Fetch AI Price Prediction: What’s the Q2 outlook after an impressive Q1?

Fetch AI [FET] enjoyed smooth tidings in Q1 of 2023. Running on a double boost, AI hype, and a bullish Bitcoin [BTC], the AI-focused token hit a new high of $0.61 in February, up from its $0.09 January low. Ergo, it’s worth looking at a Fetch AI Price Prediction.

The impressive start in 2023 didn’t stop on the price charts. On the development front, FET has covered over 40% of its roadmap objectives within early Q2 of 2023.

Read Fetch.ai’s [FET] Price Prediction 2023-24

Recently, the network partnered with Bosch and formed Fetch.ai Foundation, whose core mandate is to unlock Web3 technology potential across various domains, including industrial and consumer sections.

From a price-performance angle, FET’s Q1 shine has been dulled in early Q2, unless Bitcoin [BTC] reclaims upper price ranges.

Cognisant of recent remarkable developments and partnerships, how have FET HODLers faired in Q1? What should they expect in Q2? Let’s explore the daily price chart for some answers.

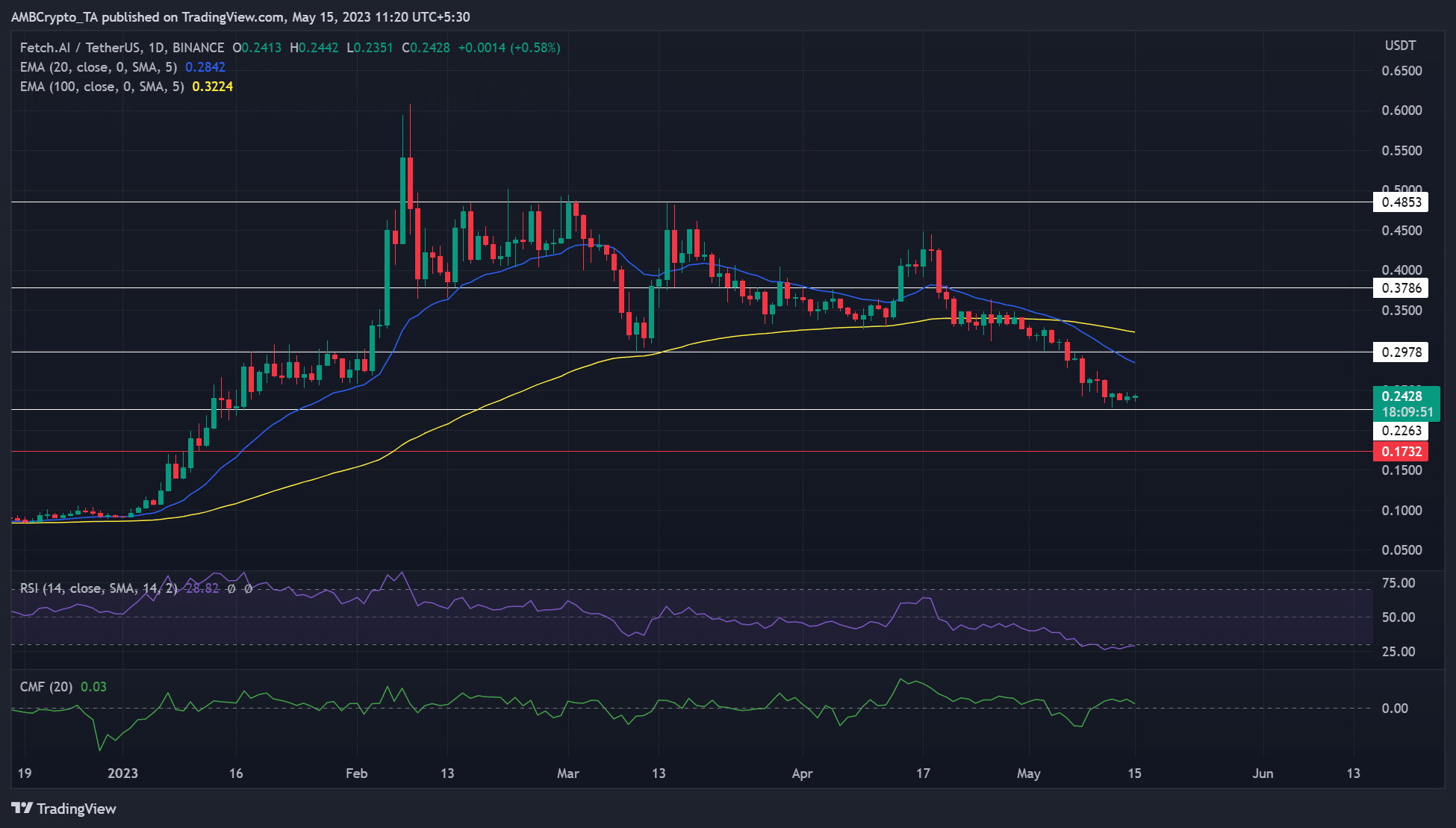

Extended contraction in Q2, clears Q1 gains

The surge from $0.09 on 1 January to a new high on 8 February marked an over 500% rally to investors. Extrapolated to its Q1 performance, the overall rally comes down to over 300%, given the correction that followed from mid-February.

