Will Polkadot Parachains play a key role in spurring DOT’s prices? Here’s analyzing…

- Polkadot Parachains saw growth on the social front. dApp activity on the Parachains declined.

- The NFT sector witnessed a surge in interest. DOT price continued to decline.

Even though Polkadot [DOT] has not been having the best time in the markets, its price may soon be impacted positively due to Polkadot Parachains’ activity. Over the last three months, the cryptocurrency space has recovered quite a bit from 2022’s crypto winter. However, DOT saw little activity in the same period.

Realistic or not, here’s DOT’s market cap in BTC’s terms

Polkadot Parachains may make a difference

According to a 13 May tweet by Polkadot Insider, many Parachains on the Polkadot network, such as Moonbeam, Moonriver, and the Aster network, saw a surge in activity on the social front.

Shoutout to the MOST INFLUENTIAL PROJECTS IN #POLKADOT ECOSYSTEM LAST 30D

Thanks to these projects, @Polkadot has grown stronger and gained more attention from investors recently ?

We thank you for your active contribution? Let's check out the names ?#Polkadot #DOT pic.twitter.com/ydJlmJetVh

— Polkadot Insider (@PolkadotInsider) May 13, 2023

Data from LunarCrush indicated that the social engagements for Moonriver increased by an alarming 470.8% over the last week. The parachain showed similar growth on the social media front, as its social mentions increased by 259.7% last month.

The growing popularity of these parachains may help Polkadot find its footing in the competitive crypto market.

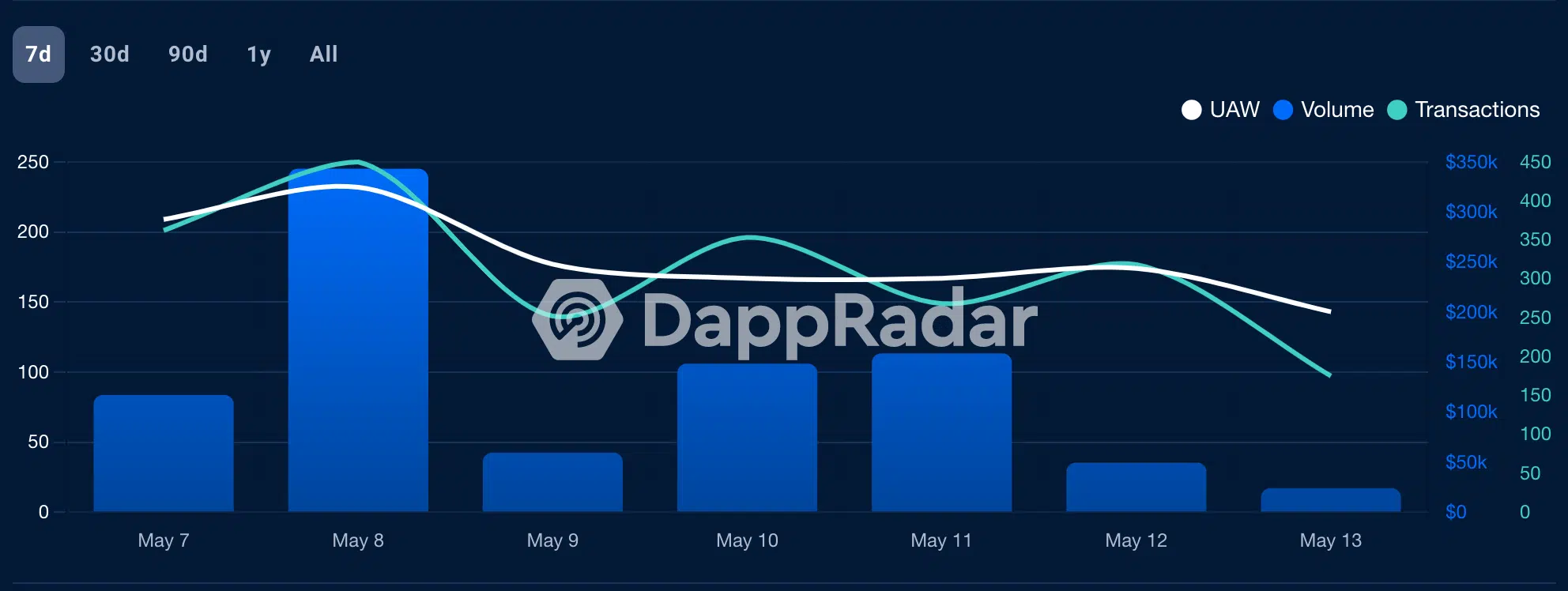

Even though these parachains were doing well on the social front, the dApps on these networks still had room to grow. For instance, one of the dApps on the Moonbeam parachain, Beamswap, was facing challenges in terms of activity on the network.

Beamswap is a DEX on the Moonbeam Chain that offers an automated market maker along with features like yield farming, bridge, faucet service, launchpad, and syrup pools to cater to everyone interested in DeFi on the Moonbeam Chain.

