Crypto market in flux: ETH, PEPE contribute to $50 million liquidation; short positions suffer

- The crypto market witnesses a $50 million liquidation event, with Ethereum and memecoins at the forefront.

- Short positions take a hit as investors face substantial liquidations.

7 May witnessed a dramatic event in the crypto market as over $50 million worth of investments got liquidated. Ethereum [ETH] took the lead in this wave of liquidation. However, hot on its heels was a memecoin that had been capturing the attention of enthusiasts worldwide.

Crypto market witness over $50 million in liquidations

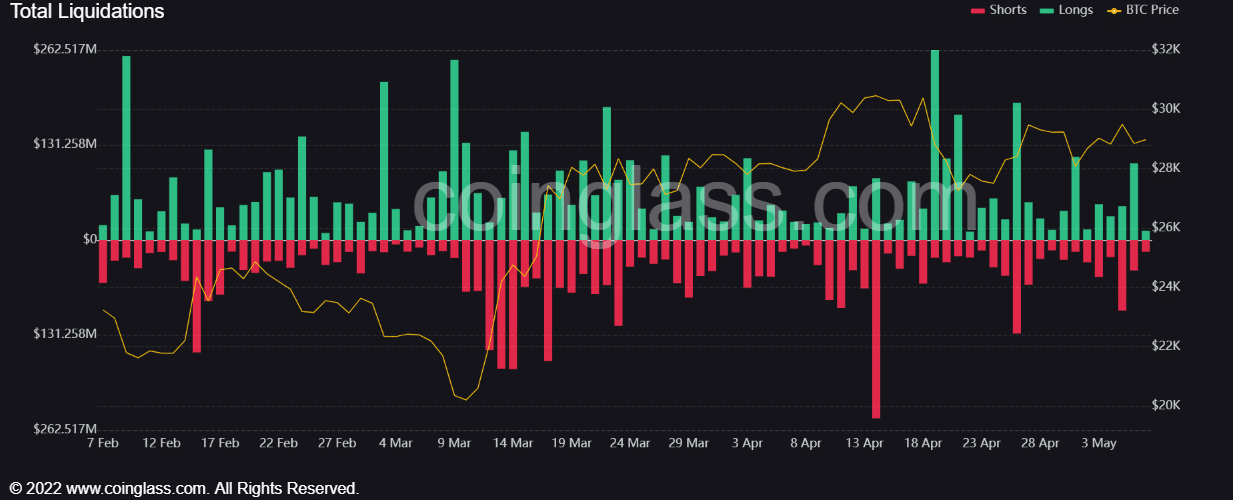

According to the latest data from Coinglass, the crypto market experienced an extraordinary 24-hour liquidation surpassing the $50 million mark. At the time of writing, the liquidation amount stood at approximately $52 million, having previously surged past $100 million. Ethereum took the lead in liquidation volume, with over $2 million currently liquidated.

Adding to the liquidation statistics was memecoin Pepe [PEPE], which ranked second, with a staggering liquidation of over 640 billion PEPE. The tokens were equivalent to a value exceeding $1 million. Other affected cryptocurrencies included king coin Bitcoin [BTC], with over 1 million coins.

Short positions see more liquidations

Coinglass’ data further revealed that the liquidations primarily targeted short positions in the market. The data indicated that a substantial portion of investors holding short positions faced liquidation. Also, over 70% of liquidations were witnessed across various major exchanges.

In certain instances, the liquidation rate reached a staggering 100%, leaving no room for short investors to escape unscathed.

At the time of writing, a detailed breakdown of Bitcoin’s liquidation data demonstrated that shorts accounted for over $16 million. Whereas, long positions experienced liquidations totaling over $12 million.

Considering Bitcoin’s significant share of the total cryptocurrency market capitalization, these liquidations bear significant implications for affected investors.

Crypto market maintains $1 trillion mark

According to an evaluation of the crypto market’s capitalization on CoinMarketCap, it remained at an impressive value exceeding $1 trillion. Also, Bitcoin maintained its dominance at nearly 50%.

At the time of writing, the 24-hour trading volume had surpassed $42 billion. Although a widespread chain reaction of liquidations had not unfolded at that point, the prevailing market conditions warranted a cautious approach from investors.

Furthermore, the rise in exchange withdrawals and notable instances of high-value cash-outs underscored the need for market participants to remain vigilant and adequately prepared for unforeseen fluctuations in market sentiment.