The correction followed BTC’s sharp drop to $20k mid-March before rebounding. BTC surged and made new monthly highs of $29k and 31K in March and April, respectively.

However, during BTC’s swing highs in March and April, FET faced price rejections just below $0.5 and $0.45. And, the value didn’t exceed February’s high of $0.06.

The AI hype could not cushion FET from BTC’s fluctuations from mid-April.

The market contraction has since extended to May, with the bearish crossover of 20-EMA ($0.2842) going below the 100-EMA ($0.3224), exposing FET to more downward pressure after 5 May.

At press time, FET had shed over 30% of its value between April and Mid-May, dropping from $0.3664 (session close on March 31) to $0.2414 (daily session close on 14 May).

How much are 1,10,100 FETs worth today?

However, the drop steadied slightly above the $0.2263-support level – A swing low in February 2022.

Notably, BTC reclaimed $27k at press time after dropping below the level on 12 May. The mild bullish sentiment propped up FET, giving bulls little hope of recovery.

Unfortunately, bulls will only gain the upper hand if FET close above the March swing low ($0.2978) and moving averages ($0.2842 & $0.3224).

At press time, FET bears still have leverage with the RSI in the oversold zone. Similarly, the CMF (Chaikin Money Flow) hovered near zero, showing limited capital inflows.

As such, bears could attempt to crack the $0.2263-support and retest the May/June 2021 low of $0.1732, especially if BTC drops below $27k.

Put differently, FET could retest its May/June 2021 lows if BTC sees more corrections in the coming days/weeks. Let’s look at buying and selling pressure across the two quarters to gauge the likelihood of such an occurrence.

