Smooth Love Potion [SLP] Price Prediction: Can the altcoin reverse early Q2 losses?

![Smooth Love Potion [SLP] Price Prediction: Can the altcoin reverse early Q2 losses?](https://ambcrypto.com/wp-content/uploads/2023/05/image-1200x900-9-1.png.webp)

Smooth Love Potion’s [SLP] popularity has fizzled like its native blockchain game ecosystem, Axie Infinity [AXS]. Ergo, it’s worth looking at an SLP Price Prediction.

SLP and AXS tokens performed exceptionally on the price charts during Bitcoin’s [BTC] rally in Q1, only to sustain losses in early Q2.

Therefore, evaluating Smooth Love Potion [SLP] is crucial to gauging what’s in store for holders.

Read Smooth Love Potion [SLP] Price Prediction 2023-24

SLP price action stuck in a long-term downtrend

Since early 2022, SLP has been on a consistent downtrend, spiralling into 2023 despite Q1’s rally.SLP’s price action in Q1 2023 faced rejections and stayed below the long-term trendline resistance level (blue line). On 1 January 2023, SLP marked a new all-time low (ATL) of $0.001980.

However, the BTC rally in early 2023 saw SLP hit a new high in Q1 at $0.003980 on 21 February on the Binance exchange. But the rally faced rejection at the trendline resistance, as did the recovery attempt in early April.

On a quarterly basis, SLP surged by 30%, rallying from an ATL of $0.001980 to a 31 March daily session close of $0.002690.

Towards mid-March, SLP dropped to its November 2022 levels of $0.002394 after BTC plunged from $26k to 20k in the same period. A rebound soon ensued after BTC moved up, but SLP faced another rejection around the trendline resistance.

The price rejection seen in mid-April has since dropped SLP near its ATL and December/January lows of $0.001980.

Is your portfolio green? Check SLP Profit Calculator

At press time, the daily RSI tried retreating from the oversold zone, indicating slight buying pressure. However, the OBV has declined since mid-April and could further undermine a strong recovery.

Ergo, SLP could retest its ATL level of $0.001980 or sink lower if the overall market sentiment doesn’t improve in the coming days/weeks.

Given the difficulty of gauging the next possible support levels below the ATL, a Fibonacci retracement tool (yellow) can be plotted between the Q1 price swing high and low.

Based on the Fibonacci tool, SLP could settle at the lower support level of $0.001511 if sellers sink it below the ATL of $0.001980. Especially if BTC drops to $26k and $25k price zones in the coming days/weeks.On the upside, a bullish BTC valued above $28k will invalidate the above bearish thesis. Such an upswing could propel SLP to clear the obstacles at $0.002394 and $0.002496. However, sellers could still gain leverage if bulls fail to close above the trendline resistance line.

Therefore, SLP could reverse early Q2 losses only if BTC reclaims its upper price ranges. However, the trendline resistance level on SLP’s daily chart could be a considerable impediment.

On the contrary, if BTC declines to $26k or lower, it will exert more downtrend momentum on SLP price action.

Sellers rule, but …

According to Coinglass, SLP’s long/short ratio showed sellers had a little edge on the 12 and 24-hour timeframes. This confirms long-term bearish bias for the rewards token for Axie Infinity games.But a bullish BTC could quickly flip the bias in favor of bulls, hence worth tracking this front. In fact, SLP’s trading volume was already up 3% at press time, according to CoinMarketCap.

How much are 1,10,100 SLPs worth today?

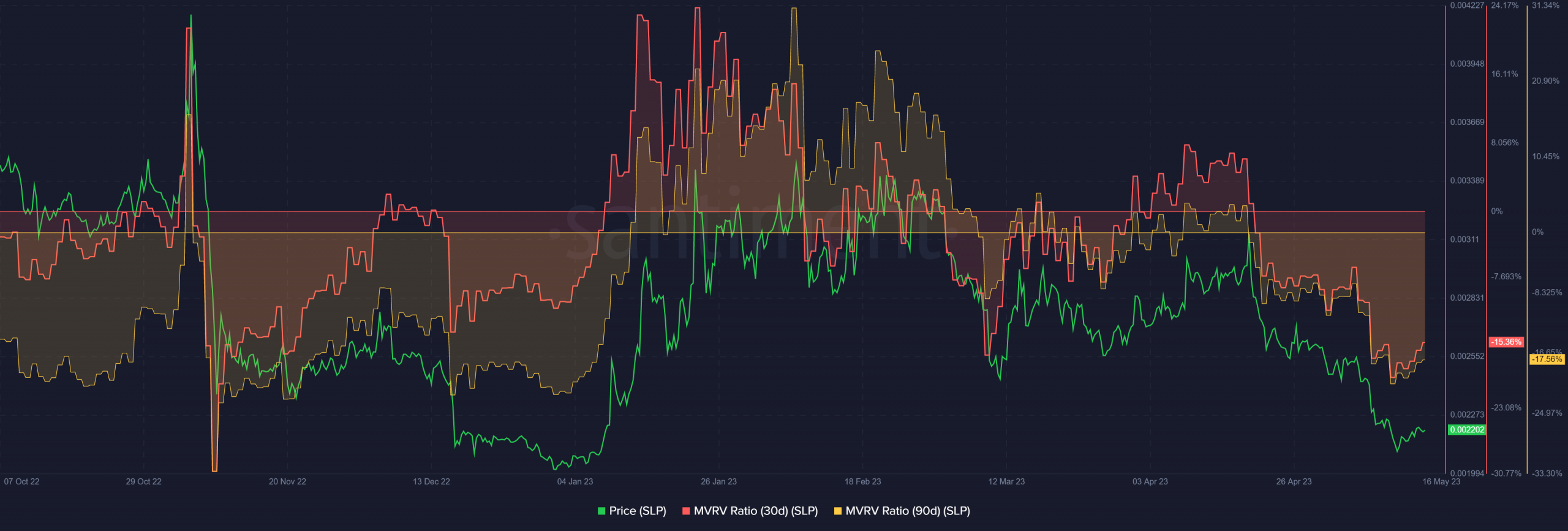

Quarterly and monthly holders suffered losses at press time too. However, monthly holders saw only 15% losses, as shown by the 30-day MVRV (Market Value to Realized Value) ratio.

On the other hand, quarterly holders saw more losses at 18%, as shown by the 90-day MVRV. Although SLP’s press time position showed SLP is undervalued, it remains to be seen if it’s an ideal buying opportunity.

Conclusion

Axie Infinity’s lacklustre performance over the past few months has undermined Smooth Love Potion’s [SLP] strong price performance. Although SLP registered commendable positive price performance in Q1, price action was stuck in an overall long-term downtrend.

In early Q2, SLP’s market contraction persisted, sinking it close to its ATL of $0.001980. The bears still have the upper hand, however, and reversing recent losses will only be feasible if bulls push above its key long-term trendline resistance.

![Smooth Love Potion [SLP]](https://ambcrypto.com/wp-content/uploads/2023/05/SLPUSDT_2023-05-16_08-23-58.png.webp)

![Smooth Love Potion [SLP] price prediction](https://ambcrypto.com/wp-content/uploads/2023/05/SLPUSDT_2023-05-16_08-52-36.png.webp)

![Smooth Love Potion [SLP] exchange long/short ratio](https://ambcrypto.com/wp-content/uploads/2023/05/SLP-long_short.png.webp)