XRP prices decline, but platform integration makes investors bullish

![Ripple [XRP] prices decline, but investors remain bullish amidst platform integration](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_A_visually_intriguing_scene_illustrating_the_contrast_f6badec4-2460-4d8a-a0aa-16ee47a732fc.png.webp)

- Limewire added XRP as a payment option after a community request.

- Despite the price decline, investors remained optimistic about XRP’s future performance.

Limewire made a dramatic announcement on 6 May via its Twitter platform, which resulted in Ripple [XRP] being added as a payment option.

Read Ripple’s [XRP] Price Prediction 2023-24

XRP community stands for Limewire

On 6 May, Limewire reached out to the Ripple community with a bold request. They asked for 300 retweets to integrate XRP as a payment option for their token sales.

Calling the @Ripple community today! ☎️

Should we integrate $XRP as a payment method for the ongoing public sale of our #LMWR Token?

300 Retweets and $XRP will be live on our platform tomorrow! pic.twitter.com/PE374gUn4z

— LimeWire (@limewire) May 6, 2023

The response from the XRP community exceeded expectations, with over 1,800 retweets at the time of this writing. Limewire followed up with a post announcing that XRP had officially been added as a token for their public token sales.

Proof of $XRP ? pic.twitter.com/5M5BrIsPMx

— LimeWire (@limewire) May 7, 2023

This move mirrored the successful integration of Cardano [ADA] following a similar call to their community, which generated an enthusiastic response.

XRP declines further

Despite the exciting integration of XRP on Limewire, the cryptocurrency was facing a downward trend according to its daily timeframe chart. Over three consecutive days, XRP experienced a decline, resulting in a total loss of nearly 7%.

What’s concerning is that each day’s losses were more significant than the previous day. At the time of writing, XRP was trading at approximately $0.43, reflecting a loss of almost 4%.

The price trended below the short Moving Average (represented by the yellow line), which also acted as a resistance level around the $0.48 price range. Unfortunately, XRP had not recovered from the bearish trend it entered in April.

This was evident in the Relative Strength Index (RSI), which indicated that XRP was still below the neutral line and displayed a downward trend.

Investors remain bullish

Despite XRP’s downward trajectory, investor sentiment remained surprisingly bullish for the token. According to data from Coinglass, XRP had a positive funding rate as of this writing. This indicated that investors were optimistic and expected the token’s price to increase.

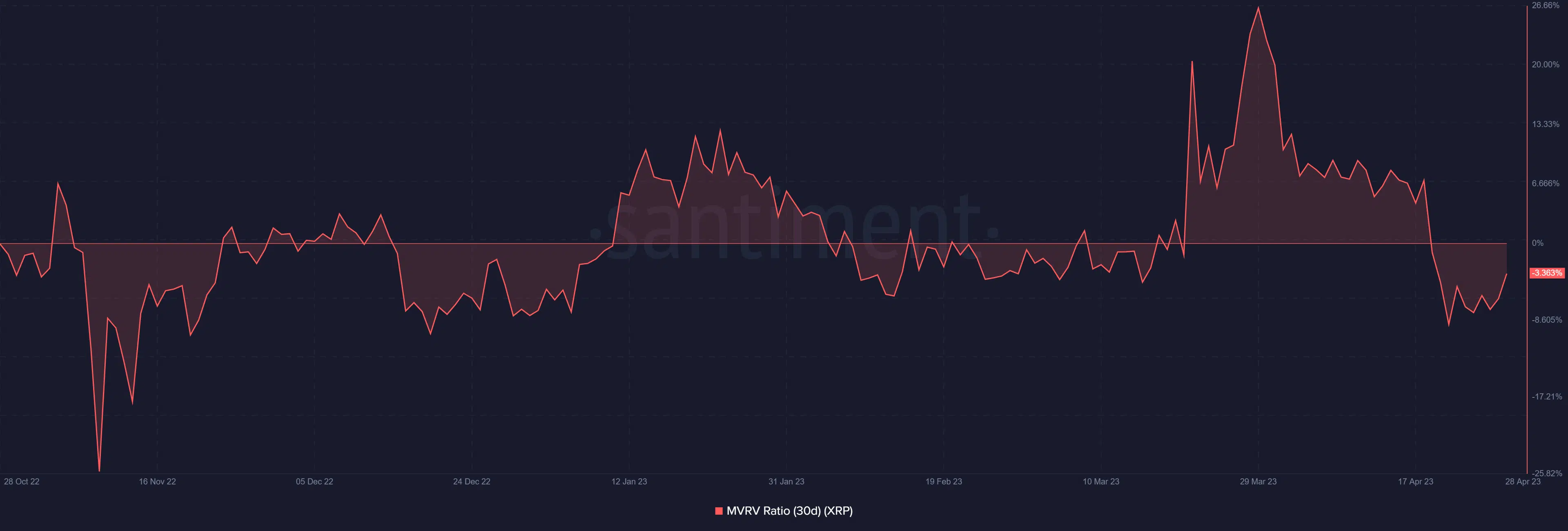

Furthermore, Santiment’s 30-day Market Value to Realized Value (MVRV) ratio for XRP stood at around -3.3% at press tine. This figure signified that the token was undervalued compared to its historical market value, suggesting a potential for future price appreciation.

Realistic or not, here’s XRP market cap in BTC’s terms

While the recent development did not have an immediate positive impact on the price trend of XRP, it highlighted the token’s continued integration on various platforms, despite its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC).

The outcome of the court case remained uncertain, and there was no clear indication of when it would conclude. Nevertheless, XRP was beginning to witness more positive interactions in the industry.