Bitcoin: Here’s why holders may not consider the BTC slump an opportunity

- The NVT ratio did not concur with an accumulation phase.

- Selling pressure was off its peak despite the price decrease.

The recent retracement in the Bitcoin [BTC] price has left many holders wondering whether it presents a chance to accumulate or a further decline that could be in the works.

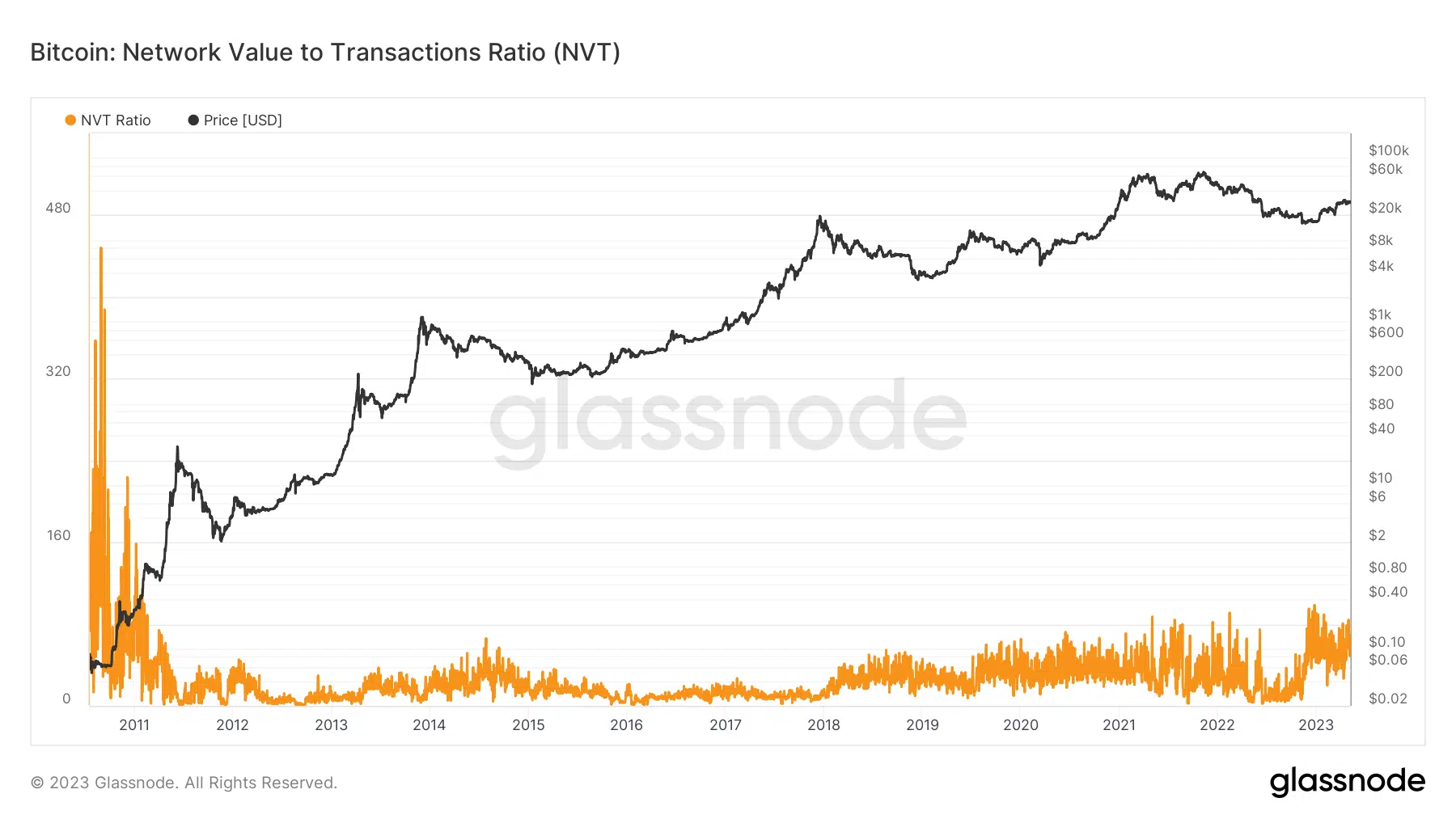

While market downturns often attract investors looking to capitalize on lower prices, the Network Value to Transactions (NVT) ratio could have another viewpoint.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Not a time for entry yet

The metric, calculated by dividing the market capitalization by the transferred on-chain volume, was 57.08 as of 8 May. When compared to the average value all year long, this state at press time, could be termed as a high value.