In the last seven days, the unique active wallets on Beamswap fell significantly. As a result, the number of transactions on the DEX also fell materially.

On the other hand, dApps on the Moonriver Parachain did relatively well in terms of activity. A DEX on the parachain, known as Solarbeam, witnessed a surge of +4.03% in terms of activity over the last week. Thus, volume and number of transactions on the DEX increased by 40% and 4%, respectively.

Despite the high activity on Solarbeam, its TVL continued to decline. This indicated that the dApp still had room for improvement.

The NFT angle

In terms of the NFT sector, many Polkadot parachains could impact the space positively. One of the parachains on Polkadot, known as the Aventus network, has been pro-active in growing its NFT network.

The network has partnered with the “Wolf of Wall Street” rights holders to produce a historical collection of NFTs related to the IP. Additionally, the network also collaborated with Aegis Custody and KILT protocol.

?? APRIL IN REVIEW OF AVENTUS NETWORK

Let's catch up with new updates and announcements from April of @AventusNetwork. There were a bunch of constructive partnerships executed forward long-term growth of the project

Check out the exciting developments below ?#Polkadot #DOT pic.twitter.com/b3OgN4LzbJ

— Polkadot Insider (@PolkadotInsider) May 13, 2023

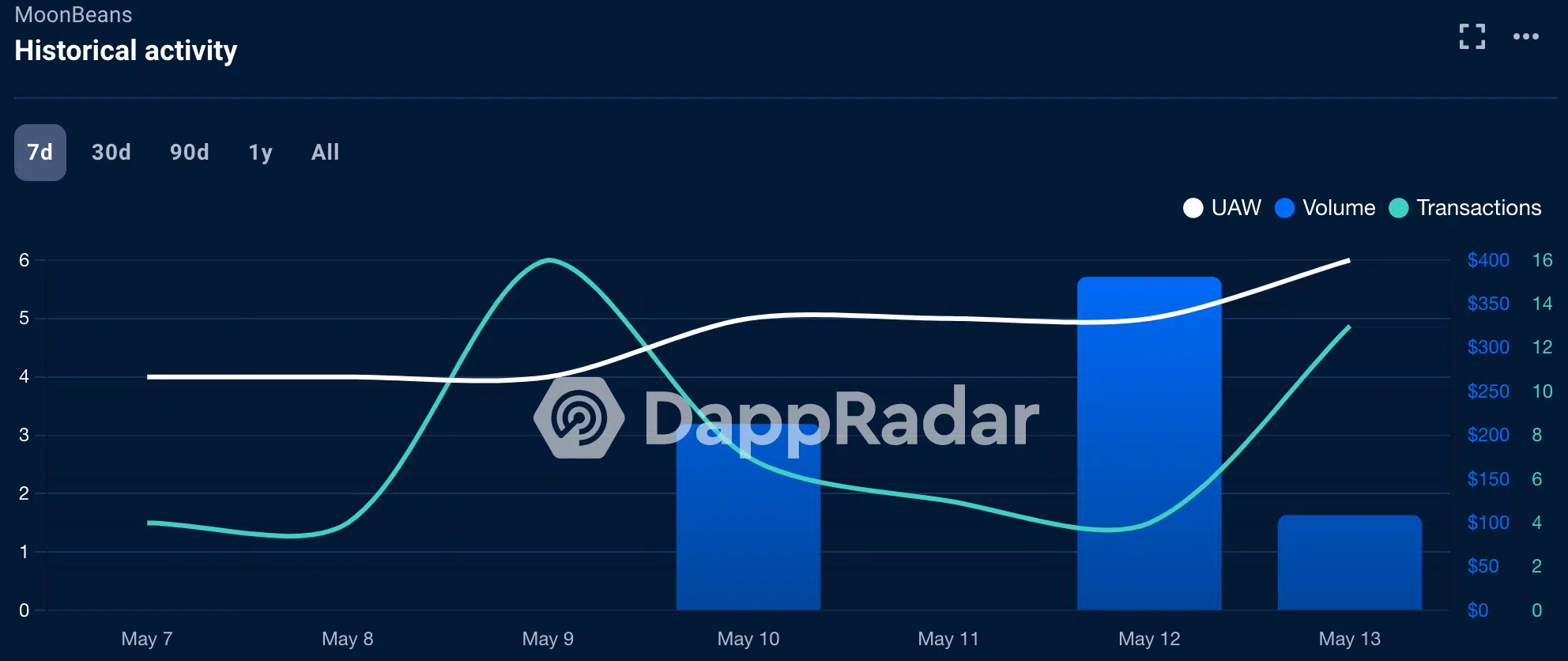

The NFT exchanges that operate on Polkadot’s Parachains have demonstrated remarkable success in recent times. Specifically, MoonBeans, an NFT exchange functioning on Moonbeam, has experienced significant growth in both activity and volume over the past few days.

The interest in Polkadot NFTs could improve the sentiment around both the protocol and the token.

