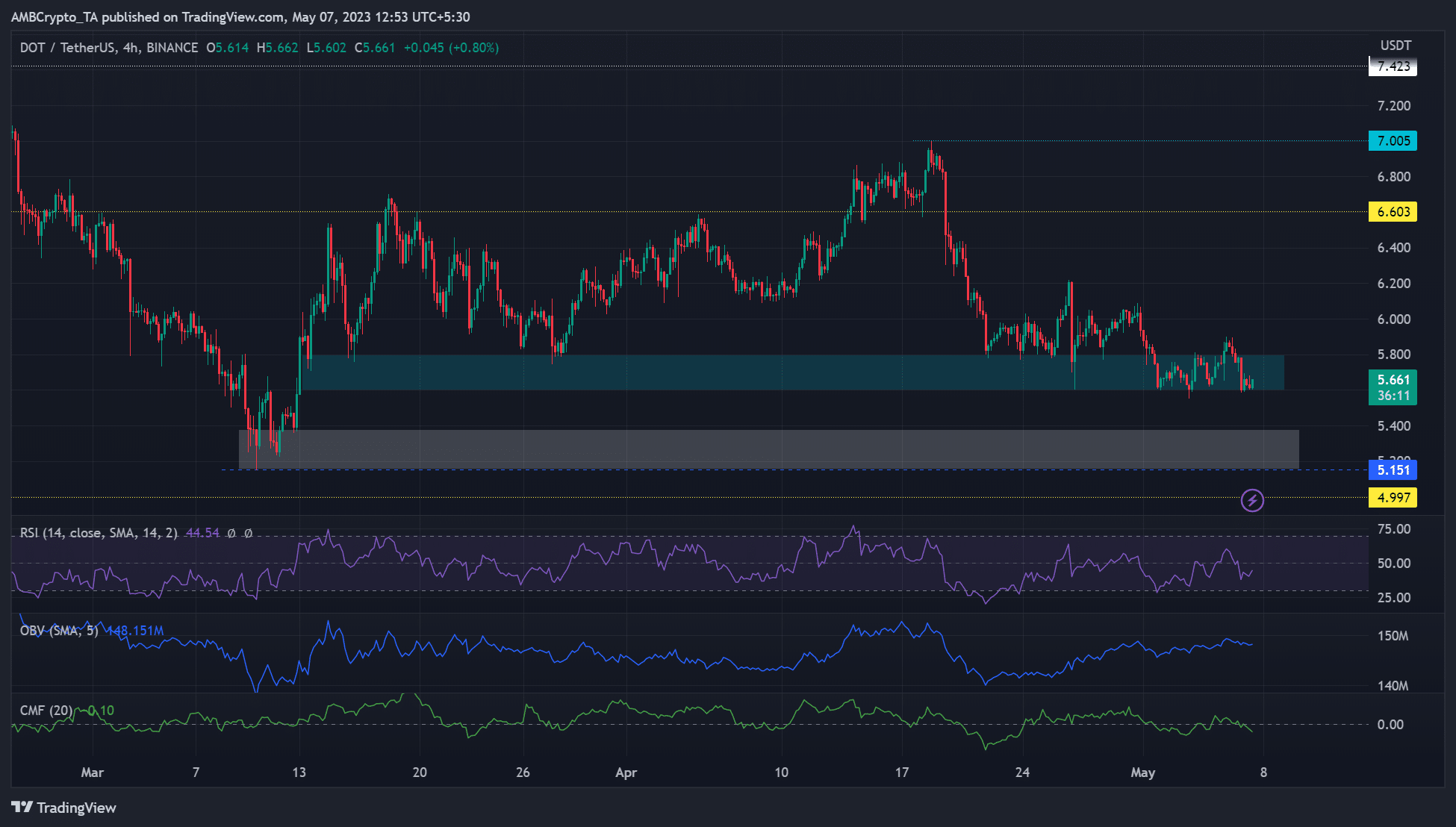

DOT was bearish on lower and higher timeframe charts, at press time. Notably, after a sharp drop in the second half of April, price action has persistently stayed near the $5.60 support (cyan). The support has been shelled over four times over the past two weeks.