Historically, a high NVT ratio suggests that Bitcoin is overbought. However, when its considerably lower below equilibrium, the asset is oversold. Therefore, the steadfast conviction of most short-term holders could tend toward overlooking accumulation at this point.

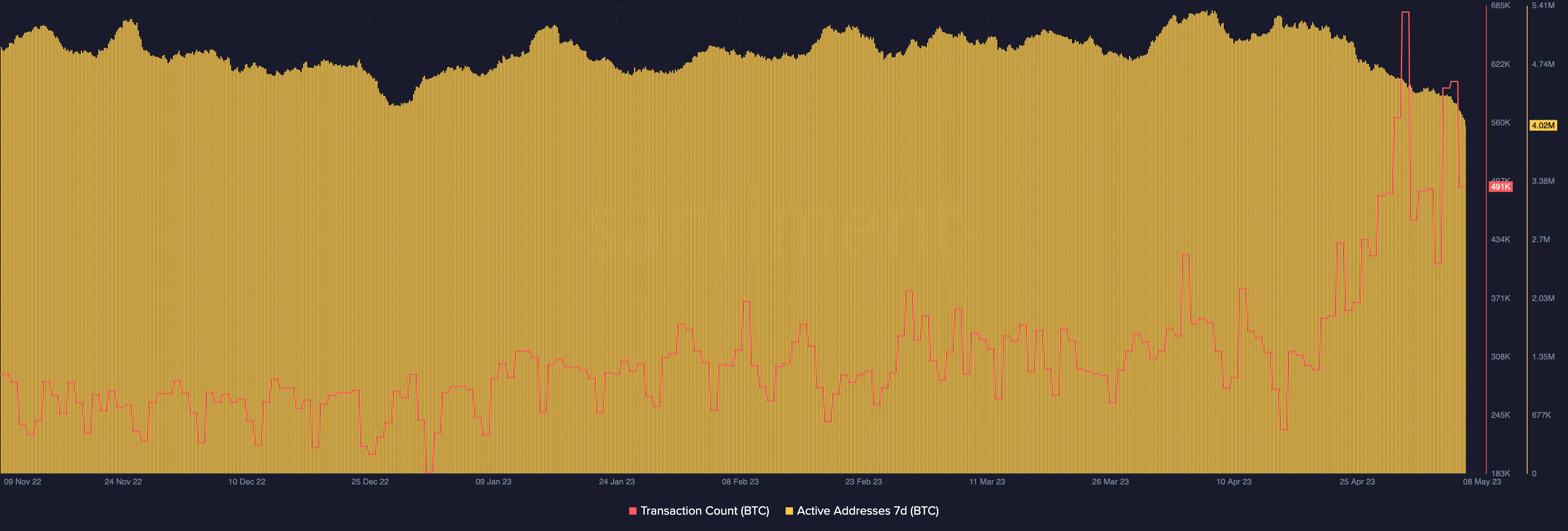

As a result, the active addresses over the last seven days have severely declined. Active addresses indicated the level of speculation around a coin by measuring the number of unique wallets involved in BTC transactions.

According to Santiment, the metric had decreased to 4.02 million within the aforementioned timeframe. This affirms that short-term holders have decided to become onlookers while observing the BTC’s broader trajectory.

Although the transaction count rose to 604,000 on 7 May, the metric backtracked. And this could be the implication of a struggle with an outrageous hike in transaction fees, which is not synonymous with Bitcoin’s fundamentals.

No glee in the terrain

Also, Binance stalling of BTC withdrawals might have contributed to the decline. Following the incident, Santiment showed that the supply on exchanges went to a low level.

At press time, the metric was down to 1.13 million. This implies that before Binance’s resumption of withdrawals, users seemed to have decided against sending BTC on exchanges. Therefore, this could also serve as a sign that selling pressure had reduced, leaving BTC at $27,576.

In terms of the weighted sentiment, on-chain data showed that there has been an attempt to recover from the negative region. Although it has been futile.

Realistic or not, here’s BTC’s market cap in XRP’s terms

Weighted sentiment soars when the vast majority of messages related to an asset are positive. When the metric is negative, it means that the average feeling with respect to the asset was far from being optimistic.

With the current price fluctuations, investor sentiment could be pushed towards overall growth and stability over immediate gains. It is also important to note that individual perspectives on market opportunities vary greatly among Bitcoin holders.