At press time, the weighted sentiment around Polkadot was extremely negative. This indicated that the negative comments made about Polkadot outnumbered the positive ones on social platforms.

Meeting with Uncle Sam

The negative sentiment around the network could change soon due to the efforts made by the network to strengthen ties with the U.S government.

Daniel Schoenberger, Chief Legal Officer at Web3 Foundation, presented the Polkadot network and Web3 vision to the United States House of Representatives House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion, and the House Agriculture Subcommittee on Commodity Markets, Digital Assets, and Rural Development. He emphasized Web3’s goal of returning control of data to users and making the internet more decentralized, secure, and user-centric.

Schoenberger also introduced Polkadot as a blockchain protocol that enables purpose-built blockchains to operate together and share security, interoperability, and scalability.

He discussed the regulatory process undertaken regarding the classification of DOT, the native currency of the Polkadot network, and urged the development of a balanced and responsible legislative and regulatory framework to address the lack of a comprehensive legislative framework for digital assets and blockchain technology.

Stake it till you make it

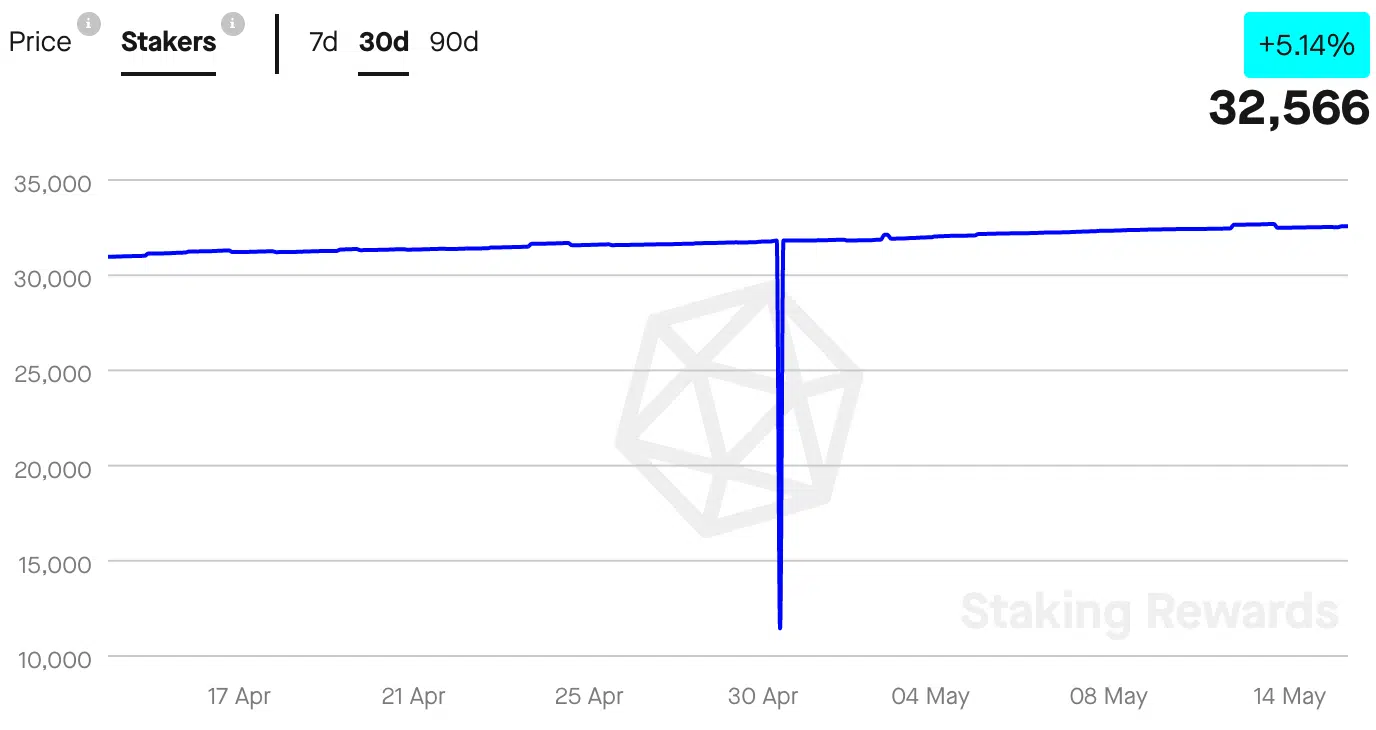

Despite the negative sentiment surrounding Polkadot, stakers on the network have increasingly shown support for the protocol. Staking Reward’s data indicated that the number of stakers on the Polkadot network surged by 5.14% over the last month.

Read Polkadot’s [DOT] Price Prediction 2023-2024

At the time of writing, there were 32,566 addresses staking DOT.

As of press time, DOT is being traded at a price of $5.38, according to CoinMarketCap. Notably, its value has declined over the past month. In addition, the trading volume of DOT has also decreased during this period, which coincided with its declining price trend.