Although it remains steady at press time, near-term sellers had little leverage. The RSI (relative strength index) was below 50, and CMF (Chaikin Money Flow) was -0.11 – indicating eased buying pressure and more outflows.

The easing money inflows could favor sellers, too, especially if it persists and BTC drops below $28k. If that’s the case, DOT/USDT pair could drop to the March swing low of $5.15.

On the other hand, a session close above the recent and immediate high of $6.2 will show a strengthening structure. Such a move could tip the pair to rally to $6.6 or April’s high and $7 psychological level.

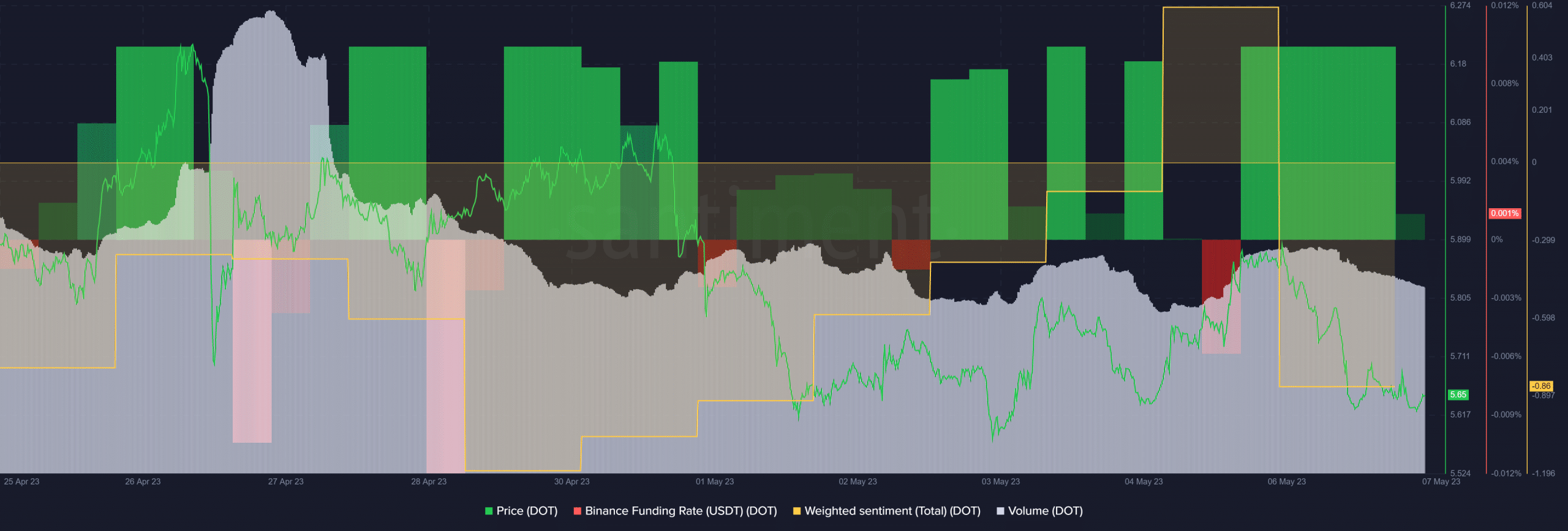

Trading volumes and funding rates fluctuated

Read Polkadot [DOT] Price Prediction 2023-24

DOT’s trading volumes have declined considerably since peaking on 27 April. It dropped from over $270 million on 27 April and stayed below $135 million since the beginning of May. The stagnating volumes have limited strong buying pressure and recovery.

Similarly, trading volumes fluctuated slightly in the same period. However, the metric was positive, at the time of writing and could offer bulls slight hope. But investors should track BTC’s price action for better-optimized setups.