Buy vs. sell pressure in Q1 and Q2

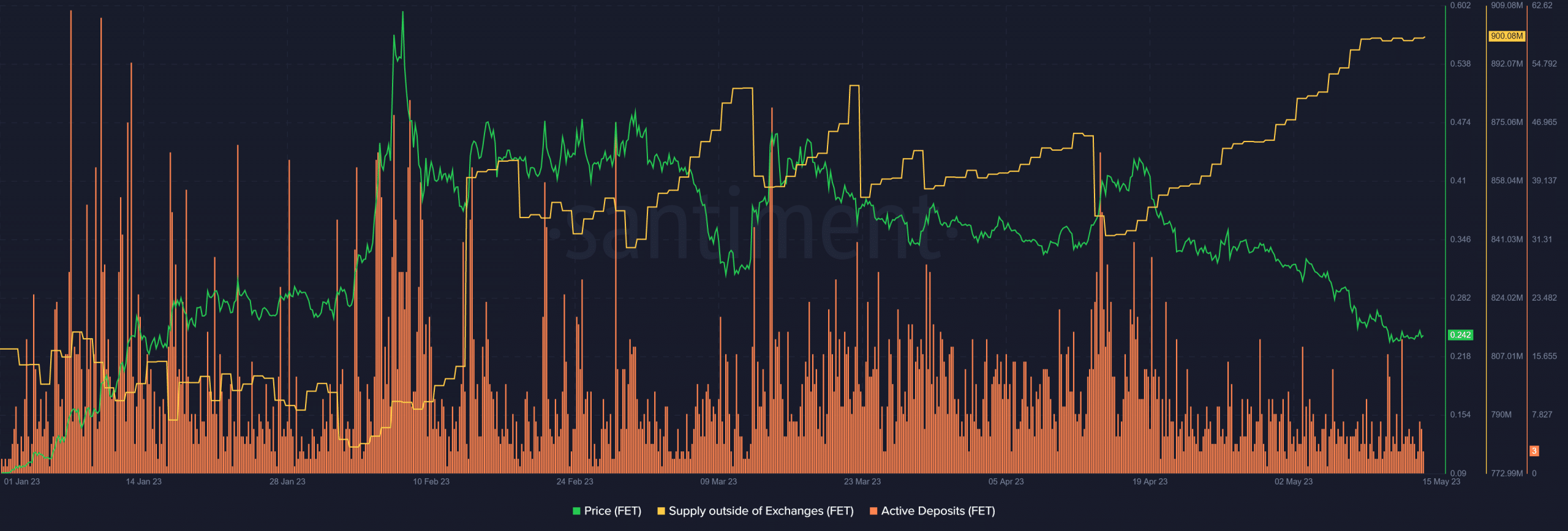

The number of FET’s supply on exchanges declined significantly after FET hit the new high of $0.06 in February. The metric dropped below its March lows at press time, showing limited short-term selling pressure.However, weighted sentiment remained negative and trading volumes muted, apart from positive price swings in mid-February, March, and April.

Is your portfolio green? Check out FET Profit Calculator

On the other hand, supply outside of exchanges in Q1 has since increased significantly over the past few weeks – Indicating an accumulation phase for FET. Similarly, the number of active deposits to exchanges eased – Suggesting seller exhaustion.

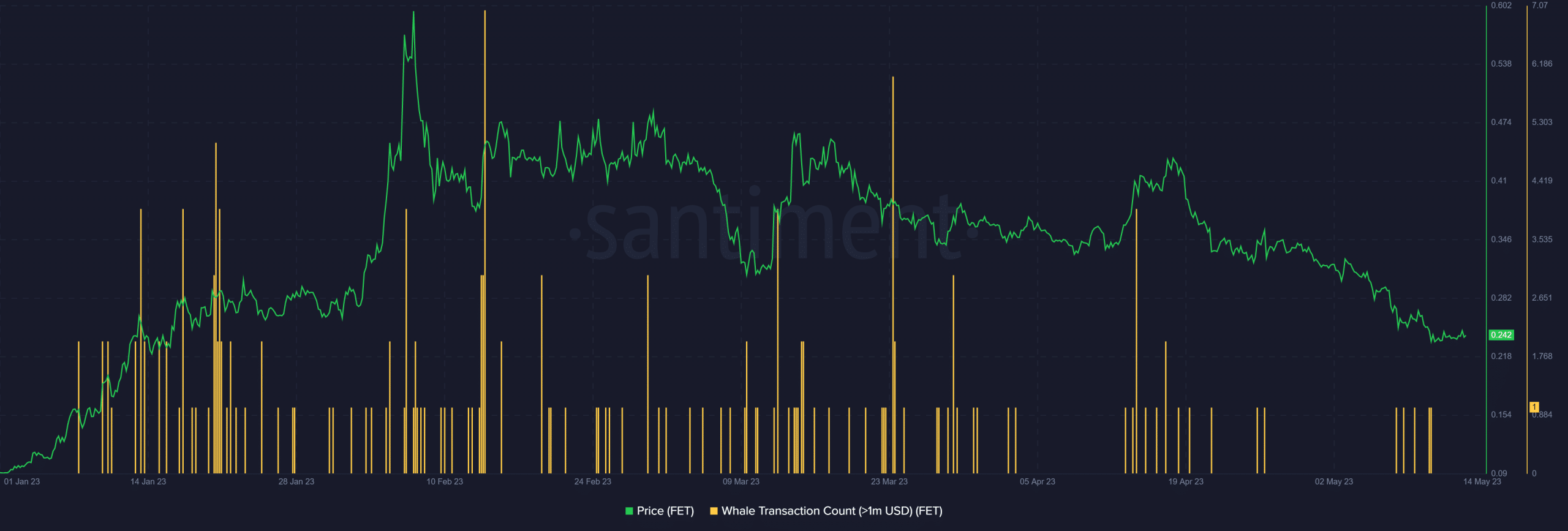

Therefore, some participants have been actively buying the dip as FET’s market contracted in late Q1 and early Q2. In fact, there was even slight interest from whales at FET’s levels between 8-10 May.

Nevertheless, FET’s demand will only increase if BTC reclaims upper price ranges. As such, any whipsawing on the BTC side in the remaining part of Q2 could undermine FET’s recovery efforts.

Conclusion

Although FET HODLers enjoyed considerable gains in Q1, Q2 seems hellbent on snatching their joy. It rallied by over 300% in Q1 but has been on a consistent downtrend on higher timeframe charts since late March.

Unless BTC reverses recent losses, FET could firmly remain under the control of bears in Q2.

Although there has been significant accumulation during the drop, a lack of solid whale interest could further spoil the party for bulls.

![Fetch.ai [FET]](https://ambcrypto.com/wp-content/uploads/2023/05/Fetch-FET-12.53.52-15-May-2023.png)